|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

One macro tailwind – and Bitcoin's [BTC] short-term cohort was quick to react

May 14, 2025 at 05:00 am

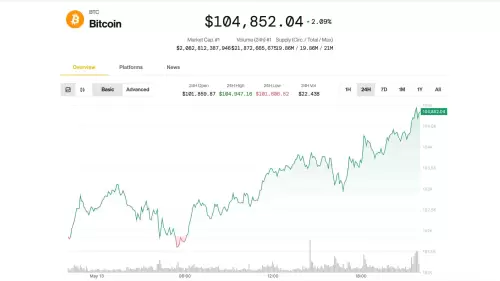

On the 11th of May, 11,549 BTC was offloaded by the short-term cohort as spot price hovered around $104,139.

![One macro tailwind – and Bitcoin's [BTC] short-term cohort was quick to react One macro tailwind – and Bitcoin's [BTC] short-term cohort was quick to react](/uploads/2025/05/14/cryptocurrencies-news/articles/macro-tailwind-bitcoin-btc-shortterm-cohort-quick-react/middle_800_480.webp)

One macro tailwind – and Bitcoin's [BTC] short-term cohort was quick to react.

On the 11th of May, 11,549 BTC was offloaded by the short-term cohort as spot price hovered around $104,139. That's a hefty $1.20 billion sell-off.

The result? A textbook flush. BTC nuked to $100,691 in a high-velocity move, notching its steepest intraday drawdown in over a week. More than $500 million in liquidations followed, as cascading stop-outs lit up the order books.

And while majors wobbled, the pain wasn't evenly distributed. Dogecoin [DOGE] and Cardano [ADA] were the hardest hit.

Bitcoin STHs take defensive action

As AMBCrypto flagged, a repeat of the mid-Q1-style STH capitulation isn't entirely off the table – unless BTC can muscle through the $106k mark, which remains a key psychological supply barrier.

The latest sell-off has only turned up the heat on this narrative.

The market's vibe? It's back in "wait-and-see mode", with eyes glued to April's CPI (Consumer Price Index) print. Hence, the data drop could be the deciding factor.

However, the real twist comes from the rate cut narrative. While traders are eyeing potential cuts, history tells a different story: Even during peak tariff chaos, the Federal Reserve held a hawkish stance.

And now, with the U.S. and China striking a "breakthrough" deal, the odds of a major pivot to dovish policy are looking slimmer by the day.

That said, should Bitcoin fail to break through the $106k supply wall, STHs may adopt a defensive posture, triggering a liquidation cascade.

The recent $500 million in forced exits could be the initial spark in a larger market sell-off.

Altcoins' safe haven appeal under fire

TOTAL3 (the crypto market cap excluding BTC and ETH) dropped by 2.32%, signaling that altcoins absorbed more pain than Bitcoin, which logged a comparatively smaller 1.05% drawdown.

Among large-caps, DOGE led the downside, plunging nearly 10% to $0.22, while ADA closely trailed, falling 6.9% to $0.79.

Consequently, significant liquidations occurred, with DOGE alone seeing a $18 million squeeze in long positions, far surpassing ADA's more modest $4.7 million in forced exits.

Historically, STHs sought refuge in altcoins as a hedge during periods of Bitcoin overextension or when BTC neared a local top.

However, that dynamic no longer holds. Altcoins now move in lockstep with Bitcoin, losing their role as volatility buffers.

Looking ahead, if Bitcoin resumes its downtrend amid rising macro uncertainty, high-cap alts won't escape the fallout.

Instead, they'll likely accelerate the drawdown, setting the stage for a "market-wide" risk-off cascade.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- Ruvi (RUV) Could Easily Outshine Avalanche (AVAX) as the Next Big Thing in Crypto

- May 14, 2025 at 11:40 am

- Disclaimer: The below article is sponsored, and the views in it do not represent those of ZyCrypto. Readers should conduct independent research before taking any actions related to the project mentioned in this piece. This article should not be regarded as investment advice.

-

-

-

-