All-time High

All-time Low

Volume(24h)

389.15M

Turnover rate

6.51%

Market Cap

5.9746B

FDV

10B

Circulating supply

428.91M

Total supply

460.58M

Max supply

715.75M

Currency Calculator

{{conversion_one_currency}}

{{conversion_two_currency}}

| Exchange | Pairs | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{val.price}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

Community sentiment

26%

74%

Bullish

Bearish

The Roy’s King: ? + ? + ? 2nd place: 10 $Avax + ? 3rd place: ? 4th place: ? 5th place: 200,000 Roy points 6th–10th: 100,000

The Roy’s King: ? + ? + ? 2nd place: 10 $Avax + ? 3rd place: ? 4th place: ? 5th place: 200,000 Roy points 6th–10th: 100,000

UPDATE: Grayscale has amended its $AVAX ETF S-1 to include STAKING REWARDS, becoming the third issuer, to add staking provisions in filings with the SEC.

UPDATE: Grayscale has amended its $AVAX ETF S-1 to include STAKING REWARDS, becoming the third issuer, to add staking provisions in filings with the SEC.

| Exchange | Pair | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{val.price}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

About Avalanche

Where Can You Avalanche (AVAX)?

AVAX is available on [Binance](https://coinmarketcap.com/exchanges/binance/), [Bitfinex](https://coinmarketcap.com/exchanges/bitfinex/), [Gate.io](https://coinmarketcap.com/exchanges/gate-io/) and [Kucoin](https://coinmarketcap.com/exchanges/kucoin/).

How Is the Avalanche Network Secured?

AVAX is traded on the Exchange Chain, which follows its own Avalanche consensus mechanism. Unlike proof-of-work or proof-of-stake, the Avalanche consensus mechanism does not have one leader processing transactions that get validated by others. Instead, all nodes process and validate transactions by employing a directed acyclic graph (DAG) protocol. That way, transactions are processed simultaneously, and validators' random polling ensures that transactions are correct with statistical certainty. There are no blocks in this consensus mechanism, allowing immediate finalization and significantly improving the blockchain’s speed.

How Many Avalanche (AVAX) Coins Are There in Circulation?

The total supply of AVAX is 720 million. Its token distribution is as follows: * 2.5% - seed sale, with 10% released on mainnet launch and the rest being released every three months. * 3.5% - private sale, with 10% released on mainnet launch and the rest being released every three months. * 10% - public sale, with 10% released on mainnet launch and 15% released every three months over a period of 18 months. * 9.26% - allocated to the foundation, released over ten years. * 7% - community endowment, released over twelve months. * 0.27% - testnet incentive program, released over one year. * 5% - strategic partners, released over four years. * 2.5% - airdrops, released over four years. * 10% - team, released over four years. * 50% staking rewards Staking AVAX currently provides an annual reward of 11.57%, with the minimum time for staking being two weeks with a minimum of 2,000 AVAX.

What Makes Avalanche Unique?

Avalanche attempts to solve the [blockchain trilemma](https://coinmarketcap.com/alexandria/de/glossary/blockchain-trilemma), which posits that blockchains cannot achieve a sufficient degree of decentralization at scale. A consequence of this are high gas fees, as is often the case on Ethereum. To solve this problem, Avalanche designed three interoperable blockchains. * The Exchange Chain (X-Chain) is employed to create and exchange the native AVAX tokens and other assets. Similar to the ERC-20 standard on Ethereum, these tokens follow a set of standardized rules. It uses the Avalanche consensus mechanism. * The Contract Chain (C-Chain) hosts smart contracts and decentralized applications. It has its own Avalanche Virtual Machine, similar to the Ethereum Virtual Machine, allowing developers to fork EVM-compatible DApps. It uses the Snowman consensus mechanism. * The Platform Chain (P-Chain) coordinates network validators, tracks active subnets and enables the creation of new subnets. Subnets are sets of validators, sort of like a validator cartel. Each subnet can be validating several blockchains, but a blockchain can only be validated by one subnet. It also uses the Snowman consensus mechanism. This division of computing tasks enables higher [throughput](https://coinmarketcap.com/alexandria/de/glossary/throughput) without compromising on decentralization. For instance, private blockchains on the network could require its subnet’s validators to be sufficiently geographically decentralized or comply with certain regulations. Following this modular structure, Avalanche improves its interoperability with other blockchains wishing to integrate with the Avalanche ecosystem. Furthermore, the two different consensus mechanisms are designed with each blockchain’s requirements in mind, further improving their efficiency.

Who Are the Founders of Avalanche?

Avalanche was launched by Ava Labs, founded by Cornell University professor Emin Gün Sirer, and Cornell University computer science PhD’s Kevin Sekniqi and Maofan “Ted” Yin. Gün Sirer is a veteran in cryptographic research, having designed a conceptual peer-to-peer virtual currency six years before the release of the Bitcoin whitepaper. He was also involved in work on Bitcoin scaling solutions and research on Ethereum before the infamous The DAO hack in 2016. From that research arose the whitepaper that led to the foundation of Ava Labs in 2018. The project closed a seed round in February 2019 that included investors such as Polychain, Andreessen Horowitz and Balaji Srinivasan. Avalanche closed its initial coin offering in 2020 in under 24 hours, raising $42 million in the process.

What Is Avalanche (AVAX)?

[Avalanche](https://coinmarketcap.com/currencies/avalanche/) is a [layer one blockchain](https://coinmarketcap.com/alexandria/glossary/layer-1-blockchain) that functions as a platform for decentralized applications and custom blockchain networks. It is one of Ethereum’s rivals, aiming to unseat [Ethereum](https://coinmarketcap.com/currencies/ethereum/) as the most popular blockchain for [smart contracts](https://coinmarketcap.com/alexandria/de/glossary/smart-contract). It aims to do so by having a higher transaction output of up to 6,500 transactions per second while not compromising scalability. This is made possible by Avalanche’s unique architecture. The Avalanche network consists of three individual blockchains: the X-Chain, C-Chain and P-Chain. Each chain has a distinct purpose, which is radically different from the approach Bitcoin and Ethereum use, namely having all nodes validate all transactions. Avalanche blockchains even use different consensus mechanisms based on their use cases. After its mainnet launch in 2020, Avalanche has worked on developing its own ecosystem of [DApps](https://coinmarketcap.com/alexandria/de/glossary/decentralized-applications-dapps) and [DeFi](https://coinmarketcap.com/alexandria/de/glossary/defi). Different Ethereum-based projects such as SushiSwap and TrueUSD have integrated with Avalanche. Furthermore, the platform is constantly working on improving interoperability between its own ecosystem and Ethereum, like through the development of [bridges](https://coinmarketcap.com/alexandria/glossary/bridges).

Avalanche News

-

Explore top crypto coins poised for explosive growth in 2025. Discover innovative projects and established networks with high ROI potential.

Nov 05, 2025 at 01:40 am

-

Analyzing the interplay between Bitcoin's price, large short positions, and the potential impact of Trump's tariff policies on the crypto market.

Oct 22, 2025 at 12:39 pm

-

Explore the 2025 crypto landscape with a focus on Ethereum, Solana, and the transformative role of AI-driven tokens like Blazpay in the evolving digital economy.

Oct 21, 2025 at 08:00 am

-

Avalanche is killing it with scalability and customization, while BlockDAG is showing, not just telling. Get the lowdown on blockchain's latest moves.

Oct 21, 2025 at 06:44 am

-

Exploring BlockDAG's presale success, Avalanche's community boost, and Cardano's market struggles. A deep dive into crypto's diverse landscape.

Oct 21, 2025 at 04:00 am

-

From ETH's institutional debates to AVAX's tokenization surge, and BullZilla's meme-coin magic, discover the crypto trends shaping NYC's digital finance scene.

Oct 21, 2025 at 03:15 am

-

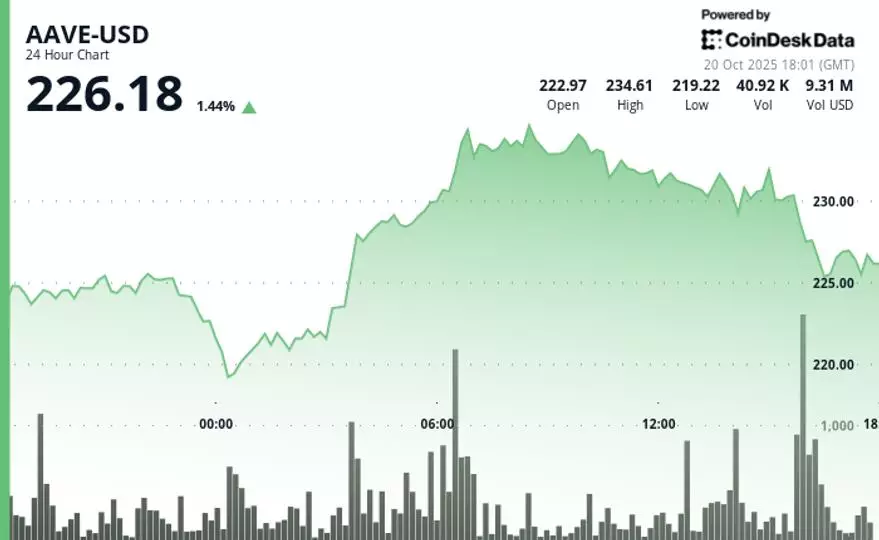

Dive into the world of AAVE, USDC, and liquidity in DeFi. Discover key trends, insights, and what's shaping the future of decentralized finance.

Oct 21, 2025 at 02:22 am

-

Explore the convergence of BlockDAG's innovative structure, Chainlink's oracle prowess, and the evolving crypto landscape, hinting at a decentralized future.

Oct 21, 2025 at 01:00 am

-

Exploring crypto presales like BlockchainFX, LivLive and Ozak AI and their ROI projections for 2025, amidst giants like Bitcoin and Solana. Find out which offer the best potential.

Oct 21, 2025 at 12:30 am

Similar Coins

Twitter

GitHub

Close