|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特币(BTC)周二收紧了在加密货币市场上的控制力,随着加密货币交易员旋转到市场的锚点资产,优势升至新鲜的四年高。

Bitcoin (BTC) tightened its grip on the crypto market on Tuesday, with dominance surging to fresh four-year highs as traders rotated into the market’s anchor asset ahead of tomorrow's key Federal Reserve policy meeting.

比特币(BTC)周二收紧了对加密货币市场的控制,在明天的主要美联储政策会议之前,贸易商旋转到市场的锚点资产中,统治地位升至新鲜的四年高点。

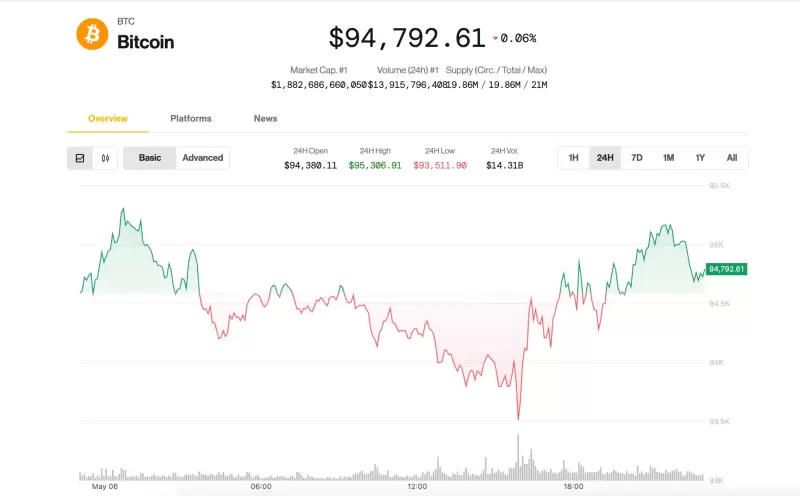

BTC held steady around the $94,000-$95,000 area, up a modest 0.4% over the past 24 hours and extending a tight-range trading pattern that has persisted since the weekend.

BTC保持稳定量约为94,000美元至95,000美元的面积,在过去的24小时内增长了0.4%,并延长了自周末以来一直存在的紧密交易模式。

Meanwhile, the broad-market CoinDesk 20 Index slipped 0.7% lower, with Ethereum's ether (ETH), and native tokens of Sui (SUI), Aptos (APT) and Polygon (POL) dragging the benchmark lower.

同时,宽市场Coindesk 20指数下跌了0.7%,以太坊的以太(ETH)和SUI(SUI),Aptos(APT)和Polygon(POL)(POL)的天然代币(ETH)下滑。

A check on traditional markets showed stocks posting back-to-back losses, with the S&P 500 and the tech-heavy Nasdaq closing 0.7%-0.8% down, once again underperforming BTC.

对传统市场的检查显示,股票背靠背损失,标准普尔500指数和技术繁重的纳斯达克股票下跌0.7%-0.8%,再次表现不佳。

Despite the lack of major price action, focus has increasingly turned to bitcoin's growing share of the overall crypto market: The so-called Bitcoin Dominance metric surpassed 65%, its highest reading since 2021 January, according to TradingView data, signaling capital consolidating into the asset perceived as the most resilient in the face of macroeconomic uncertainty.

尽管缺乏重大价格行动,但焦点越来越多地转向了比特币在整体加密市场中的份额日益增长:所谓的比特币优势指标超过65%,这是自2021年1月以来的最高读数,根据交易景观数据,信号资本巩固了资产中的资产中最能使资产视为宏观经济性不确定性的最具韧性。

Joel Kruger, market strategist at LMAX Group, described the current landscape as one of pause and anticipation. "The cryptocurrency market has remained largely stagnant since the weekly open, with prices settling into a holding pattern as investors await a pivotal catalyst," he noted. "This impetus may arise from traditional markets, driven by updates on tariff-related economic impacts or the Federal Reserve’s anticipated FOMC decision on May 7."

LMAX集团市场策略师乔尔·克鲁格(Joel Kruger)将当前的景观描述为停顿和预期之一。他指出:“自每周开放以来,加密货币市场一直停滞不前,当投资者在等待关键催化剂时,价格定为持有模式。” “这种动力可能是由传统市场引起的,这是在与关税相关的经济影响的最新情况下或美联储预期的5月7日的FOMC决定所驱动的。”

The Federal Reserve is widely expected to hold interest rates steady, according to the CME FedWatch Tool, but traders are on edge for any shift in Fed Chair Jerome Powell's tone that could impact risk appetite.

根据CME FedWatch工具的说法,人们普遍认为,美联储将保持利率稳定,但交易者在美联储主席杰罗姆·鲍威尔(Jerome Powell)的基调的任何转变中都处于优势,这可能会影响风险食欲。

Bitcoin volatility burst on the horizon

比特币波动率爆发

With bitcoin's recent price action being extremely flat, the upcoming FOMC meeting "is rigged to cause significant volatility," said Vetle Lunde, head of research at K33. He noted in a Tuesday report that BTC's short term volatility is "abnormally compressed," with the 7-day average dropping to the lowest level last week in 563 days.

K33研究负责人Vetle Lunde说,随着比特币最近的价格行动非常平坦,即将举行的FOMC会议“被操纵是为了引起大幅度的波动性”。他在周二的一份报告中指出,BTC的短期波动“异常压缩”,在563天内的7天平均水平下降到上周的最低水平。

"Such low volatility regimes in BTC tend to be short-lived," Lunde said. "Violent volatility outbursts typically follow this form of stability once prices start to move, as leveraged trades are unwound and traders are reactivated into the market."

伦德说:“ BTC中如此低的波动性制度往往是短暂的。” “一旦价格开始上涨,暴力波动爆发通常会遵循这种稳定形式,因为杠杆交易是解开的,交易者被重新激活到市场上。”

He said that a significant cascade lower is unlikely, as funding rates for perpetual swaps are consistently negative. Similar periods historically offered good buying opportunities for medium and long-term investors, Lunde added, favoring "aggressive spot exposure" ahead.

他说,由于永久掉期的资金率始终是负面的,因此不太可能降低级联。伦德补充说,类似时期历史上为中期和长期投资者提供了良好的购买机会,他赞成“积极的现场曝光”。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 比特文件以与美国证券交易委员会的交易所交易基金附近列出席位

- 2025-05-07 11:15:12

- ETF附近的位(靠近)将通过传统的经纪人跟踪近代币的价格变动

-

-

-

-

- Dogecoin(Doge)价格显示了一周的销售压力后恢复的迹象

- 2025-05-07 11:05:13

- 在销售压力和市场不确定性一周之后,Doge Price显示出恢复的迹象。滑到$ 0.1750之后

-

-

-

-