|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

如果政治上的臭名昭著成為一種聲音和絆倒的貨幣怎麼辦?唐納德·特朗普(Donald Trump)發起加密貨幣,清醒地為2025年1月17日的特朗普(Trumpon)施加了賭注,這是一個賭注,挑釁性的,可能是有利可圖的。

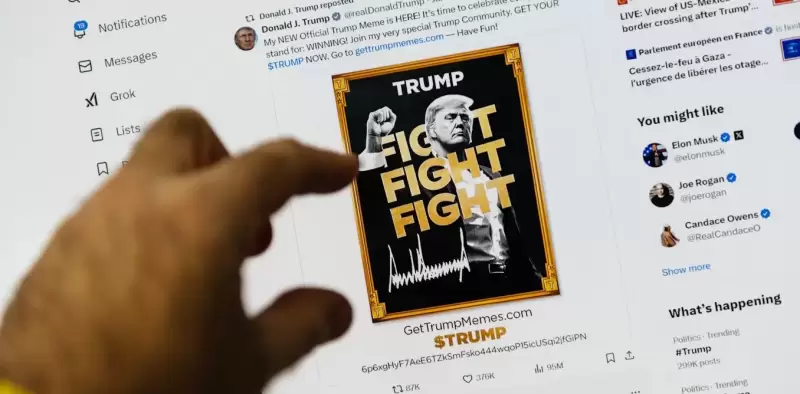

Launched three days before the inauguration of Donald Trump, the crypto $ Trump, despite lacking any concrete utility, nevertheless experienced a spectacular breakout. How can this phenomenon be explained?

加密特朗普唐納德·特朗普(Donald Trump)開幕前三天,儘管缺乏任何具體的公用事業,但仍經歷了壯觀的突破。如何解釋這種現象?

What if political notoriety became a tradable and volatile currency? It's a bet, both bold and potentially lucrative, that Donald Trump made by launching his cryptocurrency, simply named $ Trump, on January 17, 2025, three days before his official return to the White House.

如果政治上的臭名昭著成為一種可交易和波動的貨幣怎麼辦?唐納德·特朗普(Donald Trump)在2025年1月17日正式返回白宮前三天,唐納德·特朗普(Donald Trump)發起他的加密貨幣,簡單地將他的加密貨幣命名為$ trump,這是一個大膽的賭注。

This token, marketed on the Solara blockchain, even experienced a dazzling ascent. Introduced at around 8 dollars, it reached a peak at $ 77.24 on January 19, 2025, briefly pushing its capitalization to over $ 27 billion. However, this momentum quickly fizzled out. After stabilizing around $ 8.46 in early April, the token price fell to $ 7.50 on April 17.

這是在Solara區塊鏈上銷售的代幣,甚至經歷了令人眼花mass亂的上升。它以大約8美元的速度推出,達到了2025年1月19日的77.24美元的峰值,將其資本化短暫提高到270億美元。但是,這種勢頭很快消失了。在4月初穩定約8.46美元之後,代幣的價格下降至4月17日的7.50美元。

Behind this digital token, lacking any real utility, lies a phenomenon well-known to economists: speculation, fueled by collective belief, network effects, and the charisma of a politician. A bubble can emerge even in a perfectly rational market, as soon as investors anticipate a continuous increase in price. Abreu and Brunnermeier extend this analysis by showing how strategic behavior - everyone hoping to exit before the others - can artificially sustain a valuation disconnected from fundamentals.

在這個數字代幣背後,缺乏任何真正的效用,是經濟學家眾所周知的一種現象:集體信念,網絡效應和政治家的魅力所推動的猜測。即使在一個完美理性的市場中,泡沫也可以出現,因為投資者預計價格會不斷上漲。 Abreu和Brunnermeier通過表明戰略行為(希望在其他人面前退出)如何人為地維持與基本面脫節的估值是如何進行的。

From a historical perspective, all bubbles, from Dutch Tulips to Bitcoin, share the same core: an attractive story followed by a brutal setback.

從歷史的角度來看,從荷蘭鬱金香到比特幣的所有泡沫都有相同的核心:一個有吸引力的故事,然後是殘酷的挫折。

The $ Trump is not only a volatile asset; it is also the revealer of an increasingly porous border between political capital and financial capital. Can we still speak of a simple cryptocurrency initiative? Or is it a symptom of an economy in which personal influence becomes a monetary lever?

$特朗普不僅是一個動蕩的資產;它也是政治資本和金融資本之間越來越多的邊界的揭示者。我們還能說一個簡單的加密貨幣計劃嗎?還是個人影響力成為貨幣槓桿的經濟症狀?

As an economist, I offer here a critical reading of this unprecedented phenomenon at the crossroads of markets, symbols, and power.

作為一名經濟學家,我在這裡對市場,符號和權力的十字路口進行了對這種前所未有的現象的批判性閱讀。

Use Value vs. Market Value

使用價值與市場價值

In the universe of cryptocurrencies, there are broadly two main families. On one hand, projects based on technological or financial innovation, such as Ethereum, stablecoins, or DeFi protocols. On the other, we have tokens without any practical utility. Possessing strong speculative potential, they are often powered by an active community or an emblematic figure. The $ Trump falls fully into this second category. A distinction is often made between Functional crypto-actives (Utility Tokens) designed for a specific purpose and those without use value, intended purely for speculation, such as SamCoin.

在加密貨幣的宇宙中,有兩個主要家庭。一方面,基於技術或金融創新的項目,例如以太坊,穩定協議或DEFI協議。另一方面,我們沒有任何實際實用性的令牌。它們具有強大的投機潛力,通常由活躍的社區或像徵人物提供動力。特朗普完全屬於第二類。通常在為特定目的設計的功能加密激活物(實用程序令牌)和無用值的功能性加密式(實用程序令牌)之間進行區分,純粹用於猜測,例如Samcoin。

This dissociation between usage value and market valuation is not specific to the $ Trump. It has been observed since the first academic works on Bitcoin, which show that it struggles to fulfill the classic economic functions of money. As the economist Figuet remarks:

使用價值與市場估值之間的這種分離不是特朗普的特定。自比特幣上的第一部學術作品以來,就已經觀察到了它,這表明它努力實現貨幣的經典經濟功能。正如經濟學家菲格特所說:

"Bitcoin cannot be considered as a currency: the absence of intrinsic value and legal courses results in a strong volatility which does not allow it to fulfill traditional monetary functions."

“比特幣不能被視為一種貨幣:缺乏內在價值和法律課程會導致強大的波動性,這不允許其實現傳統的貨幣功能。”

The $ Trump pushes this logic even further by removing any technical or transactional dimension in favor of a pure speculative narrative.

$特朗普通過刪除任何技術或交易的維度來進一步推動這種邏輯,而有利於純粹的投機敘事。

From Monday to Friday + Sunday, receive the analyses and decrypts from our experts for free for another look at the news. Subscribe today!

從星期一到星期五 +週日,免費從我們的專家那裡收到分析和解密,以便再次查看新聞。立即訂閱!

Economic Narratives

經濟敘事

Like Dogecoin or Shiba Inu, the $ Trump does not offer any concrete service, is not based on any specific technical protocol, and does not grant access to products or rights. Its only value is founded on its image: that of a controversial president, known for his strong mobilization power, transforming his popularity into financial assets. This lack of "fundamentals" did not prevent it from experiencing a dazzling valuation (briefly). In a market where expectations are self-fulfilling, the value of an asset can then be born solely from the collective belief that it will take on value. If enough people believe that the $ Trump will rise, they buy, thus increasing the price and reinforcing this belief.

像Dogecoin或Shiba Inu一樣,特朗普不提供任何具體服務,不是基於任何特定的技術協議,也不授予對產品或權利的訪問權限。它的唯一價值是建立在其形像上的:一個有爭議的總統的價值,他以強大的動員力量而聞名,將他的受歡迎程度轉化為金融資產。缺乏“基本原理”並沒有阻止其造成令人眼花ant亂的估值(簡短地)。在一個期望是自我實現的市場中,資產的價值可以僅來自集體信念,即它將具有價值。如果足夠多的人認為特朗普會上升,他們會購買,從而提高價格並加強這種信念。

This phenomenon is not new. The economist Shiller has shown that speculative bubbles are not based solely on economic data but also on shared beliefs, amplified by the media and by collective stories. He further deepened this idea by introducing the concept of Narrative Economics: these simple, viral, and emotional stories that shape our economic decisions. The story of the $ Trump is an almost caricatural example: a president who becomes a currency, a token as a political declaration, a digital active ingredient fueled by an implicit promise of power.

這種現象並不新鮮。經濟學家希勒(Shiller)表明,投機性泡沫不僅基於經濟數據,而且還基於共同的信念,並由媒體和集體故事放大。他通過介紹敘事經濟學的概念進一步加深了這個想法:這些簡單,病毒和情感的故事來塑造我們的經濟決策。 $特朗普的故事幾乎是一個諷刺的例子:總統成為一種貨幣,作為政治宣言的代幣,一種數字積極的成分,由隱含的權力承諾推動。

The $ Trump is not simply a crypto product; it is a symbolic political object, imbued with a powerful story and a strong emotional charge. And in the markets, sometimes, that's enough.

$ trump不僅僅是加密產品。這是一個像徵性的政治對象,充滿了強大的故事和強烈的情感指控。在市場上,有時就足夠了。

Trump Brand Value

特朗普品牌價值

Unlike other SamCoins, the $ Trump is not born from a simple Internet meme or anonymous collective craze. It is backed by a very real political figure. It thus embodies a turning point: the direct monetization of political capital.

與其他Samcoins不同,特朗普不是從簡單的互聯網模因或匿名集體熱潮中誕生的。它得到了一個非常真實的政治人物的支持。因此,它體現了一個轉折點:政治資本的直接貨幣化。

In economics, we have long spoken of intangible capital to designate non-tangible resources such as reputation, visibility, or

在經濟學中,我們長期以來一直在談論無形的資本,以指定聲譽,可見性或

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

- LCX將主持一個社區電話

- 2025-04-29 14:15:12

- LCX將於4月29日上午11:00在UTC舉辦X上的社區電話。

-

- AIOZ網絡升級到1.7.0版,具有新功能和改進

- 2025-04-29 14:15:12

- AIOZ網絡已宣布即將到來的網絡升級和硬叉至版本1.7.0,計劃在塊17828400上激活

-

-

- 現在購買的最佳加密貨幣:Dexboss焦點 - 對Defi功能的重新介紹! !

- 2025-04-29 14:10:12

- 隨著越來越多的硬幣出現在市場上,如何了解正確的硬幣來關注?讓我們從加密的基礎開始

-

-

-