|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密貨幣新聞文章

Prominent Crypto Analyst Burak Kesmeci Has Tipped Bitcoin (BTC) to Hit a Price Target of $124,000

2025/04/28 02:30

Prominent crypto analyst Burak Kesmeci has tipped Bitcoin (BTC) to hit a price target of $124,000 based on data from the Golden Ratio Multiplier price model. This bullish prediction comes after an impressive price surge in the past week, hinting that the premier cryptocurrency may have more room for immediate price growth.

Can Bitcoin Return To 1.6x Accumulation Peak Target?

In an X post on April 26, Burak Kesmeci shared the latest updates on the Bitcoin Golden Ratio Multiplier price model, referencing data from Bitcoin Magazine Pro. For context, the Golden Ratio Multiplier model uses moving averages and Fibonacci ratios to help identify when BTC might be overvalued or undervalued, thereby signaling possible market tops or good accumulation opportunities.

According to the chart below, Bitcoin has recently retested the 350 daily moving average (350DMA) at $77,000. As the name implies, the 350DMA tracks BTC’s average price over the last 350 days and acts as a key support zone. Touching or briefly dipping below this level often signals a potential long-term buying opportunity.

(Image Credit: Bitcoin Magazine Pro)

Bitcoin recently rebounded off its 350DMA, after a price dip to $75,000 was followed by two subsequent price rallies to trade as high as $96,000.

In line with the price bands on the Golden Multiplier ratio, BTC is now headed for 1.6x Accumulation High, i.e, 1.6 times the 350 DMA, which is currently at $124,000. Therefore, despite the ongoing price consolidation, BTC is likely to produce another price rally based on the Golden Multiplier ratio price model.

Interestingly, when Bitcoin moves near or above this level, it often signals the end of an accumulation phase and the start of a stronger bullish trend. Therefore, BTC reaching the $124,000 would only pave the way for further price gains in line with the lofty targets of some market analysts.

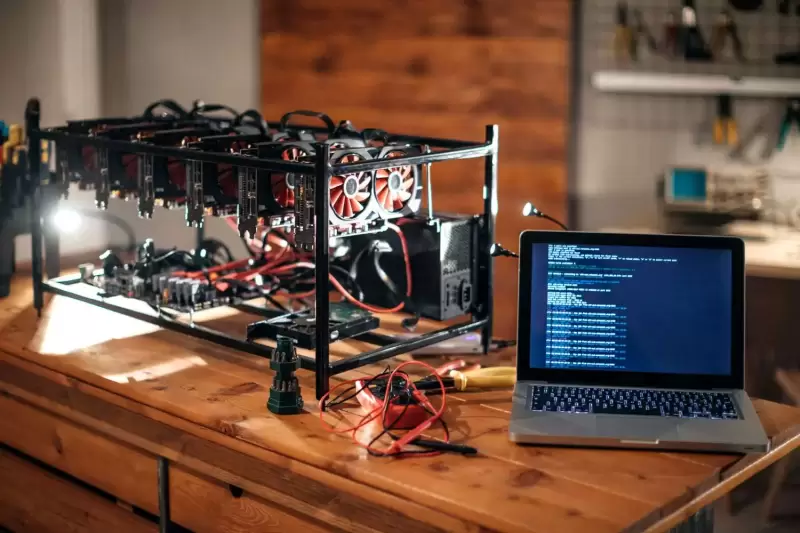

BTC Miners Gain $18.60 Million In Profit

In other news, another top crypto analyst, Ali Martinez, reports that miners have recently capitalized on Bitcoin’s impressive price rally, realizing nearly $18.60 million in profits as prices surged past $94,000.

This realized profit spike highlights that early miners are strategically taking profits at these high price levels. However, it’s worth noting that Bitcoin retains a strong bullish momentum despite this sell pressure, fueled by multiple factors, including strong inflows into spot ETFs.

At the time of writing, BTC is valued at $94,393, reflecting a price decline of 0.76% in the past day.

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

- XRP價格預測:在一系列重大發展之後,新的看漲利益

- 2025-04-28 12:10:12

- 在達到2.30美元的當地高處後,Ripple的代幣進入了過去集會的需求區域。

-

- 由於美國美聯儲的新政策轉變為RLUSD打開了機會

- 2025-04-28 12:10:12

- 在達到2.30美元的當地高處後,Ripple的代幣進入了過去集會的需求區域。

-

-

- Magacoin Finance引起了智能金錢的關注

- 2025-04-28 12:05:13

- 在加密貨幣世界中,這不僅與技術有關,而且是關於定位,時機和領先於曲線的。

-

- 加密貨幣經歷了一個平靜的周末

- 2025-04-28 12:00:26

- 美國對中國的寬鬆立場以及俄羅斯戰爭可能得出的跡像對風險市場非常積極。

-

- Shiba硬幣和WIF價格預測

- 2025-04-28 12:00:26

- 作為市值的第二大模因硬幣,Shib在122天內從122天的122天開始下降了70%,最近在3月26日重新測試了當地的峰值。

-

- Binance Coin(BNB)價格一直在試圖在重要的支撐區反彈

- 2025-04-28 11:55:13

- 最近,BNB彈起了一個重大的趨勢線,在發稿時充當了關鍵支持水平。這個水平是根據價格測試的