|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特幣(BTC)週二收緊了在加密貨幣市場上的控制力,隨著加密貨幣交易員旋轉到市場的錨點資產,優勢升至新鮮的四年高。

Bitcoin (BTC) tightened its grip on the crypto market on Tuesday, with dominance surging to fresh four-year highs as traders rotated into the market’s anchor asset ahead of tomorrow's key Federal Reserve policy meeting.

比特幣(BTC)週二收緊了對加密貨幣市場的控制,在明天的主要美聯儲政策會議之前,貿易商旋轉到市場的錨點資產中,統治地位升至新鮮的四年高點。

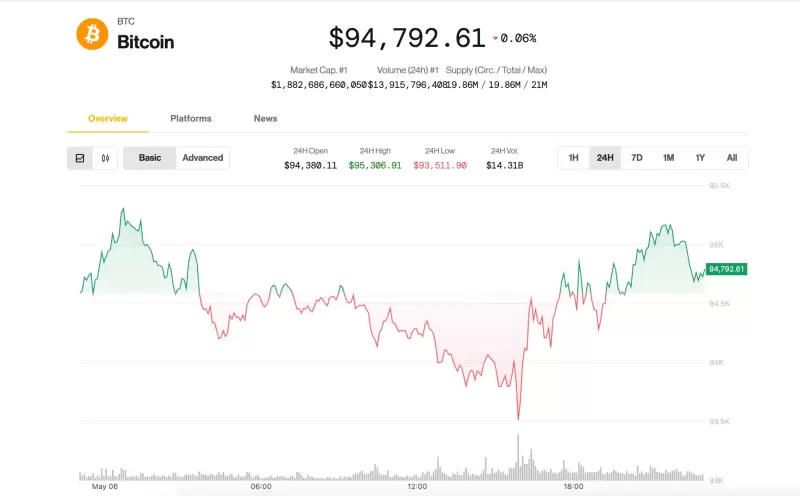

BTC held steady around the $94,000-$95,000 area, up a modest 0.4% over the past 24 hours and extending a tight-range trading pattern that has persisted since the weekend.

BTC保持穩定量約為94,000美元至95,000美元的面積,在過去的24小時內增長了0.4%,並延長了自周末以來一直存在的緊密交易模式。

Meanwhile, the broad-market CoinDesk 20 Index slipped 0.7% lower, with Ethereum's ether (ETH), and native tokens of Sui (SUI), Aptos (APT) and Polygon (POL) dragging the benchmark lower.

同時,寬市場Coindesk 20指數下跌了0.7%,以太坊的以太(ETH)和SUI(SUI),Aptos(APT)和Polygon(POL)(POL)的天然代幣(ETH)下滑。

A check on traditional markets showed stocks posting back-to-back losses, with the S&P 500 and the tech-heavy Nasdaq closing 0.7%-0.8% down, once again underperforming BTC.

對傳統市場的檢查顯示,股票背靠背損失,標準普爾500指數和技術繁重的納斯達克股票下跌0.7%-0.8%,再次表現不佳。

Despite the lack of major price action, focus has increasingly turned to bitcoin's growing share of the overall crypto market: The so-called Bitcoin Dominance metric surpassed 65%, its highest reading since 2021 January, according to TradingView data, signaling capital consolidating into the asset perceived as the most resilient in the face of macroeconomic uncertainty.

儘管缺乏重大價格行動,但焦點越來越多地轉向了比特幣在整體加密市場中的份額日益增長:所謂的比特幣優勢指標超過65%,這是自2021年1月以來的最高讀數,根據交易景觀數據,信號資本鞏固了資產中的資產中最能使資產視為宏觀經濟性不確定性的最具韌性。

Joel Kruger, market strategist at LMAX Group, described the current landscape as one of pause and anticipation. "The cryptocurrency market has remained largely stagnant since the weekly open, with prices settling into a holding pattern as investors await a pivotal catalyst," he noted. "This impetus may arise from traditional markets, driven by updates on tariff-related economic impacts or the Federal Reserve’s anticipated FOMC decision on May 7."

LMAX集團市場策略師喬爾·克魯格(Joel Kruger)將當前的景觀描述為停頓和預期之一。他指出:“自每週開放以來,加密貨幣市場一直停滯不前,當投資者在等待關鍵催化劑時,價格定為持有模式。” “這種動力可能是由傳統市場引起的,這是在與關稅相關的經濟影響的最新情況下或美聯儲預期的5月7日的FOMC決定所驅動的。”

The Federal Reserve is widely expected to hold interest rates steady, according to the CME FedWatch Tool, but traders are on edge for any shift in Fed Chair Jerome Powell's tone that could impact risk appetite.

根據CME FedWatch工具的說法,人們普遍認為,美聯儲將保持利率穩定,但交易者在美聯儲主席杰羅姆·鮑威爾(Jerome Powell)的基調的任何轉變中都處於優勢,這可能會影響風險食慾。

Bitcoin volatility burst on the horizon

比特幣波動率爆發

With bitcoin's recent price action being extremely flat, the upcoming FOMC meeting "is rigged to cause significant volatility," said Vetle Lunde, head of research at K33. He noted in a Tuesday report that BTC's short term volatility is "abnormally compressed," with the 7-day average dropping to the lowest level last week in 563 days.

K33研究負責人Vetle Lunde說,隨著比特幣最近的價格行動非常平坦,即將舉行的FOMC會議“被操縱是為了引起大幅度的波動性”。他在周二的一份報告中指出,BTC的短期波動“異常壓縮”,在563天內的7天平均水平下降到上週的最低水平。

"Such low volatility regimes in BTC tend to be short-lived," Lunde said. "Violent volatility outbursts typically follow this form of stability once prices start to move, as leveraged trades are unwound and traders are reactivated into the market."

倫德說:“ BTC中如此低的波動性制度往往是短暫的。” “一旦價格開始上漲,暴力波動爆發通常會遵循這種穩定形式,因為槓桿交易是解開的,交易者被重新激活到市場上。”

He said that a significant cascade lower is unlikely, as funding rates for perpetual swaps are consistently negative. Similar periods historically offered good buying opportunities for medium and long-term investors, Lunde added, favoring "aggressive spot exposure" ahead.

他說,由於永久掉期的資金率始終是負面的,因此不太可能降低級聯。倫德補充說,類似時期歷史上為中期和長期投資者提供了良好的購買機會,他贊成“積極的現場曝光”。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- Dogecoin(Doge)價格顯示了一周的銷售壓力後恢復的跡象

- 2025-05-07 11:05:13

- 在銷售壓力和市場不確定性一周之後,Doge Price顯示出恢復的跡象。滑到$ 0.1750之後

-

-

-

-

-

-

- 比特幣價格急劇上升至96,500美元

- 2025-05-07 10:50:12

- 這標誌著自唐納德·特朗普總統於一月份返回任職以來,兩個政府之間的第一次直接參與,並對中國商品徵收了新的關稅。

-

-

- 泵驅動新的令牌生態系統

- 2025-05-07 10:45:13

- 代幣發射台生態系統Pump.Fun最近幾個月經歷了巨大的動力,成為了分散代幣創建的中心機制。