All-time High

$2.3

Nov 16, 2021

All-time Low

$0.88

Mar 11, 2023

Volume(24h)

$17.7B

Turnover rate

27.21%

Market Cap

$65.0385B

FDV

$65B

Circulating supply

$65.04B

Total supply

$65.04B

Max supply

Website

Contracts

Explorers

https://solscan.io/token/EPjFWdd5AufqSSqeM2qN1xzybapC8G4wEGGkZwyTDt1v

https://solscan.io/token/EPjFWdd5AufqSSqeM2qN1xzybapC8G4wEGGkZwyTDt1v

https://app.nansen.ai/token-god-mode?chain=ethereum&tab=transactions&tokenAddress=0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48

https://etherscan.io/token/0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48

https://explorer.solana.com/address/EPjFWdd5AufqSSqeM2qN1xzybapC8G4wEGGkZwyTDt1v

https://tronscan.org/#/token20/TEkxiTehnzSmSe2XqrBj4w32RUN966rdz8

Currency Calculator

{{conversion_one_currency}}

{{conversion_two_currency}}

| Exchange | Pairs | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{decimal(val.price,true,2)}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

Community sentiment

26%

74%

Bullish

Bearish

Need to catch up on the news? Here's our top 10 from today:

Need to catch up on the news? Here's our top 10 from today:  FTX announces next distribution record date set for Aug. 15, 2025 with distribution on Sept. 30, 2025.

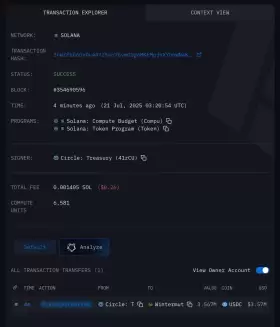

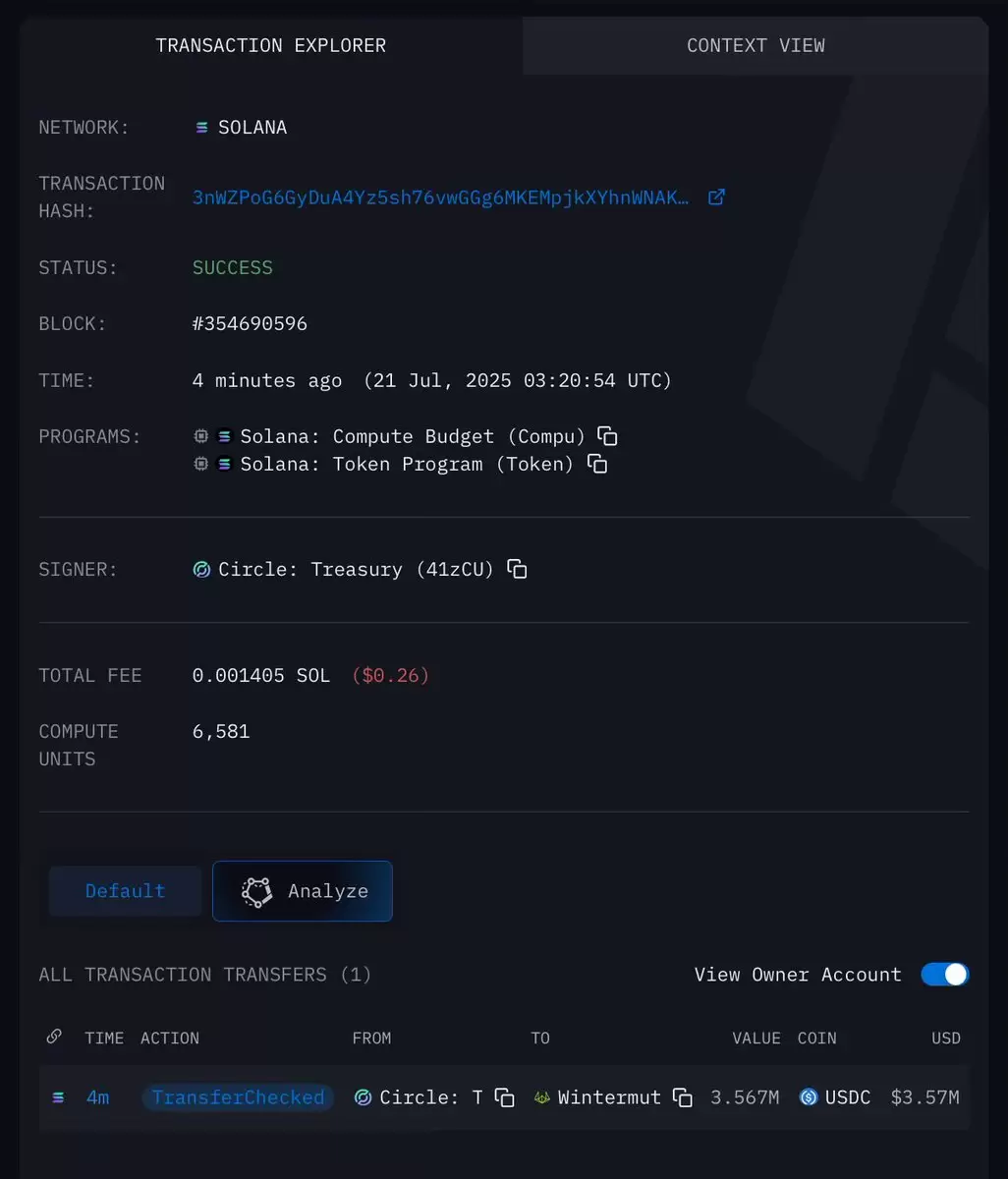

FTX announces next distribution record date set for Aug. 15, 2025 with distribution on Sept. 30, 2025.  Circle has minted a total of 750,000,000 $USDC on Solana.

Circle has minted a total of 750,000,000 $USDC on Solana.  President Trump has signed three executive

President Trump has signed three executive

| Exchange | Pair | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{decimal(val.price,true,2)}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

About USDC

Where Can You Buy USDC (USDC)?

As you might expect, one of the most enthusiastic exchanges that offers USDC is Coinbase, given how the exchange was involved in this stablecoin’s creation. USDC can also be purchased and traded on Poloniex, Binance, OKEx and Bitfinex, as well as decentralized exchanges such as Uniswap. USDC is commonly bought with Bitcoin — and if it’s your first time buying Bitcoin, be sure to check out our comprehensive guide[ here](https://coinmarketcap.com/how-to-buy-bitcoin/).

How Is the USDC Network Secured?

All of the USDCs in circulation are actually ERC-20 tokens, which can be found on the Ethereum blockchain. One of the biggest advantages here is how it can then be integrated with Ethereum-based applications. As we mentioned earlier, security and confidence in this stablecoin is delivered by proving that U.S. dollars are being held safely in reserve.

How Many USDC (USDC) Are There in Circulation?

It’s a bit difficult to give an exact number here — as in theory, the number of USDC that can exist is limitless. New coins are created in line with demand, whenever someone wants to purchase one with their humble dollar. That said, there have been factors that have helped USDC enjoy an explosion in popularity over the years — especially in 2020. One of them is the sudden, sharp rise in the popularity of decentralized finance. USDC is a common sight on many [DeFi](https://coinmarketcap.com/alexandria/article/what-is-decentralized-finance) protocols given how it serves as an onramp to the wider ecosystem.

How Much Is Held in USDC Asset Reserves?

Following the [collapse](https://coinmarketcap.com/alexandria/article/ust-plummets-to-0-38-and-luna-falls-82-in-24-hours-as-do-kwon-fails-to-deliver-recovery-plan) of TerraUSD, stablecoin issuers have been under intense scrutiny over the quality of the reserves backing their tokens. In a transparency move, Circle Internet Financial LLC (Circle), the issuer of the USDC stablecoin released its reserves report as of July 31, 2022. According to the report, the total USDC reserves held by the company consist of $42.3 billion worth of US Treasury Securities and total cash deposits of $12.2 billion. The monthly reserve report was issued by leading global accounting firm Grant Thornton. The accounting firm later released an independent attestation dated August 24, 2022. It reads: “_In our opinion, the Reserve Information in the accompanying USDC Reserve Report as of July 31, 2022 is fairly stated, based on the criteria set forth in the USDC Reserve Report, in all material respects._”

What Makes USDC (USDC) Unique?

The stablecoin market has become exceedingly crowded over recent years — but USDC has aimed to stand head and shoulders over competitors in several ways. One of them concerns transparency — and giving users the assurance that they will be able to withdraw 1 USDC and receive $1 in return without any issues. To this end, it says a major accounting firm is tasked with verifying the levels of cash that are held in reserve, and ensuring this matches up with the [number of tokens](https://coinmarketcap.com/alexandria/article/what-is-tokenomics) in circulation. Unlike some crypto ventures, Circle and Coinbase have also achieved regulatory compliance — and this has helped pave the way for international expansion. Both projects are also well-funded, giving the stablecoin certainty. [Coinbase](https://coinmarketcap.com/exchanges/coinbase-exchange/) briefly contemplated [diversifying the funds backing USDC](https://coinmarketcap.com/alexandria/article/facing-criticism-coinbase-promises-usdc-stablecoin-will-be-100-dollar-backed-again), but retracted that proposal after heavy community backlash. The transparency over the provenance of its funds has been a big reason for USDC's success. Unlike its rival [USDT](https://coinmarketcap.com/currencies/tether/), which has found itself embroiled in repeated [investigations](https://coinmarketcap.com/alexandria/article/is-tether-untouchable-the-latest-twist-in-a-long-running-drama), USDC has never been accused of any wrongdoing. That has led to USDC gobbling up much of USDT's dominance in the [stablecoin](https://coinmarketcap.com/alexandria/glossary/stablecoin) market: although USDT commanded a 74%:16% lead in market share in February 2021, this has shrunk to a 45%:30% lead in February 2022.

Who Are the Founders of USDC?

The Centre Consortium has two founding members. One of them is the peer-to-peer payment services company Circle, while the other is the Coinbase cryptocurrency exchange. Other crypto ventures are open to join this consortium. Explaining the rationale behind USDC, Circle co-founders Jeremy Allaire and Sean Neville wrote: “We believe that an open internet of value exchange can transform and integrate the world more deeply, eventually eliminating artificial economic borders and enabling a more efficient and inclusive global marketplace that connects every person on the planet.” In 2020, Circle and Coinbase collectively announced a major upgrade to USDC’s protocol and smart contract. The goal of these enhancements is to make it easier for USDC to be used for everyday payments, commerce and peer-to-peer transactions.

What Is USDC (USDC)?

USDC is a [stablecoin](https://coinmarketcap.com/alexandria/article/what-is-a-stablecoin) that is pegged to the U.S. dollar on a 1:1 basis. Every unit of this cryptocurrency in circulation is backed up by $1 that is held in reserve, in a mix of cash and short-term U.S. Treasury bonds. The Centre consortium, which is behind this asset, says USDC is issued by regulated financial institutions. The stablecoin originally launched on a limited basis in September 2018. Put simply, USDC’s mantra is “digital money for the digital age” — and the stablecoin is designed for a world where cashless transactions are becoming more common. Several use cases have been unveiled for the USDC. As well as providing a safe haven for crypto traders in times of volatility, those behind the stablecoin say it can also allow businesses to accept payments in digital assets, and shake up an array of sectors including decentralized finance and gaming. Overall, the goal is to create an ecosystem where USDC is accepted by as many wallets, exchanges, service providers and dApps as possible.

USDC News

-

Explore the clash between Bitcoin mining noise pollution and its health impacts on a Texas town, highlighting the community's struggle and the broader implications.

Jul 25, 2025 at 03:50 am

-

Tesla's Bitcoin bet in 2021 looked genius, but market shifts and meme coin volatility have created a wild ride. We dive into the latest developments and losses.

Jul 25, 2025 at 03:49 am

-

Analyzing the shifting dynamics of Bitcoin dominance as altcoins gain traction, fueled by institutional interest and innovative projects.

Jul 25, 2025 at 03:21 am

-

Japanese AI firm Quantum Solutions plans a massive Bitcoin treasury, signaling a growing trend in Asia amidst economic uncertainty. Is this a savvy move or a risky gamble?

Jul 24, 2025 at 09:41 pm

-

Dive into the latest Bitcoin Cash (BCH) price predictions, trends analysis, and market insights. Is BCH setting up for an explosive move in 2025?

Jul 24, 2025 at 08:00 am

-

Explore Tesla's Bitcoin strategies, AI advancements, and the evolving intersection of tech and crypto in 2025. A look at the trends and insights shaping the future.

Jul 24, 2025 at 05:46 am

-

Square's Bitcoin integration and Lightning Network could revolutionize retail. Get the scoop on adoption, benefits, and what it means for the future of crypto payments.

Jul 24, 2025 at 03:32 am

-

H100 Group is making waves with its Bitcoin treasury strategy. Discover how this Swedish company is diving deep into the world of cryptocurrency.

Jul 24, 2025 at 12:04 am

-

Analyzing Bitcoin's profit-taking trends, whale activity, and technical indicators to understand potential price movements in July 2025.

Jul 23, 2025 at 03:50 pm

Similar Coins

Twitter

GitHub

Close