Analyzing Bitcoin's behavior amid the Iran-Israel conflict and its correlation with the NASDAQ, revealing it's not the safe haven some believe.

In times of global turmoil, investors often seek safe havens. But how does Bitcoin, often touted as digital gold, really perform when tensions flare, especially with events like the Iran-Israel conflict impacting markets? Let's dive in.

Bitcoin's Rocky Relationship with War

While many crypto enthusiasts dream of Bitcoin as a safe harbor, reality paints a different picture. Recent events, particularly the escalating tensions between Iran and Israel, show Bitcoin struggling to maintain its value compared to traditional tech investments. Remember when Trump dropped that TruthSocial bomb about Tehran? The NASDAQ took a hit, sure, but Bitcoin got smacked way harder.

The Numbers Don't Lie

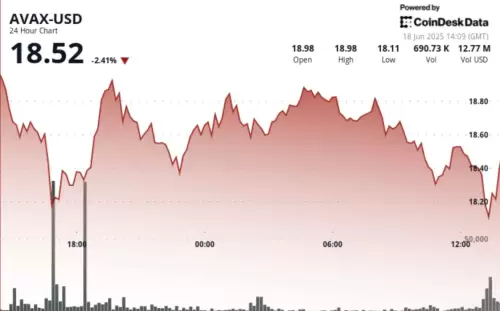

Let's break it down. When Trump's announcement hit, the NASDAQ-tracking QQQ ETF dipped, reflecting a significant loss in US public market cap. Bitcoin, however, plummeted three times further within the same 90-minute window. Ouch. This isn't an isolated incident either. We saw a similar pattern during the onset of the Russia-Ukraine conflict. The NASDAQ tanked, but Bitcoin's fall was even more dramatic. It's like Bitcoin's got a knack for amplifying the chaos.

Not-So-Safe Haven?

The takeaway? Bitcoin isn't behaving like a safe-haven asset when geopolitical storms hit. Gold rallies, Bitcoin sells off. This pattern suggests Bitcoin is more of a speculative asset, heavily influenced by risk sentiment. It's a digital asset, alright, but digital gold? Not so much.

Coinbase's Wild Ride on the NASDAQ

Speaking of risk, let's peek at Coinbase (COIN) on the NASDAQ. This stock is a rollercoaster. One month it's soaring, the next it's plunging. Coinbase is up +23.81% in one month, but down -20.38% over six months. It mirrors the crypto market's volatility. And those who bought in early? Many are still underwater, with the all-time performance showing a hefty -33.54% loss. Ouch, again.

The Energy Angle: Bitcoin Mining Goes Green(ish)

Amidst all this market drama, there's a fascinating trend emerging: Bitcoin mining is cleaning up its act (sort of). Companies are increasingly turning to alternative energy sources, like stranded natural gas. AgriFORCE Growing Systems, for instance, launched a Bitcoin mining operation in Alberta powered by this otherwise wasted resource. Even Senator Ted Cruz is getting in on the action with tax incentives for miners using flared natural gas. It's a step in the right direction, even if it's driven by economics as much as environmentalism.

Final Thoughts: Buckle Up!

So, what's the bottom line? Bitcoin's relationship with geopolitical risk and the stock market is complicated. It's not the safe haven some hoped for, and its price swings can be stomach-churning. But hey, that's the thrill of the crypto game, right? Just remember to do your homework and maybe keep a little gold handy, just in case.