|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

当政府购买或以其他方式采购比特币时,他们支持这样的想法,即这是一段有价值的资产。

Cryptocurrencies haven't escaped unscathed from the market's chaos and economic disruptions of 2025 so far. But, at least up until now, Bitcoin (BTC -0.84%) is holding together reasonably well.

到目前为止,加密货币尚未逃离市场的混乱和2025年的经济破坏。但是,至少到目前为止,比特币(BTC -0.84%)的保持良好状态。

And that's just one of the ways that it is proving that it has staying power. Let's take a look at a few of those in detail.

这只是证明它具有持久力量的方式之一。让我们看一下其中的一些。

1. Widespread governmental adoption is looking more likely

1。广泛的政府采用看起来更有可能

When governments buy or otherwise procure Bitcoin, they support the idea that it's an asset that's going to be valuable for a while. That's doubly true when governments are doing so after changing their tune about whether to allow the asset to be legally held and exchanged at all. And it's this exact situation that shows Bitcoin is proving that it has staying power.

当政府购买或以其他方式采购比特币时,他们支持这样的想法,即这是一段有价值的资产。当政府改变了是否允许合法持有和交换资产后,政府正在这样做后,这是双重的。正是这种确切的情况表明比特币证明它具有持久力。

The biggest development is the planned U.S. Strategic Bitcoin Reserve (SBR) policy, which mandates the government to retain coins it acquires via asset forfeitures and other methods rather than liquidating them for cash. While the U.S. SBR is not yet implemented, and it may never be -- or it might be, and then reversed by a future administration -- the gist of the situation is that the U.S. will aspire to hold the coins it obtains indefinitely rather than selling them. Other countries may soon follow with similar policies, given that they're investigating the merits of doing so currently.

最大的发展是计划中的美国战略比特币储备(SBR)政策,该政策要求政府保留其通过资产没收和其他方法获得的硬币,而不是将其清算以现金清算。尽管美国SBR尚未实施,但它可能永远不会 - 或者可能是,然后被未来的政府逆转,但这种情况的要旨是,美国将渴望拥有无限期获得的硬币而不是出售它们。鉴于他们目前正在调查这样做的优点,其他国家可能会遵循类似的政策。

Once players with a lot of financial heft make the move to hold the coin, smaller ones are likely to follow, as the risk of retaining assets for which there isn't a buyer of sufficient size becomes much lower. And that will simply accelerate this trend, cementing Bitcoin's position as an asset that governments like to hold for the long term.

一旦拥有大量财务状况的玩家采取行动持有硬币,较小的人可能会随之而来,因为保留资产没有足够规模的购买者的风险将变得更低。这只会加快这一趋势,巩固比特币作为政府长期持有的资产的地位。

2. The financial industry and major corporations are buying it

2。金融业和主要公司正在购买

Much like how nations holding Bitcoin encourages others to do the same, when big companies like Tesla buy and hold it, the asset becomes more legitimate in the eyes of other big companies, increasing their chance of buying it. This year wasn't the first time that Tesla or others purchased Bitcoin, but so far it has been a continuation and expansion of the trend.

就像持有比特币的国家如何鼓励他人这样做一样,当像特斯拉这样的大公司购买和持有时,在其他大公司眼中,资产变得更加合法,增加了购买它的机会。今年不是特斯拉或其他人购买比特币,但到目前为止,这是趋势的延续和扩展。

Another critical new type of holder are banks and other financial institutions. Whereas before the regulatory picture was too unclear for these players to buy in with gusto, that problem is rapidly receding thanks to a new set of leaders at the Securities and Exchange Commission (SEC), who are viewed as being very pro-crypto. Soon enough, big banks might be both allowed and willing to hold vast sums of Bitcoin on their balance sheets to capture some of its upside over time.

另一个关键的新型持有人是银行和其他金融机构。尽管在监管情况之前,这些玩家无法与狂热购买,但由于证券交易委员会(SEC)的一系列领导者,他们被认为是非常亲密的,这一问题正在迅速消退。很快,大型银行可能会被允许且愿意在其资产负债表上持有大量的比特币,以捕获其一些上行空间。

They wouldn't be interested in doing that if they thought Bitcoin was a flash in the pan, and they're more likely to hold on to their coins than small investors. In short, the asset now has more staying power than it did before because some of the market's most-enduring competitors are opting to hold it for their own purposes.

如果他们认为比特币是锅中的闪光,他们就不会对此感兴趣,而与小型投资者相比,他们更有可能坚持自己的硬币。简而言之,现在的资产比以前拥有更多的持久力,因为一些市场上一些最具认可的竞争对手选择将其用于自己的目的。

3. It didn't buckle in the face of uncertainty

3。面对不确定性并没有屈服

The prospects of a trade war between the U.S. and the rest of the world have fed huge uncertainty into financial markets, and with good reason. If trade flows decline, economies will struggle, and the businesses that compete within those economies will also, thereby depressing their stock prices, among other impacts.

美国与世界其他地区之间的贸易战前景已经为金融市场带来了巨大的不确定性,这是充分理由的。如果贸易流量下降,经济体将挣扎,而在这些经济体中竞争的企业也将降低其股票价格,以及其他影响。

On paper, Bitcoin is not directly vulnerable to detrimental trade impacts. In practice, it's widely assumed that as a risk asset, its price will decline sharply when conditions in economies or in the financial markets start to deteriorate. That has not yet happened.

在纸上,比特币并不容易受到有害贸易影响的影响。实际上,人们普遍认为,作为一种风险资产,当经济条件或金融市场的条件开始恶化时,其价格将大幅下降。那还没有发生。

Take a look at this chart:

看一下此图表:

As you can see, the story here isn't that Bitcoin is flying while everything else is crashing. It's that it isn't crashing precisely when everything else is struggling, for some very clear reasons.

如您所见,这里的故事不是比特币正在飞行,而其他一切都在崩溃。这是出于某些非常明显的原因,当其他一切都在挣扎时,它并没有确切地崩溃。

If it continues to exhibit this behavior, and it might not, it would ratify the idea that it could be an asset that isn't tightly correlated with the traditional financial markets, despite the fact that many of the businesses within those markets hold it directly. Such a confirmation would also support the idea that it might be a safe haven of sorts, like gold.

如果它继续表现出这种行为,并且可能没有,那么它将批准它可能是一种与传统金融市场没有密切相关的资产,尽管这些市场中的许多企业直接持有它。这样的确认也将支持这样的想法,即可能是类似黄金的避风港。

For now, just take this as a third sign that Bitcoin isn't going anywhere anytime soon. If it survives the ongoing turbulence mostly unscathed, and it might, it'll be yet another big vote in favor of it having unusual staying power.

就目前而言,只要将其作为第三个迹象表明,比特币不会很快到任何地方。如果它幸免于难,那可能是毫发无损的动荡,它可能会又是另一个大型投票,支持它具有不寻常的持久力。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

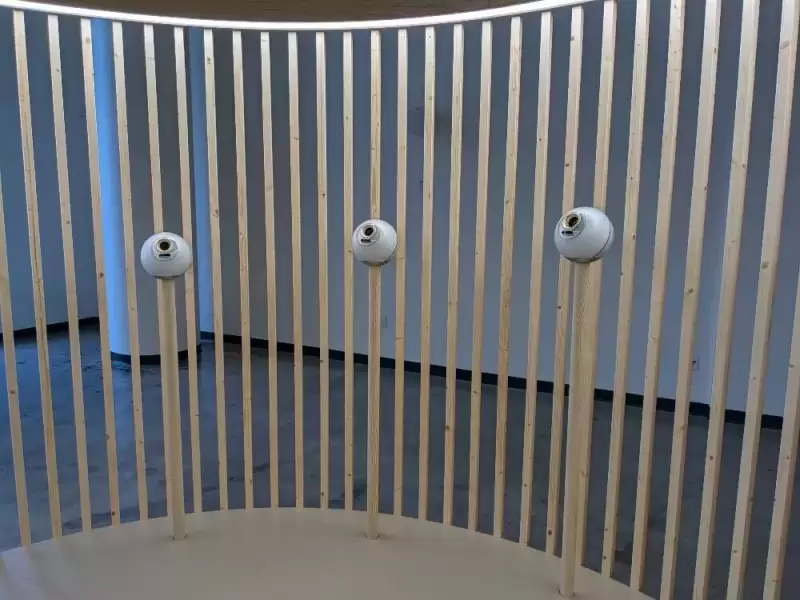

- 世界(以前称为WorldCoin)项目 - 人类工具的旗舰计划

- 2025-05-04 23:15:12

- 美国零售商店是世界上最新的产物(以前称为WorldCoin)项目 - 人类工具的旗舰计划

-

-

-

- Pepe Coin最近的价格下跌引起了广泛关注

- 2025-05-04 23:10:12

- 本文探讨了Pepe Coin最近的价格下跌背后的原因,并介绍了新的Meme Coin Copenders Pepe的思想。

-

- 现在购买的最好的加密货币可能不是显而易见的

- 2025-05-04 23:05:12

- 比特币以9.5万美元的价格调情,市场悄悄地消化了400亿美元的新鲜资本。热钱正在快速移动,投机性流入

-

- 比特币Solaris已成为严重Defi的默认平台

- 2025-05-04 23:05:12

- 以太坊已成为严重Defi的默认平台,但是任何使用它的人都知道这种体验并不总是与声誉相匹配

-

![Chainlink [Link]目睹了交换储备的略有减少,表明销售压力降低。 Chainlink [Link]目睹了交换储备的略有减少,表明销售压力降低。](/assets/pc/images/moren/280_160.png)

- Chainlink [Link]目睹了交换储备的略有减少,表明销售压力降低。

- 2025-05-04 23:00:12

- Chainlink [Link]目睹了交换储备的略有减少,表明销售压力降低。

-

-

- 在2025年下半年以巨额利润购买的最佳加密资产

- 2025-05-04 22:55:12

- 得益于越来越有利的监管气候,加密资源似乎能够在2025年下半年的价值大幅增加。

![Chainlink [Link]目睹了交换储备的略有减少,表明销售压力降低。 Chainlink [Link]目睹了交换储备的略有减少,表明销售压力降低。](/uploads/2025/05/04/cryptocurrencies-news/articles/chainlink-link-witnessed-slight-reduction-exchange-reserves-indicating-decreased-sell-pressure/middle_800_480.webp)