-

Bitcoin

Bitcoin $118600

-2.59% -

Ethereum

Ethereum $4282

-0.42% -

XRP

XRP $3.129

-4.21% -

Tether USDt

Tether USDt $0.0000

0.01% -

BNB

BNB $805.4

-1.80% -

Solana

Solana $174.3

-5.77% -

USDC

USDC $0.9998

-0.01% -

Dogecoin

Dogecoin $0.2230

-6.33% -

TRON

TRON $0.3466

1.70% -

Cardano

Cardano $0.7745

-5.73% -

Chainlink

Chainlink $21.37

-3.53% -

Hyperliquid

Hyperliquid $42.93

-7.25% -

Stellar

Stellar $0.4324

-4.94% -

Sui

Sui $3.660

-7.17% -

Bitcoin Cash

Bitcoin Cash $591.6

2.72% -

Hedera

Hedera $0.2467

-7.04% -

Ethena USDe

Ethena USDe $1.001

0.00% -

Avalanche

Avalanche $22.92

-6.14% -

Litecoin

Litecoin $118.8

-3.79% -

Toncoin

Toncoin $3.378

-0.46% -

UNUS SED LEO

UNUS SED LEO $9.011

-1.15% -

Shiba Inu

Shiba Inu $0.00001294

-5.81% -

Uniswap

Uniswap $11.24

0.53% -

Polkadot

Polkadot $3.870

-6.16% -

Cronos

Cronos $0.1662

-1.68% -

Dai

Dai $1.000

0.02% -

Ethena

Ethena $0.7915

-5.62% -

Bitget Token

Bitget Token $4.414

-1.65% -

Monero

Monero $259.3

-3.85% -

Pepe

Pepe $0.00001120

-8.29%

Which Bitcoin exchange with the lowest handling fee is better in 2025

Bitcoin exchange fees, impacting profitability, vary across platforms like Binance, OKX, Gate.io, and Bitget, influenced by volume, VIP status, and network congestion; strategic choices minimize costs.

Mar 18, 2025 at 11:19 am

Trading Fees: This is the most common type of fee. It is charged when you buy or sell Bitcoin on the exchange. Trading fees can be structured in different ways. Some exchanges charge a percentage of the trade volume, while others have a fixed fee per trade. For example, an exchange might charge 0.1% of the total value of a Bitcoin trade. So, if you're trading 10,000worthofBitcoin,thetradingfeewouldbe10 (0.1% of $10,000).

Withdrawal Fees: When you want to move your Bitcoin from the exchange to an external wallet, you'll likely encounter withdrawal fees. These fees are designed to cover the costs associated with processing the withdrawal on the blockchain. Withdrawal fees can vary widely depending on the network congestion and the exchange's policies. Some exchanges may charge a flat fee, say $5 per Bitcoin withdrawal, while others base it on the amount being withdrawn, such as 0.0005 BTC per withdrawal.

Deposit Fees: Although less common, some exchanges may charge a fee when you deposit funds into your account. This could be in the form of a fiat currency like USD or another cryptocurrency. Deposit fees are usually a percentage of the deposit amount, for instance, 0.2% of the deposited value.

Exchange's Business Model: Different exchanges have different business models. Some exchanges aim to attract a large number of users by offering low fees, while others may focus on providing additional services and charge higher fees to cover the costs of those services. For example, an exchange that offers advanced trading tools and in - depth market analysis might charge higher fees compared to a more basic trading platform.

Competition: The cryptocurrency exchange market is highly competitive. When there are many exchanges vying for users, they often try to outdo each other in terms of fees. If one exchange reduces its trading fees, others may follow suit to remain competitive. This competition can be beneficial for users as it drives down overall fees in the market.

Volume and Liquidity: Exchanges with higher trading volumes and better liquidity can often afford to offer lower fees. Higher volumes mean more transactions, and the exchange can spread its operating costs over a larger number of trades. Additionally, exchanges with good liquidity can execute trades more efficiently, which may also contribute to lower fees.

VIP or Tiered Fee Structures: Many exchanges have a VIP or tiered fee structure. As users trade more and reach higher trading volume thresholds, they are placed in higher VIP tiers. Each tier comes with its own set of fee rates, with the higher tiers generally enjoying lower fees. For example, a beginner trader might pay a 0.25% trading fee, while a high - volume trader in the top VIP tier could pay as low as 0.05%.

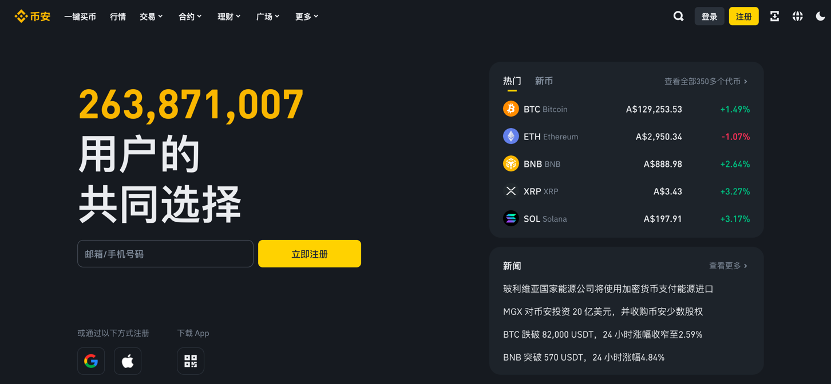

Trading Fees: Binance has a tiered fee structure based on the user's trading volume and the type of trading (maker or taker). For spot trading, the maker fee (when you add liquidity to the market) ranges from 0.1% to 0% for the highest VIP tiers, and the taker fee (when you remove liquidity from the market) ranges from 0.1% to 0.02% for the highest VIP tiers. For futures trading, the fees also vary depending on the contract type and the user's VIP tier.

Withdrawal Fees: Binance's Bitcoin withdrawal fees are dynamic and depend on the network congestion. Generally, it hovers around 0.0005 BTC per withdrawal. However, during periods of high network traffic, this fee can increase significantly.

Deposit Fees: Binance usually does not charge deposit fees for cryptocurrency deposits. For fiat currency deposits, it may charge a fee depending on the payment method used. For example, bank transfers may have a different fee structure compared to credit card deposits.

Trading Fees: OKX also has a tiered fee structure. For spot trading, the maker fees range from 0.1% to 0% for VIP users, and the taker fees range from 0.1% to 0.02% for VIP users. In the futures market, the fees are based on the contract type and the user's trading volume. OKX also offers fee discounts for users who hold its native token, OKB.

Withdrawal Fees: OKX's Bitcoin withdrawal fees are similar to Binance, being dynamic and influenced by network congestion. On average, it's around 0.0005 BTC per withdrawal.

Deposit Fees: Similar to Binance, OKX typically doesn't charge deposit fees for cryptocurrencies. Fiat currency deposits may be subject to fees depending on the payment method.

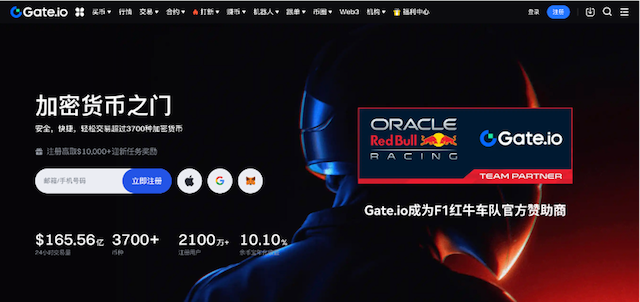

Trading Fees: Gate.io has a relatively competitive fee structure. For spot trading, the maker fees start at 0.1% and can go as low as 0.05% for VIP users. The taker fees start at 0.1% and can be reduced to 0.07% for VIP users. Gate.io also offers a fee - sharing program, where users can earn a portion of the trading fees paid by other users through its referral program.

Withdrawal Fees: Gate.io's Bitcoin withdrawal fees are also dynamic. On average, it's around 0.0005 BTC per withdrawal, but it can change according to network conditions.

Deposit Fees: Gate.io generally does not charge deposit fees for cryptocurrencies. For fiat currency deposits, it may have fees associated with different payment methods.

Trading Fees: Bitget is known for its relatively low trading fees, especially for its focus area of contract trading. For spot trading, the maker fees are around 0.1% and can be reduced for VIP users. The taker fees are also around 0.1% and can be lowered with higher trading volumes. In the contract trading space, Bitget offers competitive fees, which can be attractive for traders interested in derivatives.

Withdrawal Fees: Bitget's Bitcoin withdrawal fees are in line with the industry average, around 0.0005 BTC per withdrawal, subject to network congestion.

Deposit Fees: Bitget usually doesn't charge deposit fees for cryptocurrencies. Fiat currency deposits may be charged a fee depending on the payment method.

Become a VIP: As mentioned earlier, many exchanges offer lower fees to VIP users. By trading more and reaching higher trading volume thresholds, you can qualify for VIP status. This may involve trading a certain amount of Bitcoin or other cryptocurrencies within a specific time frame. For example, if an exchange requires you to trade $100,000 worth of Bitcoin in a month to reach a higher VIP tier, you can plan your trades accordingly to achieve this goal.

Use the Exchange's Native Token: Some exchanges offer fee discounts if you hold and use their native tokens. For instance, Binance offers lower trading fees if you pay the fees using its native token, BNB. By purchasing and holding the native token, you can not only benefit from potential price appreciation but also save on trading fees.

Trade in Larger Volumes: Many exchanges offer lower fees for larger trades. Instead of making multiple small trades, consider aggregating your trades into larger ones. However, this strategy should be balanced with your risk tolerance, as larger trades may also expose you to greater price fluctuations.

Choose the Right Time to Withdraw: Bitcoin withdrawal fees can be affected by network congestion. Try to withdraw your Bitcoin during periods of low network traffic. You can monitor the Bitcoin network congestion levels on various blockchain explorer websites. For example, if you notice that the network has a low number of unconfirmed transactions, it may be a good time to make a withdrawal as the fees are likely to be lower.

Take Advantage of Referral Programs: Some exchanges have referral programs where you can earn a portion of the trading fees paid by the users you refer. If you have a network of fellow cryptocurrency traders, you can refer them to the exchange and earn fee - sharing rewards. This can help offset your own trading costs.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

- Dogecoin, Presale, Surge: Riding the Meme Coin Wave

- 2025-08-12 11:10:12

- Dogecoin, Tron, and the ROI Reality Check: What's a Crypto Investor to Do?

- 2025-08-12 11:15:12

- Ethereum Layer-2 Scaling Competition Heats Up as ETH Breaks $4K

- 2025-08-12 10:30:12

- China Regulation, Stablecoins, and BNB Presale: Navigating the Crypto Landscape

- 2025-08-12 11:30:12

- Meme Coins, Investment, and Token Burns: What's Hot in 2025?

- 2025-08-12 10:30:12

- China's National Security Alarm Bells Ring Over Worldcoin's Iris Scans

- 2025-08-12 11:35:12

Related knowledge

How to use margin trading on Poloniex

Aug 08,2025 at 09:50am

Understanding Margin Trading on Poloniex

How to read the order book on KuCoin

Aug 10,2025 at 03:21pm

Understanding the Order Book Interface on KuCoinWhen accessing the order book on KuCoin, users are presented with a real-time display of buy and sell ...

How to read the order book on KuCoin

Aug 12,2025 at 02:28am

Understanding the Basics of Staking in CryptocurrencyStaking is a fundamental concept in the world of blockchain and cryptocurrencies, particularly wi...

How to set price alerts on Kraken

Aug 11,2025 at 08:49pm

Understanding Price Alerts on KrakenPrice alerts on Kraken are tools that allow traders to monitor specific cryptocurrency pairs for price movements. ...

How to earn cashback rewards on Crypto.com

Aug 12,2025 at 02:08am

Understanding Cashback Rewards on Crypto.comCashback rewards on Crypto.com are a feature designed to incentivize users to spend using their Crypto.com...

How to use advanced trading on Gemini

Aug 08,2025 at 04:07am

Understanding Advanced Trading on GeminiAdvanced trading on Gemini refers to a suite of tools and order types designed for experienced traders who wan...

How to use margin trading on Poloniex

Aug 08,2025 at 09:50am

Understanding Margin Trading on Poloniex

How to read the order book on KuCoin

Aug 10,2025 at 03:21pm

Understanding the Order Book Interface on KuCoinWhen accessing the order book on KuCoin, users are presented with a real-time display of buy and sell ...

How to read the order book on KuCoin

Aug 12,2025 at 02:28am

Understanding the Basics of Staking in CryptocurrencyStaking is a fundamental concept in the world of blockchain and cryptocurrencies, particularly wi...

How to set price alerts on Kraken

Aug 11,2025 at 08:49pm

Understanding Price Alerts on KrakenPrice alerts on Kraken are tools that allow traders to monitor specific cryptocurrency pairs for price movements. ...

How to earn cashback rewards on Crypto.com

Aug 12,2025 at 02:08am

Understanding Cashback Rewards on Crypto.comCashback rewards on Crypto.com are a feature designed to incentivize users to spend using their Crypto.com...

How to use advanced trading on Gemini

Aug 08,2025 at 04:07am

Understanding Advanced Trading on GeminiAdvanced trading on Gemini refers to a suite of tools and order types designed for experienced traders who wan...

See all articles