All-time High

All-time Low

Volume(24h)

121.02M

Turnover rate

2.26%

Market Cap

5.3647B

FDV

5.4B

Circulating supply

5.37B

Total supply

5.37B

Max supply

Website

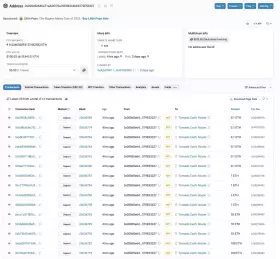

Contracts

Explorers

https://etherscan.io/token/0x6b175474e89094c44da98b954eedeac495271d0f

https://etherscan.io/token/0x6b175474e89094c44da98b954eedeac495271d0f

https://app.nansen.ai/token-god-mode?chain=ethereum&tab=transactions&tokenAddress=0x6b175474e89094c44da98b954eedeac495271d0f

https://solscan.io/token/EjmyN6qEC1Tf1JxiG1ae7UTJhUxSwk1TCWNWqxWV4J6o

https://polygonscan.com/token/0x8f3Cf7ad23Cd3CaDbD9735AFf958023239c6A063

https://bscscan.com/token/0x1af3f329e8be154074d8769d1ffa4ee058b1dbc3

Currency Calculator

{{conversion_one_currency}}

{{conversion_two_currency}}

| Exchange | Pairs | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{val.price}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

Community sentiment

26%

74%

Bullish

Bearish

LaqiDex Expands — Quietly, Efficiently, Powerfully.

LaqiDex Expands — Quietly, Efficiently, Powerfully.  Without noise or countdowns, LaqiDex has gone live on #Avalanche

Without noise or countdowns, LaqiDex has gone live on #Avalanche  , and the leading stablecoins — $USDT, $USDC, and $DAI — are already Active and Swappable.

, and the leading stablecoins — $USDT, $USDC, and $DAI — are already Active and Swappable.  Seamless on-chain swaps within

Seamless on-chain swaps within  Stable, deep

Stable, deep Official Ann | LaqiDex Enters the Multi Network Era by

Official Ann | LaqiDex Enters the Multi Network Era by A new chapter begins for LaqiDex. What started on #BNBChain now expands beyond — as @avax ( $AVAX)

A new chapter begins for LaqiDex. What started on #BNBChain now expands beyond — as @avax ( $AVAX)  officially joins the network. This integration isn’t just another update — it’s the foundation of LaqiDex’s multi x.com/LaqiraProtocol…

officially joins the network. This integration isn’t just another update — it’s the foundation of LaqiDex’s multi x.com/LaqiraProtocol…

| Exchange | Pair | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{val.price}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

About Dai

Where Can You Buy DAI [DAI]?

The purchase of DAI tokens is available on numerous online platforms. These include Decentralized Finance ([DeFi](https://coinmarketcap.com/alexandria/article/what-is-decentralized-finance)) token swap protocols: * [Uniswap](https://coinmarketcap.com/exchanges/uniswap-v2/) * [Compound](https://coinmarketcap.com/exchanges/compound/) And traditional cryptocurrency exchanges: * [Coinbase Pro](https://coinmarketcap.com/exchanges/coinbase-pro/) * [Binance](https://coinmarketcap.com/exchanges/binance/) * [OKEx](https://coinmarketcap.com/exchanges/okex/) * [HitBTC](https://coinmarketcap.com/exchanges/hitbtc/)

How Is the DAI Network Secured?

DAI is an Ethereum-based, [ERC-20](https://coinmarketcap.com/alexandria/glossary/erc-20)-compatible token. As such, it is secured by Ethereum’s Ethash algorithm.

How Many DAI [DAI] Coins Are There in Circulation?

New DAI tokens are not produced via [mining](https://coinmarketcap.com/alexandria/article/how-long-does-it-take-to-mine-one-bitcoin) like Bitcoin ([BTC](https://coinmarketcap.com/currencies/bitcoin/)) and Ethereum ([ETH](https://coinmarketcap.com/currencies/ethereum/)), nor are they minted by a private company according to its own issuance police like Tether ([USDT](https://coinmarketcap.com/currencies/tether/)). Instead, new DAI can be minted by any user via the use of Maker Protocol. Maker Protocol, which runs on the Ethereum blockchain, is the software that governs DAI issuance. In order to maintain the soft price peg to the U.S. dollar, Maker Protocol ensures that every DAI token is collateralized by an appropriate amount of other cryptocurrencies. As part of this process, the Protocol allows any user to deposit their crypto into a so-called vault — a smart contract on the Ethereum blockchain — as collateral and mint a corresponding amount of new DAI tokens. There is no upper limit on the total supply of DAI — the supply is dynamic and depends on how much collateral is stored in the vaults at any given moment. As of November 2020, there are around 940 million DAI in circulation.

What Makes DAI Unique?

DAI’s main advantage lies in its soft peg to the price of the U.S. dollar. The crypto market is notorious for its volatility with even the largest, highly-[liquid](https://coinmarketcap.com/alexandria/glossary/liquidity) coins such as [Bitcoin](https://coinmarketcap.com/currencies/bitcoin/) sometimes experiencing price changes (both up and down) of 10% or more within a single day. Under these circumstances, traders and investors are naturally predisposed to add safe-haven assets to their portfolios, whose stable price might help offset significant market fluctuations. One such kind of asset are stablecoins, of which DAI is one example. These are cryptocurrencies whose price is pegged to assets with a relatively stable value — most commonly traditional fiat currencies, such as USD or EUR. Another key advantage of DAI is the fact that it is managed not by a private company, but rather by a decentralized autonomous organization via a software protocol. As a result, all instances of issuance and burning of tokens are managed and publicly recorded by Ethereum-powered self-enforcing smart-contracts, making the entire system more transparent and less prone to corruption. In addition, the process of developing DAI software is governed in a more democratic way — via direct voting by the regular participants of the token’s ecosystem.

How to Generate Dai?

Dai is the second-largest decentralized stablecoin by [market capitalization](https://coinmarketcap.com/alexandria/glossary/market-capitalization-market-cap-mcap), having been [flipped](https://decrypt.co/88791/terra-ust-flips-dai-fourth-largest-stablecoin) recently by Terra’s native stablecoin — [UST](https://coinmarketcap.com/currencies/terrausd/). Both are backed by cryptocurrencies and pegged to the Dollar, while the top stablecoins like [USDT](https://coinmarketcap.com/currencies/tether/), [USDC](https://coinmarketcap.com/currencies/usd-coin/) and [BUSD](https://coinmarketcap.com/currencies/binance-usd/) are backed by traditional assets such as cash, corporate bonds, U.S. treasuries and commercial papers (which has come under [increased scrutiny](https://coinmarketcap.com/alexandria/article/mystery-over-tether-s-billions-deepens) in the case of USDT). So what exactly is Dai backed by? The Dai stablecoin is a collateral-based cryptocurrency soft-pegged to the U.S. dollar. Users generate Dai by depositing crypto-assets into Maker Vaults on the Maker Protocol. Users can access Maker Protocol and create Vaults through Oasis Borrow or other interfaces built by the community. On [Oasis Borrow](https://oasis.app/borrow), users can lock in collateral such as [ETH](https://coinmarketcap.com/currencies/ethereum/), [WBTC](https://coinmarketcap.com/currencies/wrapped-bitcoin/), [LINK](https://coinmarketcap.com/currencies/chainlink/), [UNI](https://coinmarketcap.com/currencies/uniswap/), [YFI](https://coinmarketcap.com/currencies/yearn-finance/), [MANA](https://coinmarketcap.com/currencies/decentraland/), [MATIC](https://coinmarketcap.com/currencies/polygon/) and more. Users can then borrow against their collateral in Dai, as long as it is within the collateral ratio, which ranges from 101% to 175%, depending on the risk level of the asset locked.

Who Are the Founders of DAI?

One of the defining features of DAI is that it wasn’t created by any single person or a small group of co-founders. Instead, the development of the software that powers it and the issuance of new tokens is governed by the MakerDAO and Maker Protocol. MakerDAO is a [decentralized autonomous organization](https://coinmarketcap.com/alexandria/glossary/decentralized-autonomous-organizations-dao) — a kind of company that runs itself in a decentralized manner via the use of smart contracts — self-enforcing agreements expressed in software code and executed on the Ethereum [blockchain](https://coinmarketcap.com/alexandria/glossary/blockchain). This organization is managed democratically by the holders of its Maker (MKR) governance tokens, which act similarly to a traditional company’s stock; MKR holders can vote on key decisions regarding the development of MakerDAO, Maker Protocol and DAI, with their voting power being proportionate to the amount of Maker tokens they own. MakerDAO itself was originally founded by a Danish entrepreneur Rune Christensen in 2015. Before starting work on the Maker ecosystem, Christensen studied biochemistry and international business in Copenhagen and founded the Try China international recruiting firm.

What Is DAI [DAI]?

DAI is an Ethereum-based [stablecoin](https://coinmarketcap.com/alexandria/article/what-is-a-stablecoin) (stable-price cryptocurrency) whose issuance and development is managed by the Maker Protocol and the MakerDAO decentralized autonomous organization. The price of DAI is soft-pegged to the U.S. dollar and is collateralized by a mix of other cryptocurrencies that are deposited into [smart-contract](https://coinmarketcap.com/alexandria/glossary/smart-contract) vaults every time new DAI is minted. It is important to differentiate between Multi-Collateral DAI and Single-Collateral DAI (SAI), an earlier version of the token that could only be collateralized by a single cryptocurrency; SAI also doesn’t support the DAI Savings Rate, which allows users to earn savings by holding DAI tokens. Multi-Collateral DAI was launched in November 2019.

Dai News

-

Bitcoin faces volatility as Saylor and Kiyosaki remain bullish. Will Kiyosaki's crash warning trigger panic or a major breakout?

Nov 05, 2025 at 08:17 am

-

CZ's personal investment in Aster Token sparks market frenzy. This blog explores CZ's history with crypto investments, the rise of Aster, and market risks.

Nov 05, 2025 at 06:00 am

-

Bitcoin's recent tumble below $100,000 signals a deepening crypto correction. What's behind the plunge, and is this a buying opportunity or a sign of more pain to come?

Nov 05, 2025 at 05:22 am

-

Navigating the crypto market's volatility: Analyzing Bitcoin's dips, XRP's developments, and emerging trends for 2025. Stay informed on the forces shaping digital asset investments.

Nov 05, 2025 at 03:52 am

-

A deep dive into the ASTER crash, Binance's influence, and the resulting market chaos, exploring the psychology behind crypto volatility and offering insights for navigating the turbulent landscape.

Nov 05, 2025 at 03:48 am

-

BNB price faces sharp decline amid broader crypto sell-off. Is this a temporary dip or a sign of deeper troubles? Let's analyze the situation.

Nov 05, 2025 at 03:46 am

-

Explore NIP Group's expanded Bitcoin mining, Bitget's altcoin liquidity program, and the potential of tokens like Little Pepe in shaping the next crypto bull run.

Nov 05, 2025 at 03:45 am

-

Bitcoin plunges below $104K amid massive liquidations and ETF outflows. Is this a temporary blip or a sign of deeper trouble? Plus, MicroStrategy's bold Euro move.

Nov 05, 2025 at 03:34 am

-

Bitcoin plunges below $101K, triggering a $200B crypto market rout. Is this a buying opportunity or the start of a deeper correction?

Nov 05, 2025 at 03:25 am

Similar Coins

Twitter

Close