|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

這項強勁的運行將淨流入量推向了年輕時,達到了108億美元的新創紀錄。同時,這些產品中管理的總資產(AUM)也攀升至新歷史最高高點1.875億美元

Digital asset investment products enticed fresh capital for the sixth straight week, attracting a hefty $3.3 billion in the seven days to August 10, continuing the strong run of institutional flows into the market.

數字資產投資產品連續第六週吸引了新的資本,在截至8月10日的7天中吸引了33億美元,繼續進行機構流入市場。

According to data from digital asset management firm CoinShares, these funds also saw net inflows of $10.8 billion in the year-to-date, setting a new all-time high. Meanwhile, total assets under management (AuM) in these products climbed to a new all-time high of $187.5 billion in the last week, further indicating growing engagement with digital assets.

根據數字資產管理公司Coinshares的數據,這些基金在年度最佳的淨流入量為108億美元,創造了新的歷史最高水平。同時,在上週,這些產品中管理的總資產(AUM)攀升至新歷史最高的1.875億美元,這進一步表明與數字資產的參與不斷增長。

According to CoinShares’ latest report, growing concerns about the U.S. economy, especially following Moody’s credit rating downgrade and the resulting spike in treasury yields, have prompted investors to seek diversification through digital assets.

根據Coinshares的最新報告,人們對美國經濟的越來越擔憂,尤其是在穆迪的信用評級降級以及最終的財政收益率上升之後,投資者促使投資者通過數字資產尋求多元化。

The United States dominated inflows, with fresh capital of $3.2 billion flowing into digital asset investment products in the week.

美國占據了流入,新的資本為32億美元,在本周流入數字資產投資產品。

Bitcoin and Ethereum Lead Inflows as XRP’s Streak Ends

XRP的條紋結束時比特幣和以太坊鉛流入

Bitcoin (BTC) received the largest share of investment, with $2.9 billion entering the market in the seven days to August 10. These funds make up roughly 25% of total inflows in 2024.

比特幣(BTC)獲得了最大的投資份額,在截至8月10日的7天內,有29億美元進入市場。這些資金約佔2024年總流入量的25%。

With Bitcoin trading above the $111,800 mark, many investors have added more to their portfolios. At the same time, some investors took advantage of Bitcoin’s growth by investing in short Bitcoin products, which saw the highest weekly inflow since December 2024.

隨著比特幣交易高於111,800美元,許多投資者增加了更多的投資組合。同時,一些投資者通過投資簡短的比特幣產品利用了比特幣的增長,這是2024年12月以來每週最高的流入。

Ethereum followed with $326 million in inflows, marking the fifth week of capital gains and the largest week of inflows in the last 15 weeks. The sustained interest results from improving market sentiment towards the token and the ecosystem developments.

以太坊隨後流入了3.26億美元,標誌著過去15週的資本收益第五周和流入最大的一周。持續的利益是由於改善了對代幣和生態系統發展的市場情緒而產生的。

On the other hand, last week’s outflow of $37.2 million ended XRP’s 80-week inflow streak. This outflow is the largest in XRP’s history and breaks the streak of continuous inflows the token saw since early 2024.

另一方面,上週的3720萬美元流出結束了XRP的80周流入連勝。此流出是XRP歷史上最大的流量,並破壞了自2024年初以來令牌鋸的連續流入的條紋。

Global Capital Flows Show Mixed Trends

全球資本流程表現出不同的趨勢

Outside the U.S., capital transfers in other markets showed mixed results. Inflows into Germany, Australia, and Hong Kong amounted to $41.5 million, $10.9 million and $33.3 million, respectively. Although these numbers are less than those in the U.S., they still reflect international investors’ participation.

在美國以外,其他市場的資本轉移表現出了不同的結果。流入德國,澳大利亞和香港的流入分別為4,150萬美元,1,090萬美元和3,330萬美元。儘管這些數字小於美國的數字,但它們仍然反映了國際投資者的參與。

Investors in Switzerland took advantage of recent price rises resulting in withdrawals of $16.6 million in the last week. Similarly, Sweden saw outflows of $12.1 million while Brazil recorded $1.9 million outflows. The rising trends highlight investors’ profit-taking or portfolio rebalancing amid the rise in digital asset prices.

瑞士的投資者利用了最近的價格上漲,導致上週退出1660萬美元。同樣,瑞典的流出量為1,210萬美元,而巴西的流出率為190萬美元。不斷上升的趨勢凸顯了投資者在數字資產價格上漲的情況下重新平衡投資者的盈利或投資組合。

Commenting on the latest trends, James Butterfill, CoinShares’ Head of Research noted that uncertainty in the U.S. economy has led investors to seek alternative assets.

Coinshares研究負責人詹姆斯·巴特菲爾(James Butterfill)在評論最新趨勢時指出,美國經濟的不確定性導致投資者尋求替代資產。

“We believe that growing concerns over the U.S.

“我們相信對美國的關注日益加劇

's economy, driven by the Moody’s downgrade and the resulting spike in treasury yields, have prompted investors to seek diversification through digital assets,” said Butterfill.

Butterfill說:“在喜怒無常的降級和財政收益率的升級的驅動下,經濟促使投資者通過數字資產尋求多元化。”

The figures underscore investors’ ongoing interest in digital asset investment products as macroeconomic trends shift. Despite some outflows from XRP, investors still have confidence in Bitcoin and Ethereum since these major cryptocurrencies are leading the inflows.

隨著宏觀經濟趨勢的變化,這些數字強調了投資者對數字資產投資產品的持續興趣。儘管XRP流出了一些流出,但投資者仍然對比特幣和以太坊充滿信心,因為這些主要的加密貨幣正在引領流入。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

- BNB,Maxwell Fork和BSC Mainnet:導航速度,穩定性和地緣政治潮汐

- 2025-06-30 06:50:12

- 在市場波動中探索麥克斯韋硬叉對BNB智能連鎖店的影響,使技術升級與經濟現實平衡。

-

-

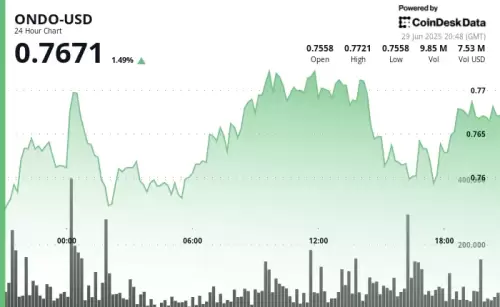

- Ondo Climbs:代幣化的股票已準備好2025年收購?

- 2025-06-30 07:12:02

- Ondo Finance在2025年將股票押注大量,而雙子座跳入歐盟市場。這是金融的未來嗎?

-

- 比特幣礦工:收入下降,但不出售?在加密貨幣場景上的紐約分鐘

- 2025-06-30 07:12:03

- 比特幣礦工在收入下降時面臨艱難的時期,但令人驚訝的是沒有出售他們的比特幣。有什麼交易?讓我們分解,紐約風格。

-

-

-