|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

该报告研究了各种指标,将该时期描述为“加密历史上最糟糕的季度”。

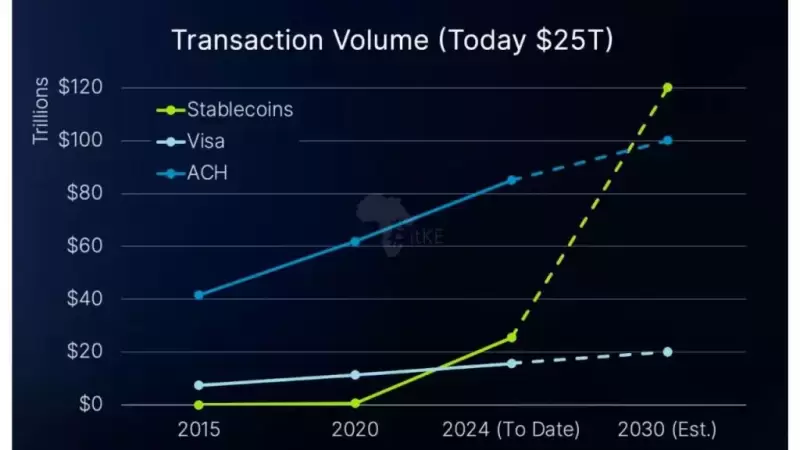

There were more stablecoin transactions than transactions on VISA in the first quarter of 2025, according to the latest Bitwise Crypto Market Review for Q1 2025.

根据第1季度2025年第1季度的最新Bitwise Crypto市场评论,在2025年第一季度,签证的交易量多于签证的交易。

The report, which surveyed various metrics, described the period as “The Best Worst Quarter in Crypto’s History.”

该报告对各种指标进行了调查,称该时期是“加密历史上最糟糕的季度”。

This installment of the report, titled "The Best Worst Quarter in Crypto's History," provides a broad overview of the crypto market in Q1 2025. It covers trends in venture capital funding, the development of tokenized real-world assets (RWA), and the performance of major crypto assets.

该报告的这一部分标题为“加密历史上最糟糕的季度”,对第1季度的Crypto市场进行了广泛的概述。它涵盖了风险投资资金的趋势,标记现实世界资产(RWA)的发展以及主要加密资产的绩效。

"We saw the first pro-crypto president take office and immediately sign an executive order making the growth of digital assets a national priority. The U.S. created a Strategic Bitcoin Reserve, the SEC dropped nearly all of its lawsuits against the crypto industry, and Operation Choke Point 2.0 - which nearly cut off crypto from the traditional banking sector - was shut down," said CIO Matt Hougan.

“我们看到了第一位亲克赖特托总统就职,并立即签署了一项行政命令,使数字资产的增长成为国家优先事项。美国创建了战略性的比特币储备金,SEC几乎撤销了针对加密货币行业的所有诉讼,而Choke Point 2.0的行动几乎从传统的银行业中脱离了Crypto。”

"Crypto dreamed of these developments for years, and they finally all happened. And yet, despite all the good news, crypto prices fell. Sharply. The Bitwise 10 Large Cap Crypto Index dropped 18%, crypto equities tumbled 27%, and Ethereum - the second-largest crypto asset - fell an astonishing 45%."

“加密货币多年来一直梦想着这些事态发展,终于都发生了。然而,尽管有很多好消息,加密货币的价格都下降了。急剧下降。10位10个大帽加密指数下跌了18%,加密货币股票跌倒了27%,以太坊 - 第二大加密货币资产 - 下降了45%的惊人45%。”

The good news continues with a whopping 30% surge in stablecoin transaction volume.

好消息继续进行,Stablecoin交易量增加了30%。

"This pushed total stablecoin transaction volume to more than $7.3 trillion for the quarter, narrowly surpassing the reported $7.1 trillion in transactions on Visa's network and marking a significant jump from the $5.6 trillion in Q4 2024.

“这将总稳定交易量推到了本季度的7.3万亿美元以上,狭义地超过了据报道的Visa网络上7.1万亿美元的交易,并从2024年第四季度的5.6万亿美元上涨了。

"It's no surprise that we're seeing an incredible level of innovation in DeFi and Web3. Venture capital funding grew at its fastest rate in the past six quarters, and we're continuing to see a strong deployment of capital into the crypto ecosystem.

“毫不奇怪,我们在Defi和Web3中看到了令人难以置信的创新水平。在过去的六个季度中,风险投资筹资的速度增长了最快的速度,我们将继续看到资本大量部署到加密生态系统中。

"DeFi projects in particular attracted their second-highest level of investment since Q1 of 2022, with two of the top 10 venture funding deals focused on DeFi: Hashflow's Series B funding round of $750 million and Animoca Brands' latest funding of $740 million.

“尤其是DEFI项目以自2022年第1季度以来吸引了其第二高的投资水平,其中十大风险投资交易中的两项集中在Defi:Hashflow的B系列B融资回合7.5亿美元和Animoca Brands的最新资金为7.4亿美元。

"DeFi protocols are becoming increasingly sophisticated, and they're offering unique investment opportunities that are piquing the interest of venture capitalists."

“ Defi协议变得越来越复杂,他们提供了引起风险资本家兴趣的独特投资机会。”

The report also highlighted the burgeoning sector of tokenized real-world assets (RWA).

该报告还强调了令牌现实世界资产(RWA)的新兴领域。

"The value of tokenized real-world assets (RWA) also jumped, rising from around $14 billion to $19 billion - more than double the $9 billion recorded in Q1 2024, Bitwise's report said.

Bitwise的报告称,Bitwise的报告称,Bitwise的报告称,Bitwise的报告称,Bitwise的报告称,Bitwise的报告称,令牌现实世界资产(RWA)的价值也跃升,从约140亿美元增加到190亿美元,是第1季度2024年第1季度记录的90亿美元的两倍以上。

"In particular, demand for tokenized U.S. Treasuries has surged, pushing the sector's value from just over $2 billion in Q4 2024 to nearly $4.5 billion this quarter, said the report.

报告说:“特别是,对代币化的美国国债的需求激增,将该行业的价值从2024年第4季度的20亿美元提高到本季度的近45亿美元。

"Finally, venture capital funding grew at its fastest rate in the past six quarters. Notably, DeFi projects attracted their second-highest level of investment, following Q1 of 2022.

“最后,在过去六个季度中,风险投资以其最快的速度增长。值得注意的是,在2022年第1季度之后,Defi项目吸引了其第二高的投资水平。

"Two of the top 10 venture funding deals were DeFi-focused: In total,

“十大风险投资交易中的两项是专注于专注的:总共

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 加密交易所MEXC宣布了3亿美元的生态系统发展基金

- 2025-05-01 19:05:12

- 该计划旨在支持迪拜的Token2049,旨在支持早期区块链技术,公共连锁店,钱包和分散工具

-

- WorldCoin正式在美国启动其身份验证平台

- 2025-05-01 19:00:11

- 根据4月30日的声明,World,以前称为WorldCoin,已正式启动其身份验证平台。

-

-

-

- 研究人员Dankrad Feist警告说,以太坊的生存取决于四年来缩放100倍。

- 2025-05-01 18:55:13

- FEIST的EIP-7938提案提高了气体限制,以支持每个块较高的交易量。

-

- MicroStrategy(MSTR)股票以其最佳每月性能结束

- 2025-05-01 18:50:13

- 策略(MSTR),以前称为MicroStrategy,以其最佳的月度表现闭幕

-

-