|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Legendary short-seller Jim Chanos bets against MicroStrategy, taking a long position on Bitcoin

May 15, 2025 at 10:56 pm

Jim Chanos, known for exposing the Enron scandal, has once again stirred the investment world—this time with a bold stance on the cryptocurrency market.

Legendary short-seller Jim Chanos, known for exposing the Enron scandal in the early 2000s, has once again stirred the investment world.

This time, however, Chanos is targeting the cryptocurrency market, where he has taken a short position on Strategy and a long position on Bitcoin, he revealed on Wednesday at the 2025 Sohn Investment Conference.

The move signals concern over growing speculation in crypto-linked stocks, particularly where company valuations have become disconnected from the underlying assets they hold.

Chanos, founder of Kynikos Associates and one of Wall Street’s most respected sceptics, explained his strategy by comparing Strategy’s stock price with its Bitcoin reserves.

While Bitcoin remains undervalued based on its long-term fundamentals, Chanos noted that Strategy’s stock has rallied far beyond the fair market value of its holdings.

Currently, Strategy owns more than 568,840 BTC, which has an estimated market value of over $58 billion, amounting to nearly 2.7% of Bitcoin’s entire supply.

The company, headed by CEO Michael Saylor, has added 122,000 BTC in 2025 alone, positioning Strategy as a leader among public firms in the digital asset space.

However, Chanos warned that this aggressive accumulation strategy has created a valuation mismatch.

“It is not a pure Bitcoin proxy; it is a company that has pivoted heavily to Bitcoin without generating comparable business growth from its core operations,” Chanos stated.

He cautioned that retail investors often misunderstand this distinction, bidding up Strategy’s stock as if it were a direct substitute for owning Bitcoin.

This, according to Chanos, creates a "classic bubble-like situation" where Strategy shares become speculative vehicles.

“People are buying the stock for its Bitcoin equivalence, and they're willing to pay more and more for that, but it's not clear what happens when that speculation recedes.”

Chanos emphasised that while Bitcoin remains a promising asset in the long run, investing in a company whose share price is inflated by hype rather than fundamentals could lead to steep losses when market sentiment shifts.

His concern is that other companies might begin mimicking Strategy’s strategy, accumulating large amounts of Bitcoin in a bid to capture investor attention.

Some firms may see this as a shortcut to higher valuations, especially if they lack strong revenue streams elsewhere.

This could set a dangerous precedent. According to Chanos, once the novelty wears off or Bitcoin’s price stalls, these companies could face pressure from shareholders, reduced liquidity, or even write-downs if their BTC holdings lose value.

“I urge you to differentiate between holding the asset itself and investing in a stock that simply owns the asset, especially when the latter is commanding a premium.”

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- Polygon (POL) Ecosystem Token Price Soars as Co-Founder Sandeep Nailwal Becomes New CEO of Polygon Foundation

- Jun 12, 2025 at 05:34 am

- The Polygon ecosystem token, POL (formerly MATIC), has seen a notable price increase in the past 24 hours amid news co-founder Nailwal Sandeep is now the new chief executive officer of Polygon Foundation.

-

-

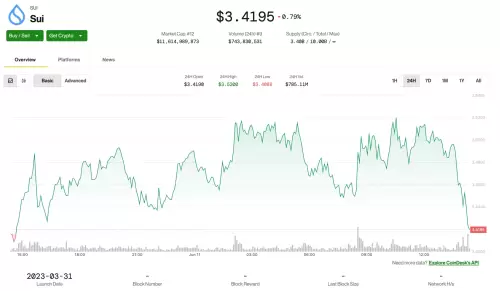

- 21Shares SUI ETF Reaches Final Stage of Approval Process as Nasdaq Files 19b-4 Form with SEC

- Jun 12, 2025 at 05:32 am

- The token rose following news that Nasdaq filed a 19b-4 form with the U.S. Securities and Exchange Commission (SEC) to list the 21Shares SUI exchange-traded fund. This marks the second major step in the ETF approval process. The first, a draft S-1 registration statement, was filed by 21Shares in April.

-

-

-

-

- e Predicted Timelines for Shiba Inu to Reach Market Cap of Dogecoin

- Jun 12, 2025 at 05:24 am

- are looking at when Shiba Inu (SHIB) could match Dogecoin (DOGE) in market cap. Since SHIB came out in August 2020, investors have called it the “Dogecoin Killer.” They believe it might one day pass DOGE to become the leading meme coin.