|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bitcoin (BTC) tightened its grip on the crypto market on Tuesday, with dominance surging to fresh four-year high as crypto traders rotated into the market's anchor asset

Bitcoin (BTC) tightened its grip on the crypto market on Tuesday, with dominance surging to fresh four-year highs as traders rotated into the market’s anchor asset ahead of tomorrow's key Federal Reserve policy meeting.

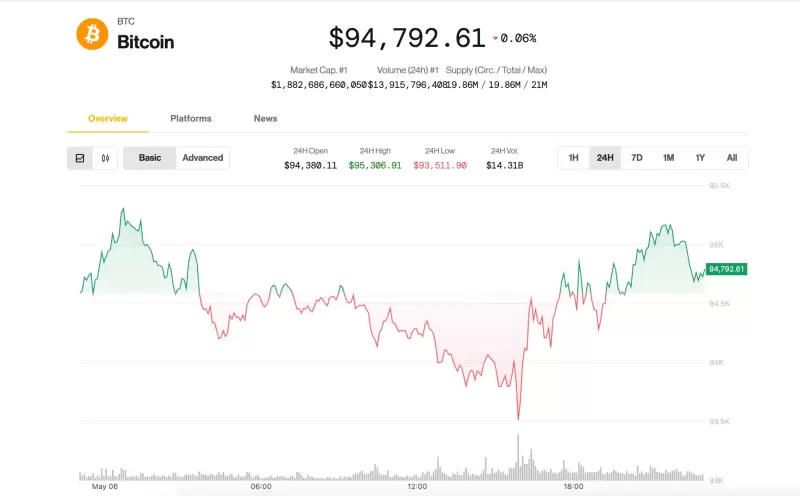

BTC held steady around the $94,000-$95,000 area, up a modest 0.4% over the past 24 hours and extending a tight-range trading pattern that has persisted since the weekend.

Meanwhile, the broad-market CoinDesk 20 Index slipped 0.7% lower, with Ethereum's ether (ETH), and native tokens of Sui (SUI), Aptos (APT) and Polygon (POL) dragging the benchmark lower.

A check on traditional markets showed stocks posting back-to-back losses, with the S&P 500 and the tech-heavy Nasdaq closing 0.7%-0.8% down, once again underperforming BTC.

Despite the lack of major price action, focus has increasingly turned to bitcoin's growing share of the overall crypto market: The so-called Bitcoin Dominance metric surpassed 65%, its highest reading since 2021 January, according to TradingView data, signaling capital consolidating into the asset perceived as the most resilient in the face of macroeconomic uncertainty.

Joel Kruger, market strategist at LMAX Group, described the current landscape as one of pause and anticipation. "The cryptocurrency market has remained largely stagnant since the weekly open, with prices settling into a holding pattern as investors await a pivotal catalyst," he noted. "This impetus may arise from traditional markets, driven by updates on tariff-related economic impacts or the Federal Reserve’s anticipated FOMC decision on May 7."

The Federal Reserve is widely expected to hold interest rates steady, according to the CME FedWatch Tool, but traders are on edge for any shift in Fed Chair Jerome Powell's tone that could impact risk appetite.

Bitcoin volatility burst on the horizon

With bitcoin's recent price action being extremely flat, the upcoming FOMC meeting "is rigged to cause significant volatility," said Vetle Lunde, head of research at K33. He noted in a Tuesday report that BTC's short term volatility is "abnormally compressed," with the 7-day average dropping to the lowest level last week in 563 days.

"Such low volatility regimes in BTC tend to be short-lived," Lunde said. "Violent volatility outbursts typically follow this form of stability once prices start to move, as leveraged trades are unwound and traders are reactivated into the market."

He said that a significant cascade lower is unlikely, as funding rates for perpetual swaps are consistently negative. Similar periods historically offered good buying opportunities for medium and long-term investors, Lunde added, favoring "aggressive spot exposure" ahead.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

- Solana Doubles Down on Core Infrastructure Improvements as Memecoins Drive Trading Activity

- May 07, 2025 at 11:10 am

- At the same time, memecoins largely drove trading activity on its network. While the broader crypto market faced a selloff in risk assets, Solana's focus on development and its growing ecosystem showed its aim for long-term leadership.

-

-

-

- Dogecoin (DOGE) Price Struggles Under the $0.18 Resistance as Geopolitical Tension Rises. Here’s How DOGE Could React If It Matches 30% of US M1 Supply

- May 07, 2025 at 11:00 am

- Dogecoin (DOGE) price momentum has weakened over the past two weeks, mirroring broader risk-off sentiment in the broader crypto markets.

-

- Melania Trump's "Meme Coin" Got Dumped by Early Investors, Making Them Millions

- May 07, 2025 at 11:00 am

- Shortly before U.S. President Donald Trump's wife, Melania, unveiled a "meme coin" named after her to the public earlier this year, a small number of investors bought the coin in advance and made huge profits, according to reports.

-