|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

分析特朗普的行動,伊朗的地緣政治格局和比特幣的市場變動的交集。發現對最近事件和潛在未來趨勢的見解。

The intersection of Trump, Iran, and Bitcoin has created a volatile landscape in recent weeks. Geopolitical tensions, shifts in market sentiment, and even meme coins are all playing a part. Let's break down the key developments.

特朗普,伊朗和比特幣的交叉點在最近幾週創造了波動的景觀。地緣政治緊張局勢,市場情緒的轉變,甚至模因硬幣都在發揮作用。讓我們分解關鍵的發展。

Trump's Actions and Bitcoin's Reaction

特朗普的行動和比特幣的反應

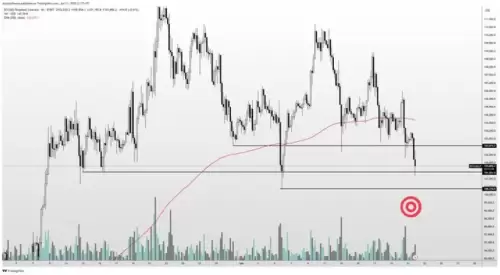

Recent events kicked off with President Trump confirming US airstrikes against Iranian nuclear facilities. Almost immediately, Bitcoin experienced a dip, briefly falling to $101,000 on Binance before quickly recovering. This volatility highlights how sensitive the crypto market is to geopolitical news. Trump's tough stance, hinted at with a statement on Truth Social calling Iran's leader an “easy target,” sent shockwaves, demonstrating the impact of presidential pronouncements on crypto confidence.

最近的事件開始了,特朗普總統確認了美國對伊朗核設施的空襲。比特幣幾乎立即經歷了傾斜,在迅速恢復之前,比特幣短暫跌至101,000美元。這種波動率強調了加密市場對地緣政治新聞的敏感程度。特朗普的堅強立場暗示了關於真相社會的聲明,稱伊朗的領導人是“輕鬆的目標”,這是Shockwaves,這表明了總統宣布對加密貨幣信心的影響。

Iran's Impact on Market Sentiment

伊朗對市場情緒的影響

The escalating conflict between Iran and Israel, coupled with Trump's actions, has intensified market uncertainty. The Crypto Fear & Greed Index has reflected this, sliding into "Neutral" territory. Analysts are even suggesting Bitcoin might test the $100,000 mark again, with some forecasting a potential drop to $93,000 if tensions worsen. It's a stark reminder that global events can significantly influence crypto investments.

伊朗和以色列之間的衝突不斷升級,再加上特朗普的行動,加劇了市場不確定性。加密恐懼和貪婪指數反映了這一點,滑入了“中性”領域。分析師甚至暗示比特幣可能會再次測試100,000美元的成績,如果緊張局勢惡化,則有些預測可能會降至93,000美元。這是一個明顯的提醒,全球事件可以極大地影響加密投資。

Bitcoin Whales to the Rescue?

比特幣鯨進行營救?

Amidst the geopolitical turmoil, Bitcoin whales have been making strategic moves. On June 21, 2025, they triggered a large transaction boost, moving over 674,530 BTC after a slight price dip. This surge suggests that major investors are taking advantage of lower prices, potentially providing support to keep Bitcoin above the critical $100,000 level. Whether this buying pressure can be sustained remains to be seen, especially if global money supply growth slows or trade tariffs tighten.

在地緣政治動盪中,比特幣鯨一直在做出戰略性動作。 2025年6月21日,他們引發了巨大的交易提升,價格略有下跌後,超過674,530 BTC。這次激增表明,主要投資者正在利用較低的價格,可能提供支持以使比特幣高於關鍵的100,000美元水平。是否可以承受這種購買壓力還有待觀察,特別是如果全球貨幣供應增長減慢或貿易關稅加劇。

Trump's Crypto Connections: More Than Meets the Eye

特朗普的加密聯繫:不止於此

Beyond geopolitical maneuvers, the Trump family's involvement in the crypto space continues to raise eyebrows. From meme projects like TRUMP and MELANIA to DeFi ventures, the Trump name is increasingly associated with digital assets. Financial disclosures reveal a complex business empire, including substantial income from WLFI token sales and significant holdings of WLFI governance tokens. It seems the Trump family is treating the crypto market as a cash machine, extracting profits extensively. The exact amount earned remains a mystery, though.

除了地緣政治演習之外,特朗普家族在加密貨幣領域的參與繼續引起人們的注意。從特朗普和梅拉尼亞(Melania)等模因項目到Defi Ventures,特朗普的名稱越來越與數字資產相關聯。財務披露揭示了一個複雜的商業帝國,包括來自WLFI代幣銷售的大量收入和WLFI治理令牌的大量持股。看來,特朗普一家正在將加密貨幣市場視為現金機,從而廣泛提取利潤。不過,確切的數量仍然是一個謎。

A Contrarian Crypto Tale: Mutuum Finance (MUTM)

一個逆勢加密故事:Mutuum Finance(MUTM)

While Bitcoin navigates choppy waters, one project, Mutuum Finance (MUTM), is defying the odds. Its presale has seen remarkable success, raising over $10 million with a promising lending platform. Investors are drawn to its innovative Peer-to-Contract and Peer-to-Peer lending models, as well as the security bolstered by a Certik audit. With a guaranteed 100% ROI at launch and analysts projecting substantial post-launch gains, MUTM presents a compelling alternative in a turbulent market. Is it possible that one should consider investment into Mutuum Finance (MUTM)? Only time will tell!

當比特幣在波濤洶湧的水域中航行時,一個項目,即Mutuum Finance(MUTM),卻違背了賠率。它的預售取得了巨大的成功,在有前途的貸款平台上籌集了超過1000萬美元。投資者被其創新的對等合同和點對點貸款模型所吸引,以及Certik審計的安全性。 MUTM在發射時保證了100%的投資回報率,分析師預測了大量發射後增長,因此在動蕩的市場中提出了令人信服的替代方案。是否應該考慮投資於Mutuum Finance(MUTM)?只有時間會證明!

Final Thoughts

最後的想法

So, what does it all mean? The interplay between Trump, Iran, and Bitcoin is a complex web of geopolitical risk, market speculation, and opportunistic ventures. While uncertainty looms, strategic investors are finding opportunities amidst the chaos. Keep your eyes peeled, folks, because in the world of crypto, anything can happen!

那麼,這意味著什麼?特朗普,伊朗和比特幣之間的相互作用是一個複雜的地緣政治風險,市場投機和機會主義冒險的網絡。儘管不確定性隱約可見,但戰略投資者在混亂中發現了機會。伙計們,請睜大眼睛,因為在加密貨幣世界中,一切都會發生!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- BTC至$ 330K?解碼轉彎頭的比特幣模型

- 2025-06-22 16:25:13

- 比特幣真的可以達到33萬美元嗎?深入研究模型和指標,暗示了這次牛的壯觀的最後階段。

-

- SUI價格每週模式:它會向上搶購嗎?

- 2025-06-22 16:25:13

- 分析SUI在每週圖表上的價格動作,關鍵模式和潛在的突破場景。是玩遊戲嗎?技術指標暗示什麼?

-

- 模因硬幣躁狂症:Neo Pepe可以超越前狂潮中的志願品嗎?

- 2025-06-22 16:45:13

- 探索圍繞Neo Pepe和Shiba Inu等模因硬幣的炒作,分析模因硬幣宇宙中的預售趨勢和潛在市場轉移。

-

- 比特幣,戰爭恐懼和對沖基金:逆勢人士的喜悅?

- 2025-06-22 16:45:13

- 在戰爭的煩惱中,比特幣看到分歧:鯨魚積累,零售逃離。對沖基金是眼睛加密,標誌著複雜的景觀。

-

-

- SPX6900模因硬幣:價格預測和市場沉思

- 2025-06-22 16:37:03

- 潛入SPX6900的野生世界,這是一個模因硬幣!獲取最新的價格預測,市場見解和少量加密幽默。是模因還是月光下?

-

- CoinMarketCap安全漏洞:喚醒加密錢包安全的呼籲

- 2025-06-22 14:25:13

- CoinMarketCap面臨最近的安全漏洞,涉及惡意錢包彈出窗口,突出了加密貨幣空間中不斷存在的危險。

-

- 加密貨幣市場跌落:比特幣傾角和清算戰爭

- 2025-06-22 14:25:13

- 地緣政治緊張局勢和大規模清算引發了加密貨幣市場的低迷。這是暫時的傾角還是更大的東西的開始?

-

- 比特幣的繩索步行:平衡風險和RSI支持

- 2025-06-22 16:40:12

- 由於RSI信號弱點,比特幣面臨著$ 10萬美元的關鍵測試。它會舉行,還是替代投資會竊取演出?