|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pectra的目標是通過自2023年“ Denkun”以來最大的以太坊網絡升級,可顯著提高以太坊可用性。

The Pectra upgrade for Ethereum is about two hours and 51 minutes away as of 4:14 p.m. on Monday, according to CoinDataFlow on Monday.

據周一的Coindataflow稱,截至週一下午4:14,以太坊的果肉升級約為兩個小時51分鐘。

According to the data, the Pectra upgrade for Ethereum is about two hours and 51 minutes as of 4:14 p.m. on Monday.

根據數據,截至週一下午4:14,以太坊的Pectra升級約為兩個小時51分鐘。

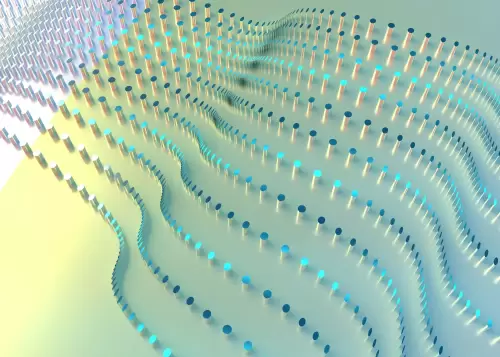

According to CoinDataFlow, Pectra, the largest Ethereum network upgrade since Denkun in 2023, is set to introduce several changes to the cryptocurrency.

根據Coindataflow的說法,Pectra是自2023年Denkun以來最大的以太坊網絡升級,它將引入加密貨幣的幾個更改。

Among them, the upgrade will increase the number of ether that Valley Data can stake (deposit virtual assets on the blockchain) for maintenance from 32 to 2048.

其中,升級將增加山谷數據可以利用的以太數量(在區塊鏈上存放虛擬資產)以從32到2048年維護。

In addition, the Pectra upgrade will introduce major improvements such as expanding Ethereum's data throughput (blob), reducing fees, enhancing verifier flexibility, and expanding verifier staking limits.

此外,Pectra升級將引入重大改進,例如擴大以太坊的數據吞吐量(BLOB),減少費用,增強驗證者的靈活性以及擴展驗證者的均衡限制。

Ahead of the upgrade, domestic virtual asset exchanges have temporarily suspended the deposit and withdrawal of ethereum-affiliated tokens.

在升級之前,國內虛擬資產交易所暫時暫停了以太坊附屬令牌的存款和撤回。

Domestic exchanges such as Upbit and Bithumb have stopped depositing and withdrawing ethereum-affiliated tokens (ERCs) from 14:00 on Monday.

UPBIT和BITHUBS等國內交易所已停止存入和撤回以太坊附屬令牌(ERC),從周一的14:00開始。

Ethereum has been sluggish time recently.

以太坊最近一直呆滯。

At the end of last month, ethereum’s share of the total virtual asset market fell below 7%.

在上個月年底,以太坊在虛擬資產總市場中的份額低於7%。

This is the first time that ethereum has failed to make a presence in the market in the early token disclosure (ICO) boom in 2017.

這是以太坊第一次未能在2017年的早期令牌披露(ICO)繁榮時期在市場上佔有一席之地。

Unlike bitcoin, which has established itself as ‘digital gold,’ ethereum has an ambiguous presence.

與比特幣不同的是“數字黃金”,以太坊具有模棱兩可的存在。

JPMorgan analyzed that bitcoin is forming a strong investment demand as digital gold, but ethereum lacks a differentiated identity.

摩根大通(JPMorgan)分析了比特幣在數字黃金中形成了強勁的投資需求,但以太坊缺乏差異化的身份。

Unlike bitcoin, which initially focused on its function as a digital currency, ethereum was in the spotlight as a ‘world computer’ based on smart contracts.

與最初集中在數字貨幣功能上的比特幣不同,以太坊是基於智能合約的“世界計算機”的聚光燈。

However, ethereum's growth is slowing as competitive blockchains such as Solana and Sui grow.

但是,隨著諸如Solana和Sui等競爭性區塊鏈的增長,以太坊的增長正在放緩。

Meanwhile, bitcoin is cruising as funds flow through exchange-traded funds (ETFs) along with the recovery of the U.S. stock market.

同時,隨著資金通過交易所交易的資金(ETF)以及美國股票市場的回收,比特幣正在巡航。

According to Faside Investors, a virtual asset statistics site, the cumulative net inflow of 11 bitcoin spot exchange-traded funds (ETFs) listed on the U.S. stock market as of Monday was $40.546.4 billion.

根據虛擬資產統計站點Faside Investors的說法,截至週一,美國股票市場上市的11個比特幣現貨交易所交易基金(ETF)的累計淨流入量為405.464億美元。

This is close to the record amount of $40.756 billion recorded on February 7.

這接近2月7日記錄的創紀錄的407.56億美元。

Bitcoin spot ETFs fell to the level of $35.231.7 billion on the 16th of last month due to continuous net outflows as bitcoin prices have been sluggish since February 7.

比特幣現貨ETF在上個月的16日下降到3523.17億美元,因為自2月7日以來比特幣價格一直慢了。

This is a 13.44% decrease from the peak.

這比峰值下降了13.44%。

However, as bitcoin rebounded since the middle of last month, ETFs also continued their net inflow and recovered $40 billion on the 2nd.

但是,隨著比特幣自上個月中旬以來反彈,ETF也繼續其淨流入,並在第二名中收回了400億美元。

Based on the Korean standard, $1.014.7 billion was net inflow from the 2nd to the 6th local time, recovering to 99.60% of the peak.

根據韓國標準,從第二次到第6次,淨流入為101.4億美元,恢復到峰值的99.60%。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- 以太坊激活Pectra網絡升級,引入智能帳戶和更高的積分限制

- 2025-05-08 05:45:12

- 2025年5月7日,以太坊激活了其最新的主要網絡升級Pectra。此更新為協議帶來了幾個關鍵更改,

-

- 2025年5月7日,加密貨幣市場正在嗡嗡作響,並取得了重大發展

- 2025-05-08 05:40:13

- 2025年5月7日,加密貨幣市場正在嗡嗡作響,尤其是有關以太坊,比特幣和XRP的重大發展。

-

-

-

-

- 協議:每週對加密貨幣技術開發中最重要的故事總結

- 2025-05-08 05:30:12

- 歡迎使用該協議,Coindesk每週對加密貨幣技術開發中最重要的故事進行總結。

-

- MicroStrategy設置為企業的比特幣標準模型

- 2025-05-08 05:30:12

- 在以企業比特幣為零的患者使用後,MicroStrategy公佈了大膽的計劃,以震撼廣泛採用。

-