|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

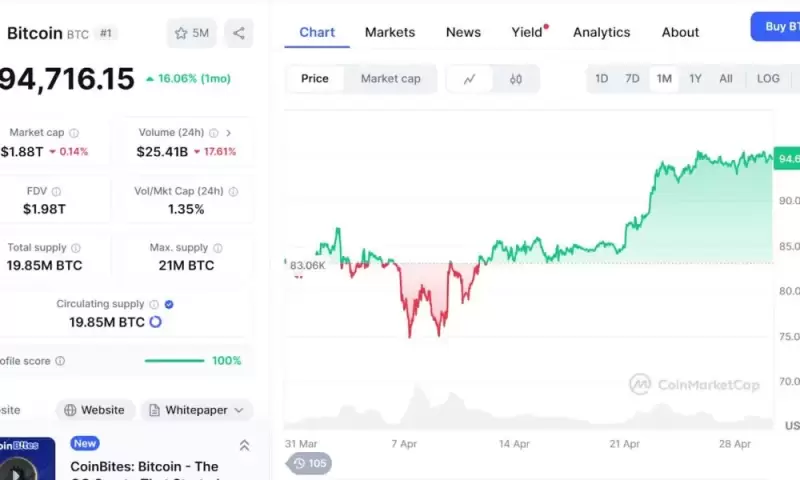

在一個令人失望的第一季度之後,世界上最大的加密貨幣捲土重來,從4月的低點開始飆升至95,000美元

Bitcoin (BTC) is quickly approaching the $95,000 mark, continuing its impressive recovery from April’s lows of $76,000. The world’s largest cryptocurrency has made a remarkable comeback, fueled in part by staggering institutional inflows into BTC ETFs.

比特幣(BTC)迅速接近$ 95,000的大關,從4月份的76,000美元的低點開始,其令人印象深刻的恢復。世界上最大的加密貨幣引起了非凡的捲土重來,部分原因是使機構流入成為BTC ETF。

In the past week alone, a record-breaking $3.4 billion flowed into Bitcoin ETFs, closely trailing the all-time high of $3.9 billion set back in December, according to Standard Chartered Bank.

根據標準Chartered Bank的數據,僅在過去的一周中,創紀錄的34億美元就流向了比特幣ETF,這在12月的歷史最高點落後了39億美元。

Among the major contributors are BlackRock’s IBIT fund, which raised nearly $1.5 billion, ARK’s Bitcoin ETF (ARKB) with around $620 million, and Fidelity’s FBTC fund, which added approximately $574 million.

在主要貢獻者中,貝萊德的IBIT基金籌集了近15億美元,ARK的比特幣ETF(ARKB),約為6.2億美元,而富達的FBTC基金則增加了約5.74億美元。

However, Geoff Kendrick, a strategist at Standard Chartered, predicts that this capital will continue shifting from US assets and into Bitcoin throughout the second quarter.

但是,標準憲章的戰略家傑夫·肯德里克(Geoff Kendrick)預測,這項資本將在第二季度繼續從美國資產轉移到比特幣。

“While timing sharp rises in bitcoin is difficult, we think the current period of potential strategic asset reallocation away from US assets may trigger the next such upswing,” Kendrick recently told Business Insider.

肯德里克(Kendrick)最近告訴《商業內幕》(Business Insider):“雖然比特幣的時機急劇上升是困難的,但我們認為目前潛在的戰略資產重新分配遠離美國資產的時期可能會觸發下一個這樣的上升。”

“If so, we would expect a new all-time high to be reached in Q2 with further gains over the summer.”

“如果是這樣,我們預計在夏季,隨著夏季的進一步增長,我們將在第二季度達到新的高位。”

This shift in capital follows a period of sluggish returns for US assets, driven partly by the ongoing trade disputes between the US and China, TechCrunch reports.

據TechCrunch報導,這一資本轉變是美國資產回報率遲鈍的一段時間,部分是由美國和中國之間持續的貿易糾紛驅動的。

The relationship between Bitcoin and gold prices has been a subject of interest. Once viewed as a ‘safe haven’ like gold, that characterization was tested several times as BTC often moved in sync with tech stocks rather than traditional hedges.

比特幣與黃金價格之間的關係一直是感興趣的主題。一旦被視為“避風港”之類的黃金,該表徵經過多次測試,因為BTC經常與技術股票而不是傳統的樹籬同步。

But this latest market movement suggests a genuine decoupling is underway. As gold prices dropped from nearly $3,500 to $3,275 last week, and tech stocks continue to struggle amid Trump tariff turmoil, Bitcoin has continued its ascent, converging with the $94,000 level.

但是,這種最新的市場運動表明正在進行真正的脫鉤。隨著上週黃金價格從近3,500美元下降到3,275美元,在特朗普關稅動蕩的情況下,科技股繼續掙扎,比特幣繼續上漲,匯聚了94,000美元的水平。

In fact, according to Standard Chartered’s analysis, capital has been flowing from gold ETFs directly into Bitcoin ETFs, indicating a preference for the world’s leading cryptocurrency.

實際上,根據標準憲章的分析,資本一直從金ETF直接流入比特幣ETF中,表明偏愛世界領先的加密貨幣。

Discussing this trend with TradingView, James Butterfill, head of research at CoinShares, said: “While equities are weighed down by tariffs and declining corporate earnings prospects, bitcoin remains unaffected and has actually benefited from investors seeking alternative safe-haven assets.”

Coinshares研究負責人詹姆斯·巴特菲爾(James Butterfill)在討論這一趨勢時說:“雖然股票受到關稅和公司收益前景下降的壓力,但比特幣仍然不受影響,實際上已經從尋求替代安全保護資產的投資者中受益。”

Other institutional players are also doubling down on their Bitcoin bets. For example, Strategy (formerly MicroStrategy) just announced its latest purchase of 15,355 BTC for a staggering $1.42 billion.

其他機構參與者也在比特幣賭注中加倍。例如,策略(以前是MicroStrategy)剛剛宣布了最新購買15,355 BTC的14.2億美元。

This brings their total Bitcoin holdings to over 553,000 BTC, valued at more than $50 billion at current prices.

這使他們的總比特幣持有量超過553,000 BTC,價值超過500億美元。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- 超過50%的加密代幣失敗了

- 2025-05-01 22:40:12

- 最近的一份報告顯示,過去五年中,所有加密代幣中有50%以上失敗了,在過去一年中,令牌生存能力顯著降低。

-

- FIFA推出了自己的區塊鏈,將阿爾戈蘭德留在後面進入元鏈

- 2025-05-01 22:35:16

- 忘記簡單的通行證和滑動鏟球:FIFA剛剛進入了元視頻。

-

- 模因硬幣市場仍在繼續指出,即使更廣泛的市場保持鎮定

- 2025-05-01 22:35:15

- 標題:Neet,Fartcoin(Fartcoin),Dogwifhat(Wif)是觀看的模因硬幣

-

- 新數據顯示,Solana(Sol)ETF批准概率達到90%

- 2025-05-01 22:30:13

- 根據彭博情報局的說法,美國監管機構批准Solana ETF(交易所交易基金)的可能性現在高達90%。

-

-

- Tezos成功激活了Rio升級,增強了固定靈活性和第2層可伸縮性

- 2025-05-01 22:25:12

- 該升級是通過網絡的鏈政治過程批准的,並參與了驗證者和社區成員

-

-

- XRP網絡看到“熱門”的強勁跳躍

- 2025-05-01 22:20:12

- 這是這種增長與比特幣和其他主要加密貨幣進行比較的方式。