|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEC昨天與Ripple提交協議後,XRP價格飆升了8%以上。現在,加密分析師Egrag Crypto已經對Altcoin的價格行動發表了評論,並揭示了它確認看漲的突破需要發生的事情。

The price of XRP, the cryptocurrency developed by Ripple, has surged over 8% following the US Securities and Exchange Commission’s (SEC) filing of its agreement with the firm yesterday, July 26. Now, crypto analyst Egrag Crypto has commented on the altcoin’s price action and revealed what needs to happen for it to confirm a bullish breakout.

XRP是Ripple開發的加密貨幣的價格,在美國證券交易委員會(SEC)昨天7月26日與該公司達成協議之後,XRP的價格飆升了8%。

In an X post, Egrag Crypto stated that in the short term, XRP must close above $2.41 to $2.50 to confirm a bullish breakout. He noted that the altcoin is at a crossroads, trading between critical breakout levels and potential retest.

在X帖子中,Egrag Crypto表示,在短期內,XRP必須在2.41美元至2.50美元上關閉以確認看漲的突破。他指出,Altcoin處於十字路口,在關鍵的突破水平和潛在的重新測試之間進行交易。

“A failure to break the range around $2.30 and begin consolidation could mean that the price correction isn’t over yet. Below $1.30/$1.20 is where we might see lower targets and the ultimate retest. A drop to this zone would present a once-in-a-generation buying opportunity,” the analyst said.

分析師說:“未能在2.30美元左右打破範圍並開始合併可能意味著價格校正還沒有結束。低於$ 1.30/$ 1.20,我們可能會看到較低的目標和最終的重新測試。該區域的下降將帶來一次一代的購買機會,”分析師說。

However, Erag Crypto still expects to see the price of XRP rally to as high as $27 in this market cycle, as he stated that his cycle targets haven’t changed. Crypto analyst Dark Defender also recently indicated that the journey of Ripple’s native crypto to double digits has begun.

但是,Erag Crypto仍然希望在這個市場週期中看到XRP集會的價格高達27美元,因為他說他的周期目標沒有改變。加密分析師Dark Defender最近還表示,Ripple的本地加密貨幣與兩位數的旅程已經開始。

This bullish outlook for the altcoin comes amid the US SEC’s filing of its settlement agreement with Ripple. This development further brings the long-running legal battle closer to a conclusion. A conclusion of the case would bring market clarity for investors and is undoubtedly bullish for the altcoin.

在美國SEC與Ripple提交了和解協議的同時,這種看漲替代幣的前景是出現的。這一發展進一步使長期的法律鬥爭更接近結論。案件的結論將使投資者的市場清晰度,無疑是對山寨幣的看漲。

After months of legal disputes with the SEC, the crypto behemoth agreed to settle the case out of court. The agency had sued Ripple in December 2020 for allegedly conducting an unregistered securities offering through its cryptocurrency, XRP. Throughout the lawsuit, the SEC asserted that XRP should be classified as a "security" due to its ties to a central issuer.

在與SEC提出了數月的法律糾紛後,加密省龐然大物同意將案件撤回法院。該機構於2020年12月起訴Ripple,據稱通過其加密貨幣XRP進行了未註冊的證券。在整個訴訟中,SEC斷言XRP由於與中央發行人的聯繫而被歸類為“安全”。

However, in a joint filing with a federal judge on Wednesday, July 26, both parties reached an agreement to dismiss the case with prejudice. This implies that the case cannot be reopened in the future.

但是,在7月26日星期三與聯邦法官的聯合文件中,雙方達成了一項協議,以偏見案件。這意味著將來無法重新審理此案。

The agency and the blockchain firm agreed to settle administrative law violations of Section 5 of the Securities Act of 1933. These violations relate to the sale of XRP to institutional investors in 2013 and 2014.

該機構和區塊鏈公司同意解決對1933年《證券法》第5條第5條的違反行政法。這些違規行為與2013年和2014年將XRP出售給機構投資者有關。

Moreover, the SEC has agreed to return any unjust enrichment to institutional investors who bought XRP during the relevant period.

此外,SEC已同意將任何不公正的豐富性退還給在相關時期購買XRP的機構投資者。

The SEC’s agreement to return any unjust enrichment is noteworthy. Usually, when a case settles, the regulator keeps any penalties levied on the accused party. However, in this instance, the SEC is returning the funds to investors.

SEC歸還任何不公正的豐富協議的協議值得注意。通常,當案件解決時,監管機構將對被告徵收任何罰款。但是,在這種情況下,SEC將資金退還給投資者。

This decision could be linked to a statement made by SEC Chair Gary Gensler earlier this year. Gensler had expressed concern over the lack of clear crypto market rules, which he believes had led to widespread fraud. He also noted that he planned to pursue any entity that flouted the applicable securities laws.

該決定可以與今年早些時候SEC主席Gary Gensler發表的聲明有關。 Gensler對缺乏明確的加密市場規則表示關注,他認為這導致了廣泛的欺詐行為。他還指出,他計劃追求任何違反了適用證券法的實體。

Amid this prediction for the XRP price, Ripple whales have moved over $175 million worth of coins.

在對XRP價格的預測中,波紋鯨已轉移了價值超過1.75億美元的硬幣。

Whale Alert data shows that one whale moved 46.4 million XRP ($106.6 million) from an unknown wallet to another unknown wallet.

鯨魚警報數據表明,一隻鯨魚將4640萬XRP(1.066億美元)從一個未知的錢包轉移到另一個未知的錢包。

Another whale then moved 29.5 million XRP ($69.5 million) from an unknown wallet to top crypto exchange Coinbase. Transfers to exchanges are typically bearish, as it suggests the holder plans to offload these coins.

然後,另一隻鯨魚將2950萬XRP(6950萬美元)從一個未知的錢包轉移到了頂級加密交易所coinbase。交換通常是看跌,因為這表明持有人計劃卸載這些硬幣。

However, whales look to be actively accumulating at the moment, which is bullish for the XRP price. As CoinGape reported, Ripple whales moved 782 million XRP to unknown wallets. Transfers to unknown wallets usually indicates that the investor is planning on holding these coins for the long term.

但是,鯨魚目前似乎正在積累積累,這對XRP價格看漲。正如Coingape報導的那樣,Ripple Whales將7.82億XRP移至未知錢包。轉交給未知錢包通常表明投資者計劃長期持有這些硬幣。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- XPF令牌預售吸引了鯨魚,從精明的投資者那裡籌集了10000多個XRP

- 2025-05-10 09:45:12

- XRP生態系統正在經歷重大突破,因為鯨魚和精明的投資者湧入XPFinance($ XPF)代幣預售

-

-

![比特幣[BTC]超過亞馬遜,成為全球第五大資產。 比特幣[BTC]超過亞馬遜,成為全球第五大資產。](/assets/pc/images/moren/280_160.png)

- 比特幣[BTC]超過亞馬遜,成為全球第五大資產。

- 2025-05-10 09:40:13

- 比特幣再次破壞了$ 10.K的門檻,經過數週的向下壓力,比特幣達到了$ 104K的驚人售價。

-

- 比特幣被認為是合理的錢嗎?

- 2025-05-10 09:40:13

- 我們認為金錢是位於銀行帳戶或投資組合中的財富。這也是我們錢包中的現金

-

-

- 比特幣再次超過了100,000美元的大關

- 2025-05-10 09:35:13

- 比特幣再次超過了100,000美元的大關,引發了投資者和分析師的樂觀情緒,他們現在預見到加密貨幣

-

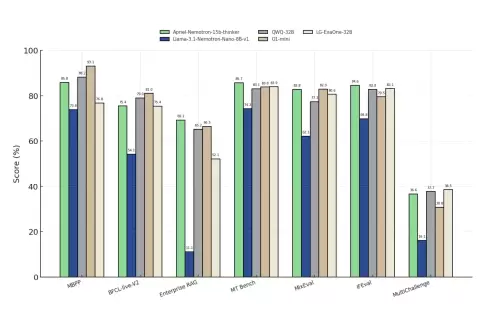

- 介紹Apriel-Nemotron-15b-thinker:一種資源有效的推理模型

- 2025-05-10 09:30:13

- 建立此類模型需要數學推理,科學理解和高級模式識別的整合。

-

-

- 美聯儲保持利率不變,為4.25%至4.5%

- 2025-05-10 09:25:15

- 美聯儲在其最新會議上將利率保持在4.25%至4.5%

![比特幣[BTC]超過亞馬遜,成為全球第五大資產。 比特幣[BTC]超過亞馬遜,成為全球第五大資產。](/uploads/2025/05/10/cryptocurrencies-news/articles/bitcoin-btc-surpasses-amazon-th-largest-asset-market-cap/image_500_300.webp)