|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

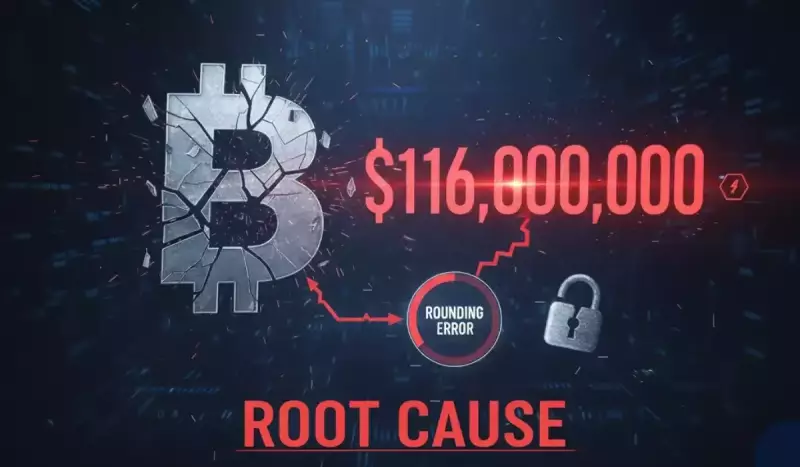

深入研究 Balancer 漏洞,揭示導致 1.16 億美元損失的捨入錯誤及其對 DeFi 的影響。

Balancer, once a DeFi darling, faced a harsh reality check when a rounding error in its BatchSwap feature led to a $116 million exploit. Let's break down what happened and why it matters.

Balancer 曾經是 DeFi 的寵兒,但它的 BatchSwap 功能中的捨入錯誤導致了 1.16 億美元的漏洞,因此面臨著嚴峻的現實檢驗。讓我們來分析一下發生了什麼以及為什麼它很重要。

The Root Cause: A Tiny Rounding Error, Massive Impact

根本原因:微小的捨入誤差,巨大的影響

The culprit? A subtle rounding error in the "upscale" function of Balancer's v2 vault's BatchSwaps feature. This function, designed to save gas fees by combining multiple swaps, had a flaw. Instead of always rounding down when calculating token prices, it sometimes didn't, creating tiny discrepancies. Hackers exploited this, using flash loans to manipulate balances and drain funds. Think of it as finding a minuscule crack in a dam – seemingly harmless, but capable of unleashing a torrent.

罪魁禍首? Balancer v2Vault 的 BatchSwaps 功能的“高檔”功能中存在細微的捨入錯誤。這個功能旨在通過組合多個交換來節省汽油費,但有一個缺陷。在計算代幣價格時,它並不總是向下舍入,而是有時不向下舍入,從而產生微小的差異。黑客利用這一點,利用閃電貸來操縱餘額並耗盡資金。可以把它想像成在大壩上發現一個微小的裂縫——看似無害,但能夠釋放洪流。

The Timeline: From Discovery to Damage Control

時間表:從發現到損害控制

The exploit, discovered on November 3, 2025, quickly escalated, targeting Balancer v2 Stable Pools and Composable Stable (CSP) v5 Pools across multiple blockchains, including Ethereum, Base, Avalanche, Arbitrum, Optimism, Gnosis, Polygon, Berachain, and Sonic. Initial estimates of $70 million ballooned to over $128 million within hours. The attack targeted Balancer Pool Tokens (BPT), manipulating pool prices during batch swaps.

該漏洞於 2025 年 11 月 3 日發現,並迅速升級,針對跨多個區塊鏈的 Balancer v2 穩定池和可組合穩定 (CSP) v5 池,包括以太坊、Base、Avalanche、Arbitrum、Optimism、Gnosis、Polygon、Berachain 和 Sonic。最初預計的 7000 萬美元在數小時內飆升至超過 1.28 億美元。該攻擊針對 Balancer 礦池代幣(BPT),在批量交換期間操縱礦池價格。

The Aftermath: Recovery Efforts and DeFi's Vulnerability

後果:恢復工作和 DeFi 的漏洞

Balancer and its security partners sprang into action, pausing affected pools, disabling new pool creation, and halting rewards for vulnerable pools. They even offered a 20% white hat bounty. Some funds were recovered, thanks to the efforts of StakeWise, BitFinding, and Base MEV bots, amounting to millions. Berachain validators halted their network to prevent further damage. It's like a frantic, multi-team effort to bail out a sinking ship.

Balancer 及其安全合作夥伴迅速採取行動,暫停受影響的礦池,禁止創建新礦池,並停止對脆弱礦池進行獎勵。他們甚至提供了 20% 的白帽賞金。在 StakeWise、BitFinding 和 Base MEV 機器人的努力下,一些資金被追回,金額達數百萬美元。 Berachain 驗證者停止了他們的網絡以防止進一步的損害。這就像多團隊瘋狂地努力救助一艘正在下沉的船。

Why This Matters: A Wake-Up Call for DeFi

為什麼這很重要:為 DeFi 敲響警鐘

This exploit isn't just about Balancer; it highlights a fundamental challenge in DeFi: the composability paradox. The same features that enable innovation also multiply systemic risk. As one security expert put it, it was a "trust collapse, not just a hack." Even protocols with multiple audits can harbor hidden vulnerabilities. This incident underscores the need for stronger risk management infrastructure in the DeFi space and a more nuanced understanding of smart contract risk.

此漏洞不僅僅與 Balancer 有關;還與 Balancer 相關。它凸顯了 DeFi 的一個根本挑戰:可組合性悖論。促進創新的相同特徵也會增加系統性風險。正如一位安全專家所說,這是“信任崩潰,而不僅僅是黑客攻擊”。即使具有多重審核的協議也可能隱藏著隱藏的漏洞。這一事件凸顯了 DeFi 領域需要更強大的風險管理基礎設施以及對智能合約風險更細緻的了解。

The Human Element: Trust and Credibility

人的因素:信任和信譽

Beyond the technical aspects, this incident underscores the importance of trust and credibility in the decentralized world. As one developer pointed out, people follow people they trust, not just whitepapers. Projects led by visible, consistent, and credible builders are more likely to succeed. The Balancer exploit serves as a stark reminder that in DeFi, resilience is never guaranteed, not even after eleven audits.

除了技術方面之外,這一事件還強調了去中心化世界中信任和信譽的重要性。正如一位開發人員指出的那樣,人們追隨他們信任的人,而不僅僅是白皮書。由可見、一致且可信的建設者領導的項目更有可能成功。 Balancer 漏洞清楚地提醒我們,在 DeFi 中,彈性永遠無法得到保證,即使經過 11 次審計也是如此。

Looking Ahead: A More Resilient DeFi?

展望未來:更具彈性的 DeFi?

The Balancer exploit was a painful lesson, but it's also an opportunity to learn and build a more resilient DeFi ecosystem. Stronger risk management, a deeper understanding of smart contract vulnerabilities, and a focus on trust and credibility are essential. It's like DeFi is going through its awkward teenage years, full of growing pains, but with the potential to mature into something truly remarkable. And who knows, maybe Balancer will even make a comeback story worthy of a Hollywood script!

Balancer 漏洞是一個慘痛的教訓,但它也是一個學習和構建更具彈性的 DeFi 生態系統的機會。更強的風險管理、對智能合約漏洞的更深入了解以及對信任和信譽的關注至關重要。就像 DeFi 正在經歷尷尬的青少年時期,充滿成長的煩惱,但有潛力成熟為真正非凡的東西。誰知道呢,也許 Balancer 甚至會製作出一個值得好萊塢劇本的捲土重來的故事!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- Zcash ZEC 幣價格爆炸:從隱私利基到中心舞台

- 2025-11-08 18:00:00

- 在隱私敘事、技術升級和市場動態的推動下,Zcash (ZEC) 的價格大幅上漲。這是隱私幣新時代的開始嗎?

-

-

-

- 柴犬的下一步行動:駕馭不斷變化的市場

- 2025-11-08 17:51:17

- 柴犬在市場變化中等待下一步行動。本文探討了 SHIB 的彈性、潛在復蘇趨勢以及市場分析師的見解。

-

- 巴基斯坦的加密貨幣十字路口:平衡機會與資產支持的現實

- 2025-11-08 17:35:00

- 巴基斯坦在加密貨幣領域中游刃有餘,權衡監管障礙和網絡安全風險的潛在收益,並通過資產支持的解決方案提供了前進的道路。

-

- 穩定幣、貨幣政策和美聯儲:新的平衡法案?

- 2025-11-08 16:00:02

- 美聯儲官員斯蒂芬·米蘭強調穩定幣對貨幣政策的影響力越來越大,可能需要調整利率策略。

-

-

![圖表價格預測 [GRT 今日加密貨幣價格新聞] 圖表價格預測 [GRT 今日加密貨幣價格新聞]](/uploads/2025/11/07/cryptocurrencies-news/videos/690d4df44fe69_image_500_375.webp)