|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特幣礦業公司瑪拉(Mara)在周五的股票上表現優於競爭對手,儘管第一季度的收入估計不足。

Shares of (NASDAQ:) , a leading Bitcoin (BTC) mining firm, closed higher on Friday, extending gains after the company missed earnings estimates for the first quarter.

領先的比特幣(BTC)礦業公司(NASDAQ :)的股票在周五關閉,在公司錯過第一季度的收益估算後,股票延長了。

However, investors appeared to be more focused on the company’s efforts to reduce costs, which analysts believe will be crucial for miners to succeed in the long run. At press time, MARA stock is up by 9%, trading at $15.52 on Friday.

但是,投資者似乎更加專注於公司降低成本的努力,分析師認為,從長遠來看,這對於礦工來說至關重要。發稿時,Mara股票增長了9%,週五的交易價格為15.52美元。

What Happened: Jefferies analysts highlighted that the recent surge in Bitcoin price and MARA’s transition toward more sustainable energy, including solar and flared gas-driven data centers, will likely lower the company’s power costs.

發生了什麼事:Jefferies分析師強調,最近的比特幣價格上漲以及Mara向更可持續的能源的過渡,包括太陽能和燃氣驅動的數據中心,可能會降低公司的電力成本。

Jonathan Petersen, an analyst at Jefferies, noted that the company’s infrastructure expansion, impacting 114 MW wind farm and newly energized 25 MW micro flared gas data center would aid in decreasing energy costs, ultimately improving profit margins. “MARA is expanding infrastructure at its 114 MW wind farm and has fully energized its 25 MW micro flared gas data center,” Petersen stated.

Jefferies的分析師喬納森·彼得森(Jonathan Petersen)指出,該公司的基礎設施擴展影響了114兆瓦的風電場和新啟動的25 MW Micro喇叭形燃氣數據中心,將有助於降低能源成本,最終提高利潤率。彼得森說:“瑪拉(Mara)正在其114兆瓦的風電場擴大基礎設施,並為其25兆瓦的微型燃氣數據中心提供了充分的能量。”

Analysts are optimistic that as MARA continues investing in energy assets, they will be able to cut costs even further, leading to improved profitability. Petersen raised his price target for the stock to $16 from $13, while maintaining a “hold” rating.

分析師樂觀的是,隨著Mara繼續投資能源資產,他們將能夠進一步降低成本,從而提高盈利能力。彼得森將其對股票的價格目標從13美元提高了16美元,同時保持“持有”評級。

Bitcoin miners have struggled in recent times as their profit margins have been squeezed by lower crypto prices and higher energy costs. In response, some miners are exploring additional sources of revenue, such as artificial intelligence and high-performance computing (HPC).

比特幣礦工近來一直在掙扎,因為他們的加密價格較低和能源成本較高,他們的利潤率被擠壓了。作為回應,一些礦工正在探索其他收入來源,例如人工智能和高性能計算(HPC)。

However, MARA has remained focused on diversifying within its core business, aiming to generate revenue from transaction services, mining pools, and cutting energy costs through green energy.

但是,瑪拉(Mara)一直專注於在其核心業務中多樣化,旨在通過交易服務,採礦池和通過綠色能源降低能源成本的收入。

H.C. Wainwright analyst Kevin Dede highlighted MARA’s strategy to stay ahead of competitors. “The company remains focused on technology development in its core vertical of power conversion,” Dede added.

HC Wainwright分析師Kevin Dede強調了Mara保持領先的戰略。 Dede補充說:“該公司仍然專注於技術發展的核心垂直力。”

He believes MARA’s approach will provide a sustained competitive edge. Dede, who has a buy rating on the stock with a target of $28, agreed that the company’s focus on improving power efficiency will be key to their success.

他認為,瑪拉的方法將提供持續的競爭優勢。 Dede對股票的買入評級為28美元,他同意該公司專注於提高功率效率的關注將是他們成功的關鍵。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

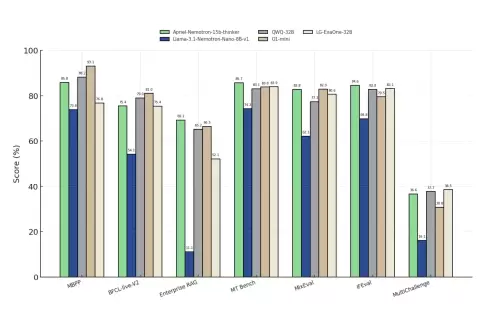

- 介紹Apriel-Nemotron-15b-thinker:一種資源有效的推理模型

- 2025-05-10 09:30:13

- 建立此類模型需要數學推理,科學理解和高級模式識別的整合。

-

-

- 美聯儲保持利率不變,為4.25%至4.5%

- 2025-05-10 09:25:15

- 美聯儲在其最新會議上將利率保持在4.25%至4.5%

-

-

- 隨著加密貨幣市場集會,Pepe硬幣(PEPE)飆升了40%

- 2025-05-10 09:20:12

- 在一個顯著的周轉中,加密貨幣市場在過去的48小時中飆升,比特幣(BTC)首次打破了100,000美元的障礙

-

- 77%的低點激增後,以太坊眼睛的抗抗藥性

- 2025-05-10 09:20:12

- Makrovision Analytics報告說,以太坊的價格結構恢復了,證實了他們早期看漲的前景。

-

-

-

![Virtuals協議[Virtual]記錄了過去24小時內最重要的市場收益之一,速度增長了50%。 Virtuals協議[Virtual]記錄了過去24小時內最重要的市場收益之一,速度增長了50%。](/assets/pc/images/moren/280_160.png)

![Virtuals協議[Virtual]記錄了過去24小時內最重要的市場收益之一,速度增長了50%。 Virtuals協議[Virtual]記錄了過去24小時內最重要的市場收益之一,速度增長了50%。](/uploads/2025/05/10/cryptocurrencies-news/articles/virtuals-protocol-virtualrecorded-market-gains-hours-surge/image_500_300.webp)