|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在伊朗 - 以色列的冲突及其与纳斯达克的相关性中,分析比特币的行为,表明这不是避风港。

In times of global turmoil, investors often seek safe havens. But how does Bitcoin, often touted as digital gold, really perform when tensions flare, especially with events like the Iran-Israel conflict impacting markets? Let's dive in.

在全球动荡时期,投资者经常寻求避风港。但是,当紧张局势爆发时,比特币经常被吹捧为数字黄金,尤其是在影响伊朗 - 以色列冲突等市场的事件时,比特币如何真正执行?让我们潜水。

Bitcoin's Rocky Relationship with War

比特币与战争的岩石关系

While many crypto enthusiasts dream of Bitcoin as a safe harbor, reality paints a different picture. Recent events, particularly the escalating tensions between Iran and Israel, show Bitcoin struggling to maintain its value compared to traditional tech investments. Remember when Trump dropped that TruthSocial bomb about Tehran? The NASDAQ took a hit, sure, but Bitcoin got smacked way harder.

尽管许多加密爱好者梦想比特币作为安全港,但现实却描绘了不同的图片。最近的事件,尤其是伊朗和以色列之间的紧张局势,与传统技术投资相比,比特币努力保持其价值。还记得特朗普放弃了关于德黑兰的真理炸弹吗?当然,纳斯达克大获成功,但比特币变得更加困难。

The Numbers Don't Lie

数字不撒谎

Let's break it down. When Trump's announcement hit, the NASDAQ-tracking QQQ ETF dipped, reflecting a significant loss in US public market cap. Bitcoin, however, plummeted three times further within the same 90-minute window. Ouch. This isn't an isolated incident either. We saw a similar pattern during the onset of the Russia-Ukraine conflict. The NASDAQ tanked, but Bitcoin's fall was even more dramatic. It's like Bitcoin's got a knack for amplifying the chaos.

让我们分解。当特朗普宣布这一消息时,纳斯达克式QQQ ETF下降了,这反映了美国公共市场上限的巨大损失。但是,比特币在同一90分钟的窗口中进一步跌落了三次。哎哟。这也不是孤立的事件。在俄罗斯 - 乌克兰冲突开始期间,我们看到了类似的模式。纳斯达克坦克,但比特币的跌倒更加引人注目。就像比特币有一个诀窍来放大混乱。

Not-So-Safe Haven?

不是那么安全的天堂?

The takeaway? Bitcoin isn't behaving like a safe-haven asset when geopolitical storms hit. Gold rallies, Bitcoin sells off. This pattern suggests Bitcoin is more of a speculative asset, heavily influenced by risk sentiment. It's a digital asset, alright, but digital gold? Not so much.

外卖?当地缘政治风暴袭来时,比特币的行为不像是避风港的资产。黄金集会,比特币卖出。这种模式表明,比特币更像是一种投机性资产,受风险情绪的影响很大。这是数字资产,好的,但是数字黄金吗?不多。

Coinbase's Wild Ride on the NASDAQ

Coinbase在纳斯达克的狂野骑行

Speaking of risk, let's peek at Coinbase (COIN) on the NASDAQ. This stock is a rollercoaster. One month it's soaring, the next it's plunging. Coinbase is up +23.81% in one month, but down -20.38% over six months. It mirrors the crypto market's volatility. And those who bought in early? Many are still underwater, with the all-time performance showing a hefty -33.54% loss. Ouch, again.

说到风险,让我们窥视纳斯达克岛上的Coinbase(Coin)。该股票是过山车。一个月的飞涨,下一个正在跌落。 Coinbase在一个月内增长 +23.81%,但在六个月内下跌了-20.38%。它反映了加密货币市场的波动性。还有那些早点买的人?许多仍在水下,历史绩效表现出大量-33.54%的损失。哎呀,再次。

The Energy Angle: Bitcoin Mining Goes Green(ish)

能量角度:比特币采矿变绿(ISH)

Amidst all this market drama, there's a fascinating trend emerging: Bitcoin mining is cleaning up its act (sort of). Companies are increasingly turning to alternative energy sources, like stranded natural gas. AgriFORCE Growing Systems, for instance, launched a Bitcoin mining operation in Alberta powered by this otherwise wasted resource. Even Senator Ted Cruz is getting in on the action with tax incentives for miners using flared natural gas. It's a step in the right direction, even if it's driven by economics as much as environmentalism.

在所有这些市场戏剧中,出现了一个引人入胜的趋势:比特币采矿正在清理其行为(一种)。公司越来越多地转向替代能源,例如滞留的天然气。例如,Agriforce生长系统在艾伯塔省推出了一个由这种浪费的资源提供支持的比特币采矿业务。甚至参议员泰德·克鲁兹(Ted Cruz)也采取了使用爆发天然气的矿工的税收优惠。即使是由经济学和环保主义驱动的,这是朝着正确方向迈出的一步。

Final Thoughts: Buckle Up!

最终想法:搭扣!

So, what's the bottom line? Bitcoin's relationship with geopolitical risk and the stock market is complicated. It's not the safe haven some hoped for, and its price swings can be stomach-churning. But hey, that's the thrill of the crypto game, right? Just remember to do your homework and maybe keep a little gold handy, just in case.

那么,最重要的是什么?比特币与地缘政治风险和股票市场的关系很复杂。这不是某些人希望的避风港,其价格波动可能是在胃口。但是,嘿,这就是加密游戏的刺激,对吗?只需记住做作业,也许可以放一点金色的方便,以防万一。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 比特币的平衡行为:导航地缘政治紧张局势达到眼睛记录高点

- 2025-06-19 00:25:12

- 随着地缘政治紧张局势加剧通货膨胀的担忧,比特币眼睛的新高点。机构积累,市场导航不确定性。

-

- Crypto ATMS在华盛顿市被禁止:这是怎么回事?

- 2025-06-19 00:45:13

- 华盛顿斯波坎(Spokane)在骗局问题上禁止加密货币。这是局部镇压还是更大趋势的迹象?让我们潜水。

-

-

- 冷钱包,陶,靠近:安全地导航加密不稳定性

- 2025-06-19 01:10:13

- 在陶的市场波动中,冷钱包作为安全的避风港出现,强调用户控制和隐私。这是2025年的正确选择吗?

-

- 冷钱包:您的代币堡垒在毛茸茸的贸易狂潮中

- 2025-06-19 00:45:13

- 用冷钱包在加密货币的狂野世界中浏览。优先考虑隐私,控制和安全性,这是精明的交易者的明智之举。

-

-

- Memecoin Mania:基本面符合高风险市场

- 2025-06-19 01:45:12

- 深入了解大型赌注和社区支持的狂野世界。发现基本面在这个高风险游戏中如何变得至关重要。

-

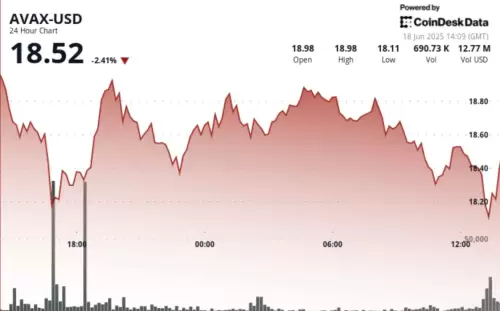

- avax恢复:短期动量还是看跌陷阱?

- 2025-06-19 01:12:13

- 在看跌情绪的情况下,分析了Avax最近的价格行动,短期势头和潜在的恢复。 V形恢复会持有,还是暂时的缓刑?

-