Analyzing the intersection of Trump's actions, Iran's geopolitical landscape, and Bitcoin's market movements. Uncover insights into recent events and potential future trends.

The intersection of Trump, Iran, and Bitcoin has created a volatile landscape in recent weeks. Geopolitical tensions, shifts in market sentiment, and even meme coins are all playing a part. Let's break down the key developments.

Trump's Actions and Bitcoin's Reaction

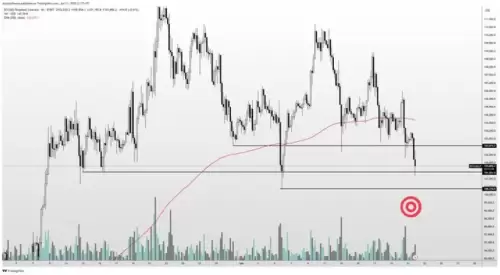

Recent events kicked off with President Trump confirming US airstrikes against Iranian nuclear facilities. Almost immediately, Bitcoin experienced a dip, briefly falling to $101,000 on Binance before quickly recovering. This volatility highlights how sensitive the crypto market is to geopolitical news. Trump's tough stance, hinted at with a statement on Truth Social calling Iran's leader an “easy target,” sent shockwaves, demonstrating the impact of presidential pronouncements on crypto confidence.

Iran's Impact on Market Sentiment

The escalating conflict between Iran and Israel, coupled with Trump's actions, has intensified market uncertainty. The Crypto Fear & Greed Index has reflected this, sliding into "Neutral" territory. Analysts are even suggesting Bitcoin might test the $100,000 mark again, with some forecasting a potential drop to $93,000 if tensions worsen. It's a stark reminder that global events can significantly influence crypto investments.

Bitcoin Whales to the Rescue?

Amidst the geopolitical turmoil, Bitcoin whales have been making strategic moves. On June 21, 2025, they triggered a large transaction boost, moving over 674,530 BTC after a slight price dip. This surge suggests that major investors are taking advantage of lower prices, potentially providing support to keep Bitcoin above the critical $100,000 level. Whether this buying pressure can be sustained remains to be seen, especially if global money supply growth slows or trade tariffs tighten.

Trump's Crypto Connections: More Than Meets the Eye

Beyond geopolitical maneuvers, the Trump family's involvement in the crypto space continues to raise eyebrows. From meme projects like TRUMP and MELANIA to DeFi ventures, the Trump name is increasingly associated with digital assets. Financial disclosures reveal a complex business empire, including substantial income from WLFI token sales and significant holdings of WLFI governance tokens. It seems the Trump family is treating the crypto market as a cash machine, extracting profits extensively. The exact amount earned remains a mystery, though.

A Contrarian Crypto Tale: Mutuum Finance (MUTM)

While Bitcoin navigates choppy waters, one project, Mutuum Finance (MUTM), is defying the odds. Its presale has seen remarkable success, raising over $10 million with a promising lending platform. Investors are drawn to its innovative Peer-to-Contract and Peer-to-Peer lending models, as well as the security bolstered by a Certik audit. With a guaranteed 100% ROI at launch and analysts projecting substantial post-launch gains, MUTM presents a compelling alternative in a turbulent market. Is it possible that one should consider investment into Mutuum Finance (MUTM)? Only time will tell!

Final Thoughts

So, what does it all mean? The interplay between Trump, Iran, and Bitcoin is a complex web of geopolitical risk, market speculation, and opportunistic ventures. While uncertainty looms, strategic investors are finding opportunities amidst the chaos. Keep your eyes peeled, folks, because in the world of crypto, anything can happen!