|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Stablecoin Transactions Surpassed VISA Transactions in the First Quarter of 2025

May 01, 2025 at 12:24 pm

The report, which examines various metrics, describes the period as “The Best Worst Quarter in Crypto’s History.”

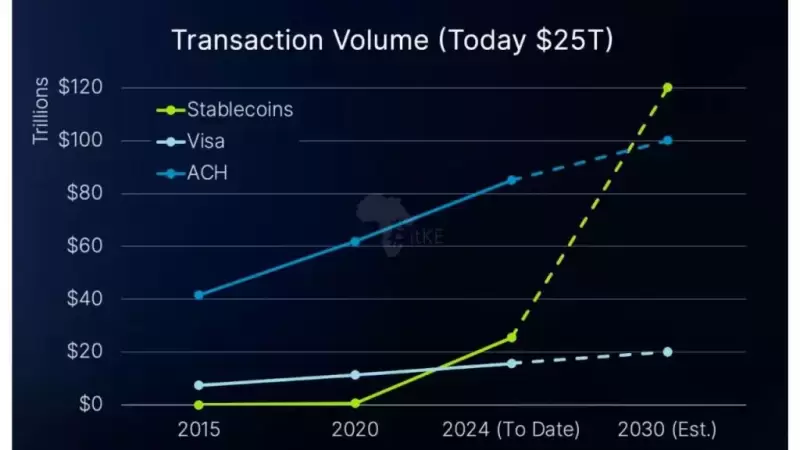

There were more stablecoin transactions than transactions on VISA in the first quarter of 2025, according to the latest Bitwise Crypto Market Review for Q1 2025.

The report, which surveyed various metrics, described the period as “The Best Worst Quarter in Crypto’s History.”

This installment of the report, titled "The Best Worst Quarter in Crypto's History," provides a broad overview of the crypto market in Q1 2025. It covers trends in venture capital funding, the development of tokenized real-world assets (RWA), and the performance of major crypto assets.

"We saw the first pro-crypto president take office and immediately sign an executive order making the growth of digital assets a national priority. The U.S. created a Strategic Bitcoin Reserve, the SEC dropped nearly all of its lawsuits against the crypto industry, and Operation Choke Point 2.0 - which nearly cut off crypto from the traditional banking sector - was shut down," said CIO Matt Hougan.

"Crypto dreamed of these developments for years, and they finally all happened. And yet, despite all the good news, crypto prices fell. Sharply. The Bitwise 10 Large Cap Crypto Index dropped 18%, crypto equities tumbled 27%, and Ethereum - the second-largest crypto asset - fell an astonishing 45%."

The good news continues with a whopping 30% surge in stablecoin transaction volume.

"This pushed total stablecoin transaction volume to more than $7.3 trillion for the quarter, narrowly surpassing the reported $7.1 trillion in transactions on Visa's network and marking a significant jump from the $5.6 trillion in Q4 2024.

"It's no surprise that we're seeing an incredible level of innovation in DeFi and Web3. Venture capital funding grew at its fastest rate in the past six quarters, and we're continuing to see a strong deployment of capital into the crypto ecosystem.

"DeFi projects in particular attracted their second-highest level of investment since Q1 of 2022, with two of the top 10 venture funding deals focused on DeFi: Hashflow's Series B funding round of $750 million and Animoca Brands' latest funding of $740 million.

"DeFi protocols are becoming increasingly sophisticated, and they're offering unique investment opportunities that are piquing the interest of venture capitalists."

The report also highlighted the burgeoning sector of tokenized real-world assets (RWA).

"The value of tokenized real-world assets (RWA) also jumped, rising from around $14 billion to $19 billion - more than double the $9 billion recorded in Q1 2024, Bitwise's report said.

"In particular, demand for tokenized U.S. Treasuries has surged, pushing the sector's value from just over $2 billion in Q4 2024 to nearly $4.5 billion this quarter, said the report.

"Finally, venture capital funding grew at its fastest rate in the past six quarters. Notably, DeFi projects attracted their second-highest level of investment, following Q1 of 2022.

"Two of the top 10 venture funding deals were DeFi-focused: In total,

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- USD1 stablecoin selected as the official stablecoin to close MGX's $2 billion investment in Binance

- May 01, 2025 at 06:55 pm

- Eric Trump, son of U.S. President Donald Trump, said that World Liberty Financial's dollar denominated stablecoin (USD1) has been officially selected as the official stablecoin

-

-

-

-

- MEXC Ventures Unveils a $300 Million Ecosystem Development Fund to Accelerate Blockchain Innovation

- May 01, 2025 at 06:45 pm

- VICTORIA, Seychelles, May 1, 2025 /PRNewswire/ -- MEXC Ventures, the investment arm of the global cryptocurrency exchange MEXC, has unveiled a $300 million Ecosystem Development Fund aimed at accelerating blockchain innovation and ecosystem growth over the next five years.

-

- Metaplanet Establishes a Wholly Owned Subsidiary in Florida to Double Down on its Bitcoin (BTC)-Focused Treasury Strategy

- May 01, 2025 at 06:45 pm

- Metaplanet is establishing a wholly owned subsidiary in Florida named Metaplanet Treasury Corp., doubling down on its bitcoin (BTC)-focused treasury strategy that has made it the largest public BTC holder in Asia.

-

-

- VIRTUAL Rallied as Much as 38% Today Following Renewed Investor Interest After the Virtuals' Team Rolled Out a Big Genesis Update

- May 01, 2025 at 06:40 pm

- VIRTUAL rallied as much as 38% today following renewed investor interest after the Virtuals' team rolled out a big Genesis update aimed at boosting transparency

-