|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

這引發了人們對更廣泛的經濟傳染的擔憂,這種傳染可能會滲透到全球加密貨幣市場中。

Japan’s government bond market is facing its worst liquidity crisis since the 2008 financial meltdown, prompting fears of a broader economic contagion that could ripple into global crypto markets.

日本政府債券市場正面臨著自2008年金融崩潰以來的最嚴重的流動性危機,這引起了人們對更廣泛的經濟傳染的擔憂,可能會侵入全球加密貨幣市場。

As bond yields surge and long-standing financial structures unravel, analysts are sounding the alarm.

隨著債券產量激增和長期存在的金融結構破裂,分析師正在發出警報。

In just 45 days, the country’s 30-year government bond yield has surged 100 basis points (bps) to a record 3.20%. Meanwhile, the 40-year bond, previously seen as a “safe” investment, has shed more than 20% in value, with over $500 billion in market losses.

在短短45天內,該國的30年政府債券收益率飆升了100個基點(BP),達到創紀錄的3.20%。同時,以前被視為“安全”投資的40年期債券的價值超過20%,市場虧損超過5000億美元。

According to analyst Financelot, liquidity in the bond market has also dropped to levels last seen during the Lehman Brothers collapse, suggesting a potential impending financial crisis.

根據分析師Financerot的說法,債券市場的流動性也已降至雷曼兄弟(Lehman Brothers)崩潰期間最後一次看到的水平,這表明潛在的金融危機可能存在。

“Japan’s bond market liquidity has dropped to 2008 Lehman crisis levels. Are we about to experience another financial crisis?” asked the analyst on X (Twitter).

“日本的債券市場流動性已降至2008年雷曼危機水平。我們是否要遇到另一種金融危機?” X(Twitter)上的分析師問。

The crisis traces back to the Bank of Japan’s (BOJ) recent policy pivot. After years of aggressive bond-buying, the BOJ abruptly pulled back, flooding the market with supply and driving yields higher.

危機追溯到日本銀行(BOJ)最近的政策樞紐。經過多年積極的債券購買,棚屋突然撤退,供應和駕駛收益率更高。

The central bank still holds $4.1 trillion in government bonds, 52% of the total outstanding. With this, its grip on the market has distorted pricing and investor expectations.

中央銀行仍然持有4.1萬億美元的政府債券,佔未償還總額的52%。這樣,它對市場的控制已經扭曲了定價和投資者的期望。

Japan’s total debt has ballooned to $7.8 trillion, pushing its debt-to-GDP ratio to a record 260%, more than double that of the US.

日本的總債務已激增至7.8萬億美元,將其債務與GDP比率提高到了創紀錄的260%,是美國的兩倍以上。

The fallout has been swift. Japan’s real GDP contracted 0.7% in Q1 2025, more than double the expected 0.3% drop.

輻射一直很迅速。日本的真正GDP在第1季度2025年收縮了0.7%,是預期下降0.3%的兩倍以上。

Moreover, CPI inflation accelerated to 3.6% in April. Real wages, however, plunged 2.1% year-over-year (YoY), intensifying fears of stagflation.

此外,CPI通貨膨脹率在4月加速至3.6%。然而,實際工資同比同比下降2.1%,這加劇了對散落的恐懼。

“Japan needs a major restructuring,” warned The Kobeissi Letter, highlighting the fragility of the nation’s economic model.

“日本需要重大的重組,” Kobeissi信件警告說,強調了國家經濟模式的脆弱性。

Bitcoin Emerges as a Safe Haven Amid Yen Carry Trade Unwind

日元帶來的避風港,比特幣出現了

As global investors digest these warning signs, attention is turning to the crypto markets, specifically Bitcoin. The pioneer crypto is progressively presenting as a potential refuge from bond market volatility.

隨著全球投資者消化這些警告標誌,注意力轉向加密貨幣市場,特別是比特幣。先驅加密貨幣逐漸成為債券市場波動的潛在避難所。

The yen carry trade, a strategy in which investors borrow low-yielding yen to invest in higher-yielding assets abroad, is now also coming under scrutiny.

日元攜帶貿易是一種策略,在這種策略中,投資者藉用低收益的日元來投資於國外的高產資產,現在也受到了審查。

According to Wolf Street, surging Japanese yields and a weakening economy are squeezing these highly leveraged positions.

根據沃爾夫街(Wolf Street)的說法,日本人的收益率飆升和經濟趨勢正在擠壓這些高度槓桿的職位。

“The huge mess is coming home to roost,” the outlet wrote, noting that the unwind of this trade could trigger a global risk-off event.

媒體寫道:“巨大的混亂正在回家。

That shift is already visible. As yields rise in Japan and the UK, demand for Bitcoin has soared in both regions.

這種轉變已經可見。隨著日本和英國的收益率上升,對比特幣的需求在兩個地區都飆升。

“Is it a coincidence that the UK and Japan are seeing huge demand for bitcoin exposure?” asked analyst James Van Straten.

“英國和日本對比特幣暴露的需求巨大,這是巧合嗎?”分析師詹姆斯·範·斯特拉滕(James van Straten)問。

The analyst added that the 30-year UK gilt yield was nearing a 27-year high.

分析師補充說,英國30年的鍍金收益率接近27年。

Meanwhile, Cauê Oliveira, Head of Research at BlockTrendsBR, observed a growing positive correlation between bond volatility and Bitcoin flows, with Bitwise’s European Head of Research, Andre Dragosche, agreeing.

同時,BlockTrendsbr研究負責人CauêOliveira觀察到鍵波動率與比特幣流之間的正相關,與Bitwise的歐洲研究負責人Andre Dragosche同意。

“A lot of big players [are] rotating from bonds to BTC,” Oliveira stated.

奧利維拉說:“許多大型球員正在從債券轉向BTC。”

BeInCrypto data shows Bitcoin was trading for $109,632 as of this writing, down 0.17% in the last 24 hours.

Beincrypto數據顯示,比特幣在撰寫本文時的交易價格為109,632美元,在過去24小時內下跌了0.17%。

Still, Bitcoin’s role comes with its own risk. BeInCrypto recently reported an analysis of the yen carry trade, which warned that disorderly unwinds could pressure crypto assets alongside traditional markets. This is especially true if a global flight to safety prompts USD strength and capital outflows from risk assets.

儘管如此,比特幣的角色仍具有自身的風險。 Beincrypto最近報導了對日元攜帶貿易的分析,該分析警告說,無序的休息可能會向傳統市場施加壓力加密資產。如果全球飛往安全的航班促使美元的實力和資本資本流出,則尤其如此。

Yet, in the long term, Japan’s debt crisis may strengthen Bitcoin’s case as a hedge against monetary instability.

然而,從長遠來看,日本的債務危機可能會加強比特幣的案件,以紀念金錢不穩定。

As traditional “safe” assets like long-dated sovereign bonds falter, institutions are increasingly considering digital assets viable alternatives.

隨著諸如長期君主債券(如久遠的君主債券)的傳統“安全”資產的步履蹣跚,機構越來越考慮數字資產可行的替代方案。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

-

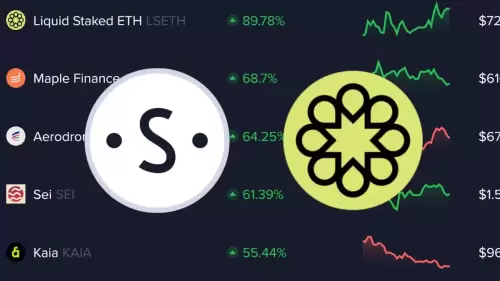

- 情感數據的隱藏寶石:您缺少的最佳性能加密

- 2025-07-01 23:10:15

- 揭開了由情感數據加油的最高表現的加密貨幣,包括隱藏的寶石和市場上意外的潮流。

-

-

- 雪崩,合作夥伴和比特幣:加密貨幣的紐約分鐘

- 2025-07-01 23:10:15

- 探索雪崩,夥伴關係和比特幣的交集,突出了加密貨幣領域的最新發展和未來趨勢。

-

-

- Breez SDK:閃電般的比特幣登機功能下一波應用程序

- 2025-07-01 23:50:12

- Breez SDK正在徹底改變比特幣應用程序的登機,使閃電網絡付款易於訪問且容易。深入了解最新的整合和趨勢。

-

- 比特幣,上市公司和ETF:加密投資的新時代

- 2025-07-01 23:55:12

- 探索比特幣,上市公司和ETF的交匯處,揭示了塑造加密投資格局的最新趨勢和見解。提示:是看好的。