|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在伊朗 - 以色列的衝突及其與納斯達克的相關性中,分析比特幣的行為,表明這不是避風港。

In times of global turmoil, investors often seek safe havens. But how does Bitcoin, often touted as digital gold, really perform when tensions flare, especially with events like the Iran-Israel conflict impacting markets? Let's dive in.

在全球動盪時期,投資者經常尋求避風港。但是,當緊張局勢爆發時,比特幣經常被吹捧為數字黃金,尤其是在影響伊朗 - 以色列衝突等市場的事件時,比特幣如何真正執行?讓我們潛水。

Bitcoin's Rocky Relationship with War

比特幣與戰爭的岩石關係

While many crypto enthusiasts dream of Bitcoin as a safe harbor, reality paints a different picture. Recent events, particularly the escalating tensions between Iran and Israel, show Bitcoin struggling to maintain its value compared to traditional tech investments. Remember when Trump dropped that TruthSocial bomb about Tehran? The NASDAQ took a hit, sure, but Bitcoin got smacked way harder.

儘管許多加密愛好者夢想比特幣作為安全港,但現實卻描繪了不同的圖片。最近的事件,尤其是伊朗和以色列之間的緊張局勢,與傳統技術投資相比,比特幣努力保持其價值。還記得特朗普放棄了關於德黑蘭的真理炸彈嗎?當然,納斯達克大獲成功,但比特幣變得更加困難。

The Numbers Don't Lie

數字不撒謊

Let's break it down. When Trump's announcement hit, the NASDAQ-tracking QQQ ETF dipped, reflecting a significant loss in US public market cap. Bitcoin, however, plummeted three times further within the same 90-minute window. Ouch. This isn't an isolated incident either. We saw a similar pattern during the onset of the Russia-Ukraine conflict. The NASDAQ tanked, but Bitcoin's fall was even more dramatic. It's like Bitcoin's got a knack for amplifying the chaos.

讓我們分解。當特朗普宣布這一消息時,納斯達克式QQQ ETF下降了,這反映了美國公共市場上限的巨大損失。但是,比特幣在同一90分鐘的窗口中進一步跌落了三次。哎喲。這也不是孤立的事件。在俄羅斯 - 烏克蘭衝突開始期間,我們看到了類似的模式。納斯達克坦克,但比特幣的跌倒更加引人注目。就像比特幣有一個訣竅來放大混亂。

Not-So-Safe Haven?

不是那麼安全的天堂?

The takeaway? Bitcoin isn't behaving like a safe-haven asset when geopolitical storms hit. Gold rallies, Bitcoin sells off. This pattern suggests Bitcoin is more of a speculative asset, heavily influenced by risk sentiment. It's a digital asset, alright, but digital gold? Not so much.

外賣?當地緣政治風暴襲來時,比特幣的行為不像是避風港的資產。黃金集會,比特幣賣出。這種模式表明,比特幣更像是一種投機性資產,受風險情緒的影響很大。這是數字資產,好的,但是數字黃金嗎?不多。

Coinbase's Wild Ride on the NASDAQ

Coinbase在納斯達克的狂野騎行

Speaking of risk, let's peek at Coinbase (COIN) on the NASDAQ. This stock is a rollercoaster. One month it's soaring, the next it's plunging. Coinbase is up +23.81% in one month, but down -20.38% over six months. It mirrors the crypto market's volatility. And those who bought in early? Many are still underwater, with the all-time performance showing a hefty -33.54% loss. Ouch, again.

說到風險,讓我們窺視納斯達克島上的Coinbase(Coin)。該股票是過山車。一個月的飛漲,下一個正在跌落。 Coinbase在一個月內增長 +23.81%,但在六個月內下跌了-20.38%。它反映了加密貨幣市場的波動性。還有那些早點買的人?許多仍在水下,歷史績效表現出大量-33.54%的損失。哎呀,再次。

The Energy Angle: Bitcoin Mining Goes Green(ish)

能量角度:比特幣採礦變綠(ISH)

Amidst all this market drama, there's a fascinating trend emerging: Bitcoin mining is cleaning up its act (sort of). Companies are increasingly turning to alternative energy sources, like stranded natural gas. AgriFORCE Growing Systems, for instance, launched a Bitcoin mining operation in Alberta powered by this otherwise wasted resource. Even Senator Ted Cruz is getting in on the action with tax incentives for miners using flared natural gas. It's a step in the right direction, even if it's driven by economics as much as environmentalism.

在所有這些市場戲劇中,出現了一個引人入勝的趨勢:比特幣採礦正在清理其行為(一種)。公司越來越多地轉向替代能源,例如滯留的天然氣。例如,Agriforce生長系統在艾伯塔省推出了一個由這種浪費的資源提供支持的比特幣採礦業務。甚至參議員泰德·克魯茲(Ted Cruz)也採取了使用爆發天然氣的礦工的稅收優惠。即使是由經濟學和環保主義驅動的,這是朝著正確方向邁出的一步。

Final Thoughts: Buckle Up!

最終想法:搭扣!

So, what's the bottom line? Bitcoin's relationship with geopolitical risk and the stock market is complicated. It's not the safe haven some hoped for, and its price swings can be stomach-churning. But hey, that's the thrill of the crypto game, right? Just remember to do your homework and maybe keep a little gold handy, just in case.

那麼,最重要的是什麼?比特幣與地緣政治風險和股票市場的關係很複雜。這不是某些人希望的避風港,其價格波動可能是在胃口。但是,嘿,這就是加密遊戲的刺激,對嗎?只需記住做作業,也許可以放一點金色的方便,以防萬一。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 比特幣的平衡行為:導航地緣政治緊張局勢達到眼睛記錄高點

- 2025-06-19 00:25:12

- 隨著地緣政治緊張局勢加劇通貨膨脹的擔憂,比特幣眼睛的新高點。機構積累,市場導航不確定性。

-

- Crypto ATMS在華盛頓市被禁止:這是怎麼回事?

- 2025-06-19 00:45:13

- 華盛頓斯波坎(Spokane)在騙局問題上禁止加密貨幣。這是局部鎮壓還是更大趨勢的跡象?讓我們潛水。

-

-

- 冷錢包,陶,靠近:安全地導航加密不穩定性

- 2025-06-19 01:10:13

- 在陶的市場波動中,冷錢包作為安全的避風港出現,強調用戶控制和隱私。這是2025年的正確選擇嗎?

-

- 冷錢包:您的代幣堡壘在毛茸茸的貿易狂潮中

- 2025-06-19 00:45:13

- 用冷錢包在加密貨幣的狂野世界中瀏覽。優先考慮隱私,控制和安全性,這是精明的交易者的明智之舉。

-

-

- Memecoin Mania:基本面符合高風險市場

- 2025-06-19 01:45:12

- 深入了解大型賭注和社區支持的狂野世界。發現基本面在這個高風險遊戲中如何變得至關重要。

-

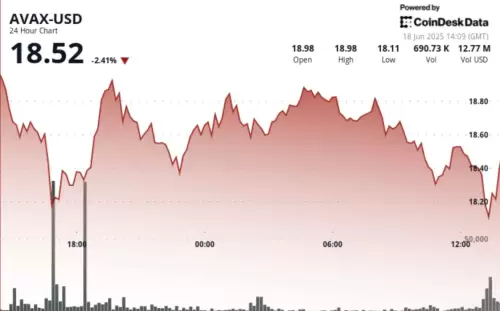

- avax恢復:短期動量還是看跌陷阱?

- 2025-06-19 01:12:13

- 在看跌情緒的情況下,分析了Avax最近的價格行動,短期勢頭和潛在的恢復。 V形恢復會持有,還是暫時的緩刑?

-