|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

該報告研究了各種指標,將該時期描述為“加密歷史上最糟糕的季度”。

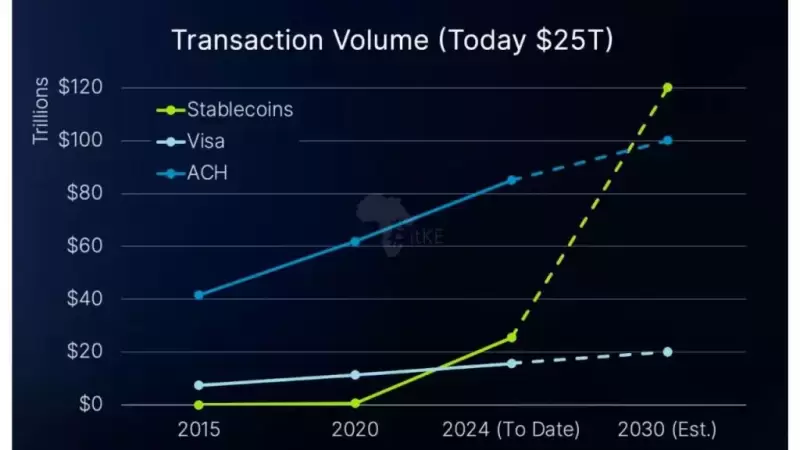

There were more stablecoin transactions than transactions on VISA in the first quarter of 2025, according to the latest Bitwise Crypto Market Review for Q1 2025.

根據第1季度2025年第1季度的最新Bitwise Crypto市場評論,在2025年第一季度,簽證的交易量多於簽證的交易。

The report, which surveyed various metrics, described the period as “The Best Worst Quarter in Crypto’s History.”

該報告對各種指標進行了調查,稱該時期是“加密歷史上最糟糕的季度”。

This installment of the report, titled "The Best Worst Quarter in Crypto's History," provides a broad overview of the crypto market in Q1 2025. It covers trends in venture capital funding, the development of tokenized real-world assets (RWA), and the performance of major crypto assets.

該報告的這一部分標題為“加密歷史上最糟糕的季度”,對第1季度的Crypto市場進行了廣泛的概述。它涵蓋了風險投資資金的趨勢,標記現實世界資產(RWA)的發展以及主要加密資產的績效。

"We saw the first pro-crypto president take office and immediately sign an executive order making the growth of digital assets a national priority. The U.S. created a Strategic Bitcoin Reserve, the SEC dropped nearly all of its lawsuits against the crypto industry, and Operation Choke Point 2.0 - which nearly cut off crypto from the traditional banking sector - was shut down," said CIO Matt Hougan.

“我們看到了第一位親克賴特托總統就職,並立即簽署了一項行政命令,使數字資產的增長成為國家優先事項。美國創建了戰略性的比特幣儲備金,SEC幾乎撤銷了針對加密貨幣行業的所有訴訟,而Choke Point 2.0的行動幾乎從傳統的銀行業中脫離了Crypto。”

"Crypto dreamed of these developments for years, and they finally all happened. And yet, despite all the good news, crypto prices fell. Sharply. The Bitwise 10 Large Cap Crypto Index dropped 18%, crypto equities tumbled 27%, and Ethereum - the second-largest crypto asset - fell an astonishing 45%."

“加密貨幣多年來一直夢想著這些事態發展,終於都發生了。然而,儘管有很多好消息,加密貨幣的價格都下降了。急劇下降。10位10個大帽加密指數下跌了18%,加密貨幣股票跌倒了27%,以太坊 - 第二大加密貨幣資產 - 下降了45%的驚人45%。”

The good news continues with a whopping 30% surge in stablecoin transaction volume.

好消息繼續進行,Stablecoin交易量增加了30%。

"This pushed total stablecoin transaction volume to more than $7.3 trillion for the quarter, narrowly surpassing the reported $7.1 trillion in transactions on Visa's network and marking a significant jump from the $5.6 trillion in Q4 2024.

“這將總穩定交易量推到了本季度的7.3萬億美元以上,狹義地超過了據報導的Visa網絡上7.1萬億美元的交易,並從2024年第四季度的5.6萬億美元上漲了。

"It's no surprise that we're seeing an incredible level of innovation in DeFi and Web3. Venture capital funding grew at its fastest rate in the past six quarters, and we're continuing to see a strong deployment of capital into the crypto ecosystem.

“毫不奇怪,我們在Defi和Web3中看到了令人難以置信的創新水平。在過去的六個季度中,風險投資籌資的速度增長了最快的速度,我們將繼續看到資本大量部署到加密生態系統中。

"DeFi projects in particular attracted their second-highest level of investment since Q1 of 2022, with two of the top 10 venture funding deals focused on DeFi: Hashflow's Series B funding round of $750 million and Animoca Brands' latest funding of $740 million.

“尤其是DEFI項目以自2022年第1季度以來吸引了其第二高的投資水平,其中十大風險投資交易中的兩項集中在Defi:Hashflow的B系列B融資回合7.5億美元和Animoca Brands的最新資金為7.4億美元。

"DeFi protocols are becoming increasingly sophisticated, and they're offering unique investment opportunities that are piquing the interest of venture capitalists."

“ Defi協議變得越來越複雜,他們提供了引起風險資本家興趣的獨特投資機會。”

The report also highlighted the burgeoning sector of tokenized real-world assets (RWA).

該報告還強調了令牌現實世界資產(RWA)的新興領域。

"The value of tokenized real-world assets (RWA) also jumped, rising from around $14 billion to $19 billion - more than double the $9 billion recorded in Q1 2024, Bitwise's report said.

Bitwise的報告稱,Bitwise的報告稱,Bitwise的報告稱,Bitwise的報告稱,Bitwise的報告稱,Bitwise的報告稱,令牌現實世界資產(RWA)的價值也躍升,從約140億美元增加到190億美元,是第1季度2024年第1季度記錄的90億美元的兩倍以上。

"In particular, demand for tokenized U.S. Treasuries has surged, pushing the sector's value from just over $2 billion in Q4 2024 to nearly $4.5 billion this quarter, said the report.

報告說:“特別是,對代幣化的美國國債的需求激增,將該行業的價值從2024年第4季度的20億美元提高到本季度的近45億美元。

"Finally, venture capital funding grew at its fastest rate in the past six quarters. Notably, DeFi projects attracted their second-highest level of investment, following Q1 of 2022.

“最後,在過去六個季度中,風險投資以其最快的速度增長。值得注意的是,在2022年第1季度之後,Defi項目吸引了其第二高的投資水平。

"Two of the top 10 venture funding deals were DeFi-focused: In total,

“十大風險投資交易中的兩項是專注於專注的:總共

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- MicroStrategy(MSTR)股票以其最佳每月性能結束

- 2025-05-01 18:50:13

- 策略(MSTR),以前稱為MicroStrategy,以其最佳的月度表現閉幕

-

-

-

-

- MAG和Multibank Group啟動歷史悠久的30億美元RWA令牌化計劃

- 2025-05-01 18:40:12

- 同類的最大的令牌化計劃是在$ MBG的象徵發布會之前

-

-

-

-

- 您知道您可能擁有一段歷史嗎?

- 2025-05-01 18:30:12

- 這座城鎮的話題是歷史性和稀缺的硬幣,如果您擁有這枚硬幣,您可能會獲得1000萬美元的富裕。