|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密货币新闻

Prominent Crypto Analyst Burak Kesmeci Has Tipped Bitcoin (BTC) to Hit a Price Target of $124,000

2025/04/28 02:30

Prominent crypto analyst Burak Kesmeci has tipped Bitcoin (BTC) to hit a price target of $124,000 based on data from the Golden Ratio Multiplier price model. This bullish prediction comes after an impressive price surge in the past week, hinting that the premier cryptocurrency may have more room for immediate price growth.

Can Bitcoin Return To 1.6x Accumulation Peak Target?

In an X post on April 26, Burak Kesmeci shared the latest updates on the Bitcoin Golden Ratio Multiplier price model, referencing data from Bitcoin Magazine Pro. For context, the Golden Ratio Multiplier model uses moving averages and Fibonacci ratios to help identify when BTC might be overvalued or undervalued, thereby signaling possible market tops or good accumulation opportunities.

According to the chart below, Bitcoin has recently retested the 350 daily moving average (350DMA) at $77,000. As the name implies, the 350DMA tracks BTC’s average price over the last 350 days and acts as a key support zone. Touching or briefly dipping below this level often signals a potential long-term buying opportunity.

(Image Credit: Bitcoin Magazine Pro)

Bitcoin recently rebounded off its 350DMA, after a price dip to $75,000 was followed by two subsequent price rallies to trade as high as $96,000.

In line with the price bands on the Golden Multiplier ratio, BTC is now headed for 1.6x Accumulation High, i.e, 1.6 times the 350 DMA, which is currently at $124,000. Therefore, despite the ongoing price consolidation, BTC is likely to produce another price rally based on the Golden Multiplier ratio price model.

Interestingly, when Bitcoin moves near or above this level, it often signals the end of an accumulation phase and the start of a stronger bullish trend. Therefore, BTC reaching the $124,000 would only pave the way for further price gains in line with the lofty targets of some market analysts.

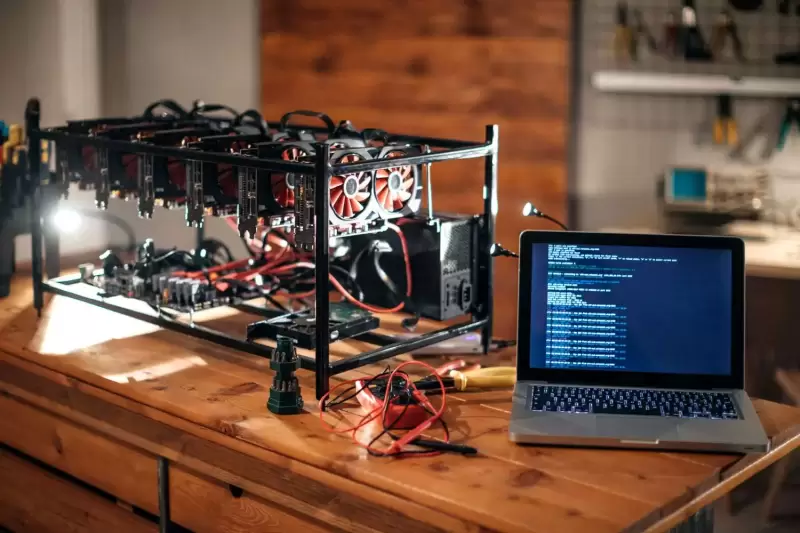

BTC Miners Gain $18.60 Million In Profit

In other news, another top crypto analyst, Ali Martinez, reports that miners have recently capitalized on Bitcoin’s impressive price rally, realizing nearly $18.60 million in profits as prices surged past $94,000.

This realized profit spike highlights that early miners are strategically taking profits at these high price levels. However, it’s worth noting that Bitcoin retains a strong bullish momentum despite this sell pressure, fueled by multiple factors, including strong inflows into spot ETFs.

At the time of writing, BTC is valued at $94,393, reflecting a price decline of 0.76% in the past day.

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

- XRP价格预测:在一系列重大发展之后,新的看涨利益

- 2025-04-28 12:10:12

- 在达到2.30美元的当地高处后,Ripple的代币进入了过去集会的需求区域。

-

- 由于美国美联储的新政策转变为RLUSD打开了机会

- 2025-04-28 12:10:12

- 在达到2.30美元的当地高处后,Ripple的代币进入了过去集会的需求区域。

-

-

- Magacoin Finance引起了智能金钱的关注

- 2025-04-28 12:05:13

- 在加密货币世界中,这不仅与技术有关,而且是关于定位,时机和领先于曲线的。

-

- 加密货币经历了一个平静的周末

- 2025-04-28 12:00:26

- 美国对中国的宽松立场以及俄罗斯战争可能得出的迹象对风险市场非常积极。

-

- Shiba硬币和WIF价格预测

- 2025-04-28 12:00:26

- 作为市值的第二大模因硬币,Shib在122天内从122天的122天开始下降了70%,最近在3月26日重新测试了当地的峰值。

-

- Binance Coin(BNB)价格一直在试图在重要的支撑区反弹

- 2025-04-28 11:55:13

- 最近,BNB弹起了一个重大的趋势线,在发稿时充当了关键支持水平。这个水平是根据价格测试的