|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特幣本周正遇到新的壓力,隨著市場消化美國最新通貨膨脹數據,今天降低了1.8%。

Bitcoin (BTC) experienced renewed pressure on Monday, declining by 1.8% as markets digested the latest U.S. inflation data.

比特幣(BTC)週一遭受了新的壓力,隨著市場消化了美國最新通貨膨脹數據,比特幣(BTC)下降了1.8%。

The crypto firstborn has retested the support at $101,000 level. This pullback coincides with the U.S. Bureau of Labor Statistics’ release of the April Producer Price Index (PPI), which revealed weaker-than-expected inflation at the producer level.

加密前長子已重新測試了101,000美元的支持。這種回調恰逢美國勞工統計局的《四月生產商價格指數》(PPI)的發布,該指數揭示了生產商一級的通貨膨脹率較弱。

Specifically, the PPI dropped by 0.5% on a monthly basis, marking the sharpest decline since the series began. Over the past 12 months, the index rose just 2.3%. Notably, this is a signal that upstream inflationary pressures are easing more rapidly than experts expect.

具體而言,PPI每月下降了0.5%,這標誌著該系列賽開始以來的最高下降。在過去的12個月中,該指數僅增長2.3%。值得注意的是,這表明上游通貨膨脹壓力的速度比專家預期的要快。

US Core PPI falls to 2.4%, lower than expectations.

美國核心PPI降至2.4%,低於預期。

Most of April’s PPI decline came from a massive 0.7% drop in final demand services, while goods prices held steady. Notably, trade service margins fell by 1.6%, with machinery and vehicle wholesaling plunging over 6%.

4月的大部分PPI下降來自最終需求服務的0.7%下降,而商品價格穩定。值得注意的是,貿易服務利潤率下降了1.6%,機械和車輛批發的暴跌超過6%。

Further, a sharp 39.4% collapse in egg prices also contributed to the overall decline in food-related producer prices. Meanwhile, core PPI, which strips out volatile food, energy, and trade services, ticked down 0.1%, the first such decline since April 2020.

此外,雞蛋價格急劇下跌39.4%也導致食品相關生產商價格的總體下降。同時,脫離揮發性食品,能源和貿易服務的Core PPI下降了0.1%,這是自2020年4月以來的首次下降。

These figures arrived just two days after the release of the April Consumer Price Index (CPI), which painted a similarly lower inflation picture. Specifically, headline CPI rose 0.2% for the month, bringing the annual inflation rate down to 2.3%, its lowest since February 2021.

這些數字在四月消費者價格指數(CPI)發布後僅兩天就到達,該指數繪製了同樣較低的通貨膨脹圖片。具體而言,本月的標題CPI增長了0.2%,使年度通貨膨脹率降至2.3%,這是自2021年2月以來最低的。

Core CPI, which excludes food and energy, also rose 0.2% month-over-month and stood at 2.8% year-over-year. Also, egg prices at the consumer level fell 12.7%, though they remain significantly elevated, up over 49% from the same time last year.

不包括糧食和能源的Core CPI也會在月超月份上漲0.2%,同比為2.8%。同樣,消費者水平的雞蛋價格下跌了12.7%,儘管它們的漲幅顯著升高,比去年同期增長了49%以上。

Notably, these two gauges are fundamentally different. The CPI shows price changes experienced by consumers at the retail level, directly impacting household expenses. In contrast, the PPI measures wholesale price changes that affect producers.

值得注意的是,這兩個儀表根本不同。 CPI顯示了消費者在零售水平上經歷的價格變化,直接影響家庭費用。相比之下,PPI衡量影響生產者的批發價格變化。

Interestingly, the dual release of soft CPI and PPI data has triggered speculation about the Federal Reserve’s interest rate decisions. As producer and consumer inflation both ease, the central bank may find new flexibility to consider rate cuts later in 2025.

有趣的是,軟CPI和PPI數據的雙重釋放引發了人們對美聯儲的利率決策的猜測。由於生產商和消費者通貨膨脹均可輕鬆,中央銀行可能會發現新的靈活性來考慮2025年晚些時候降低速率。

Such decisions could impact Bitcoin and broader crypto markets. Historically, Bitcoin has responded positively to looser monetary policy, as lower interest rates reduce the opportunity cost of holding non-yielding assets like crypto.

這樣的決定可能會影響比特幣和更廣泛的加密市場。從歷史上看,比特幣對更寬鬆的貨幣政策做出了積極的反應,因為較低的利率降低了持有Crypto等非收益資產的機會成本。

If the Federal Reserve moves toward easing later this year, crypto markets could benefit from increased risk appetite and capital flows. However, there is still uncertainty. The Trump administration’s tariffs could still act as a potential inflationary wildcard that could complicate the Fed’s path forward.

如果美聯儲在今年晚些時候放鬆,加密貨幣市場可能會受益於增加的風險食慾和資本流動。但是,仍然存在不確定性。特朗普政府的關稅仍然可以充當潛在的通貨膨脹通配符,這可能會使美聯儲的前進道路複雜化。

Additionally, Bitcoin’s short-term technicals show vulnerability around the $101,000 support level, which, if broken, could lead to further downside despite bullish macroeconomic tailwinds.

此外,比特幣的短期技術表明,在101,000美元的支持水平上顯示了脆弱性,如果破碎,儘管宏偉的宏觀經濟偏執,但它可能會導致進一步的缺點。

Bitcoin, which surged to a five-month high of $105,000 on May 12, is currently trading at $101,660. Despite the dip, Bitcoin remains up 8.26% for May and has gained 9.17% year-to-date, though it has slipped 2.06% over the past week.

比特幣在5月12日飆升至5月的105,000美元高點,目前為101,660美元。儘管下降了,但5月的比特幣仍增長了8.26%,並且逐漸上漲了9.17%,儘管過去一周的下滑2.06%。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

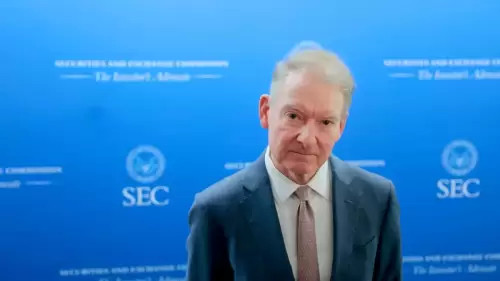

- SEC通過其用戶計數指標調查了Coinbasecoin-3.06%)

- 2025-05-16 04:30:13

- 美國證券交易委員會正在調查Coinbasecoin-3.06%以前聲稱擁有超過1億“經過驗證的用戶”

-

- 選擇具有真實上漲空間的低成本硬幣可以將平均投資組合轉變為非凡的東西

- 2025-05-16 04:30:13

- 該列表重點介紹了現在購買的最高看漲加密貨幣,這些加密貨幣已經開始在加密觀察者中引起嚴重的關注。

-

-

- 連鎖促進的加密貨幣XRP通常被吹捧為改變付款和跨境交易的遊戲規則。

- 2025-05-16 04:25:13

- 然而,伊斯蘭教徒對沖基金Arca質疑XRP的金融業務。

-

-

-

- 在過去的38天內,多黴素的集會超過78%

- 2025-05-16 04:15:13

- 在過去的38天內,多黴素的集會超過78%

-

![矮胖的企鵝[Pengu]在翻轉超級趨勢指標後繼續前鋒的反彈,在$ 0.013的支撐區上收回了地面。 矮胖的企鵝[Pengu]在翻轉超級趨勢指標後繼續前鋒的反彈,在$ 0.013的支撐區上收回了地面。](/assets/pc/images/moren/280_160.png)

-

- 4個隨著增長而爆炸的雷達下加密項目

- 2025-05-16 04:10:13

- 這些名稱因超出短期價格行動的原因而引起關注。他們正在建設基礎架構,提供更新並擴展到現實世界中的用例。