|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

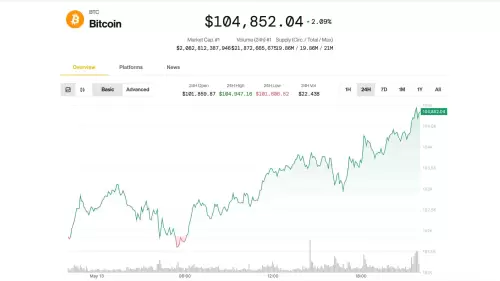

5月11日,由於現貨價格徘徊在104,139美元左右,因此短期同夥將11,549 BTC卸載。

![一個宏大風 - 和比特幣的[BTC]短期隊列很快做出反應 一個宏大風 - 和比特幣的[BTC]短期隊列很快做出反應](/uploads/2025/05/14/cryptocurrencies-news/articles/macro-tailwind-bitcoin-btc-shortterm-cohort-quick-react/middle_800_480.webp)

One macro tailwind – and Bitcoin's [BTC] short-term cohort was quick to react.

一個宏大的尾風 - 比特幣的[BTC]短期隊列很快做出了反應。

On the 11th of May, 11,549 BTC was offloaded by the short-term cohort as spot price hovered around $104,139. That's a hefty $1.20 billion sell-off.

5月11日,由於現貨價格徘徊在104,139美元左右,因此短期同夥將11,549 BTC卸載。那是一筆100億美元的拋售。

The result? A textbook flush. BTC nuked to $100,691 in a high-velocity move, notching its steepest intraday drawdown in over a week. More than $500 million in liquidations followed, as cascading stop-outs lit up the order books.

結果?一本教科書沖洗。 BTC以高速行動的價格將$ 100,691納入了100,691美元,在一周多的時間內就陷入了最陡峭的盤盤縮水量。隨著級聯停止的訂單賬簿,級聯的停車量超過5億美元的清算。

And while majors wobbled, the pain wasn't evenly distributed. Dogecoin [DOGE] and Cardano [ADA] were the hardest hit.

當大滿貫搖擺時,疼痛并沒有平均分發。 Dogecoin [Doge]和Cardano [Ada]是最難的打擊。

Bitcoin STHs take defensive action

比特幣STH採取防禦行動

As AMBCrypto flagged, a repeat of the mid-Q1-style STH capitulation isn't entirely off the table – unless BTC can muscle through the $106k mark, which remains a key psychological supply barrier.

正如Ambcrypto的標記一樣,Q1中Mid-Q1風格的STH投降的重複並不完全不在桌面上 - 除非BTC可以通過$ 106K Mark的肌肉進行肌肉,這仍然是一個關鍵的心理供應障礙。

The latest sell-off has only turned up the heat on this narrative.

最新的拋售僅在這種敘述上引起了熱烈的影響。

The market's vibe? It's back in "wait-and-see mode", with eyes glued to April's CPI (Consumer Price Index) print. Hence, the data drop could be the deciding factor.

市場的氛圍?它又回到了“等待觀看模式”,眼睛粘在四月的CPI(消費者價格指數)印刷品上。因此,數據下降可能是決定因素。

However, the real twist comes from the rate cut narrative. While traders are eyeing potential cuts, history tells a different story: Even during peak tariff chaos, the Federal Reserve held a hawkish stance.

但是,真正的轉折來自削減敘述。儘管交易者正在關注潛在的削減,但歷史講述了一個不同的故事:即使在高峰關稅混亂期間,美聯儲也保持了鷹派的立場。

And now, with the U.S. and China striking a "breakthrough" deal, the odds of a major pivot to dovish policy are looking slimmer by the day.

而現在,隨著美國和中國達成“突破性”協議,一日遊行政策的主要樞紐的機率看上去很苗條。

That said, should Bitcoin fail to break through the $106k supply wall, STHs may adopt a defensive posture, triggering a liquidation cascade.

也就是說,如果比特幣無法突破106K的供應牆,STH可能會採取防禦性姿勢,從而引發清算級聯。

The recent $500 million in forced exits could be the initial spark in a larger market sell-off.

最近的5億美元強迫出口可能是更大的市場拋售中的最初火花。

Altcoins' safe haven appeal under fire

Altcoins在大火中的避風港上訴

TOTAL3 (the crypto market cap excluding BTC and ETH) dropped by 2.32%, signaling that altcoins absorbed more pain than Bitcoin, which logged a comparatively smaller 1.05% drawdown.

Total3(不包括BTC和ETH的加密市值)下降了2.32%,表明Altcoins吸收的疼痛比比特幣更大,比特幣記錄了相對較小的1.05%的縮水。

Among large-caps, DOGE led the downside, plunging nearly 10% to $0.22, while ADA closely trailed, falling 6.9% to $0.79.

在大型駕駛室中,總督領導下跌,下跌近10%至$ 0.22,而ADA緊密落後,下降了6.9%,至0.79美元。

Consequently, significant liquidations occurred, with DOGE alone seeing a $18 million squeeze in long positions, far surpassing ADA's more modest $4.7 million in forced exits.

因此,發生了重大的清算,僅門多格就看到了1800萬美元的擠壓,遠遠超過了艾達(Ada)的強迫出口470萬美元。

Historically, STHs sought refuge in altcoins as a hedge during periods of Bitcoin overextension or when BTC neared a local top.

從歷史上看,在比特幣過度擴張期間或BTC靠近當地上衣時,STH在Altcoins中尋求避難所作為對沖。

However, that dynamic no longer holds. Altcoins now move in lockstep with Bitcoin, losing their role as volatility buffers.

但是,這種動態不再存在。現在,AltCoins用比特幣鎖定了鎖,失去了其作為波動性緩衝區的角色。

Looking ahead, if Bitcoin resumes its downtrend amid rising macro uncertainty, high-cap alts won't escape the fallout.

展望未來,如果比特幣在宏觀不確定性上升的情況下恢復了下降,那麼高帽子的Alts將不會逃脫後果。

Instead, they'll likely accelerate the drawdown, setting the stage for a "market-wide" risk-off cascade.

取而代之的是,他們可能會加速下降,為“整個市場”的風險級聯奠定基礎。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 雅芳價格與鏈上活動一起飆升

- 2025-05-14 11:50:13

- 雪崩的原住民令牌隨著鏈上活動的激增而同時升起。阿瓦克斯在上週能夠維持25%的增長

-

- 一條加密鯨已將2.4億美元轉移到binance

- 2025-05-14 11:50:13

- 該投資者的活動很重要,因為它引起了加密社區的關注。首先,它強調了對集中式交流和Defi市場的鯨魚興趣的日益增長。

-

- 當關鍵技術指標表明看漲勢頭轉移時,XRP價格似乎有望進行重大突破

- 2025-05-14 11:45:17

- 隨機相對強度指數(RSI)現在正在爬出超售區,這表明了山寨幣的潛在上升趨勢延續。

-

-

-

- 比特幣(BTC)的價格在星期二上漲了104,000美元以上

- 2025-05-14 11:40:13

- 憑藉歡迎的新通貨膨脹數據,特朗普總統對金融市場的看漲前景,以及Coinbase納入標準普爾500指數

-

-

- 下一個美國PPI數據發布只有幾個小時的路程。這導致加密市場的波動性增加。

- 2025-05-14 11:35:14

- 考慮到短期目標,這可能以積極的方式影響加密貨幣和股票市場。

-