|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

分析特朗普的行动,伊朗的地缘政治格局和比特币的市场变动的交集。发现对最近事件和潜在未来趋势的见解。

The intersection of Trump, Iran, and Bitcoin has created a volatile landscape in recent weeks. Geopolitical tensions, shifts in market sentiment, and even meme coins are all playing a part. Let's break down the key developments.

特朗普,伊朗和比特币的交叉点在最近几周创造了波动的景观。地缘政治紧张局势,市场情绪的转变,甚至模因硬币都在发挥作用。让我们分解关键的发展。

Trump's Actions and Bitcoin's Reaction

特朗普的行动和比特币的反应

Recent events kicked off with President Trump confirming US airstrikes against Iranian nuclear facilities. Almost immediately, Bitcoin experienced a dip, briefly falling to $101,000 on Binance before quickly recovering. This volatility highlights how sensitive the crypto market is to geopolitical news. Trump's tough stance, hinted at with a statement on Truth Social calling Iran's leader an “easy target,” sent shockwaves, demonstrating the impact of presidential pronouncements on crypto confidence.

最近的事件开始了,特朗普总统确认了美国对伊朗核设施的空袭。比特币几乎立即经历了倾斜,在迅速恢复之前,比特币短暂跌至101,000美元。这种波动率强调了加密市场对地缘政治新闻的敏感程度。特朗普的坚强立场暗示了关于真相社会的声明,称伊朗的领导人是“轻松的目标”,这是Shockwaves,这表明了总统宣布对加密货币信心的影响。

Iran's Impact on Market Sentiment

伊朗对市场情绪的影响

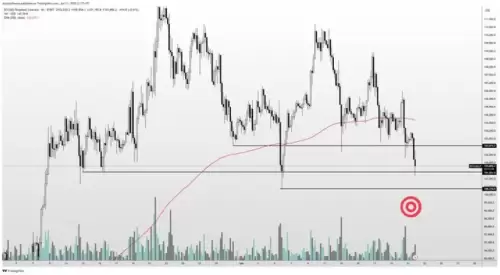

The escalating conflict between Iran and Israel, coupled with Trump's actions, has intensified market uncertainty. The Crypto Fear & Greed Index has reflected this, sliding into "Neutral" territory. Analysts are even suggesting Bitcoin might test the $100,000 mark again, with some forecasting a potential drop to $93,000 if tensions worsen. It's a stark reminder that global events can significantly influence crypto investments.

伊朗和以色列之间的冲突不断升级,再加上特朗普的行动,加剧了市场不确定性。加密恐惧和贪婪指数反映了这一点,滑入了“中性”领域。分析师甚至暗示比特币可能会再次测试100,000美元的成绩,如果紧张局势恶化,则有些预测可能会降至93,000美元。这是一个明显的提醒,全球事件可以极大地影响加密投资。

Bitcoin Whales to the Rescue?

比特币鲸进行营救?

Amidst the geopolitical turmoil, Bitcoin whales have been making strategic moves. On June 21, 2025, they triggered a large transaction boost, moving over 674,530 BTC after a slight price dip. This surge suggests that major investors are taking advantage of lower prices, potentially providing support to keep Bitcoin above the critical $100,000 level. Whether this buying pressure can be sustained remains to be seen, especially if global money supply growth slows or trade tariffs tighten.

在地缘政治动荡中,比特币鲸一直在做出战略性动作。 2025年6月21日,他们引发了巨大的交易提升,价格略有下跌后,超过674,530 BTC。这次激增表明,主要投资者正在利用较低的价格,可能提供支持以使比特币高于关键的100,000美元水平。是否可以承受这种购买压力还有待观察,特别是如果全球货币供应增长减慢或贸易关税加剧。

Trump's Crypto Connections: More Than Meets the Eye

特朗普的加密联系:不止于此

Beyond geopolitical maneuvers, the Trump family's involvement in the crypto space continues to raise eyebrows. From meme projects like TRUMP and MELANIA to DeFi ventures, the Trump name is increasingly associated with digital assets. Financial disclosures reveal a complex business empire, including substantial income from WLFI token sales and significant holdings of WLFI governance tokens. It seems the Trump family is treating the crypto market as a cash machine, extracting profits extensively. The exact amount earned remains a mystery, though.

除了地缘政治演习之外,特朗普家族在加密货币领域的参与继续引起人们的注意。从特朗普和梅拉尼亚(Melania)等模因项目到Defi Ventures,特朗普的名称越来越与数字资产相关联。财务披露揭示了一个复杂的商业帝国,包括来自WLFI代币销售的大量收入和WLFI治理令牌的大量持股。看来,特朗普一家正在将加密货币市场视为现金机,从而广泛提取利润。不过,确切的数量仍然是一个谜。

A Contrarian Crypto Tale: Mutuum Finance (MUTM)

一个逆势加密故事:Mutuum Finance(MUTM)

While Bitcoin navigates choppy waters, one project, Mutuum Finance (MUTM), is defying the odds. Its presale has seen remarkable success, raising over $10 million with a promising lending platform. Investors are drawn to its innovative Peer-to-Contract and Peer-to-Peer lending models, as well as the security bolstered by a Certik audit. With a guaranteed 100% ROI at launch and analysts projecting substantial post-launch gains, MUTM presents a compelling alternative in a turbulent market. Is it possible that one should consider investment into Mutuum Finance (MUTM)? Only time will tell!

当比特币在波涛汹涌的水域中航行时,一个项目,即Mutuum Finance(MUTM),却违背了赔率。它的预售取得了巨大的成功,在有前途的贷款平台上筹集了超过1000万美元。投资者被其创新的对等合同和点对点贷款模型所吸引,以及Certik审计的安全性。 MUTM在发射时保证了100%的投资回报率,分析师预测了大量发射后增长,因此在动荡的市场中提出了令人信服的替代方案。是否应该考虑投资于Mutuum Finance(MUTM)?只有时间会证明!

Final Thoughts

最后的想法

So, what does it all mean? The interplay between Trump, Iran, and Bitcoin is a complex web of geopolitical risk, market speculation, and opportunistic ventures. While uncertainty looms, strategic investors are finding opportunities amidst the chaos. Keep your eyes peeled, folks, because in the world of crypto, anything can happen!

那么,这意味着什么?特朗普,伊朗和比特币之间的相互作用是一个复杂的地缘政治风险,市场投机和机会主义冒险的网络。尽管不确定性隐约可见,但战略投资者在混乱中发现了机会。伙计们,请睁大眼睛,因为在加密货币世界中,一切都会发生!

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- BTC至$ 330K?解码转弯头的比特币模型

- 2025-06-22 16:25:13

- 比特币真的可以达到33万美元吗?深入研究模型和指标,暗示了这次牛的壮观的最后阶段。

-

- SUI价格每周模式:它会向上抢购吗?

- 2025-06-22 16:25:13

- 分析SUI在每周图表上的价格动作,关键模式和潜在的突破场景。是玩游戏吗?技术指标暗示什么?

-

- 模因硬币躁狂症:Neo Pepe可以超越前狂潮中的志愿品吗?

- 2025-06-22 16:45:13

- 探索围绕Neo Pepe和Shiba Inu等模因硬币的炒作,分析模因硬币宇宙中的预售趋势和潜在市场转移。

-

- 比特币,战争恐惧和对冲基金:逆势人士的喜悦?

- 2025-06-22 16:45:13

- 在战争的烦恼中,比特币看到分歧:鲸鱼积累,零售逃离。对冲基金是眼睛加密,标志着复杂的景观。

-

-

- SPX6900模因硬币:价格预测和市场沉思

- 2025-06-22 16:37:03

- 潜入SPX6900的野生世界,这是一个模因硬币!获取最新的价格预测,市场见解和少量加密幽默。是模因还是月光下?

-

- CoinMarketCap安全漏洞:唤醒加密钱包安全的呼吁

- 2025-06-22 14:25:13

- CoinMarketCap面临最近的安全漏洞,涉及恶意钱包弹出窗口,突出了加密货币空间中不断存在的危险。

-

- 加密货币市场跌落:比特币倾角和清算战争

- 2025-06-22 14:25:13

- 地缘政治紧张局势和大规模清算引发了加密货币市场的低迷。这是暂时的倾角还是更大的东西的开始?

-

- 比特币的绳索步行:平衡风险和RSI支持

- 2025-06-22 16:40:12

- 由于RSI信号弱点,比特币面临着$ 10万美元的关键测试。它会举行,还是替代投资会窃取演出?