|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin rallied past the $110,500 level on Monday

Jun 12, 2025 at 02:49 am

The largest crypto is down nearly 2% as bullish momentum slowly fades. Interestingly, US crypto-linked stocks rose alongside Bitcoin and are currently consolidating

The price of Bitcoin (BTC) rallied past the $110,500 level on Monday. The largest crypto is down nearly 2% as bullish momentum slowly fades. Interestingly, US crypto-linked stocks rose alongside Bitcoin and are currently consolidating alongside the largest crypto.

Crypto stocks posted double-digit gains in the past month even as Bitcoin (BTC) yielded a modest increase of under 4%. In this deep dive we compare the performance of crypto stocks, Bitcoin and altcoins and examine the profitability of the sector in a traders’ portfolio.

US crypto stocks vs. Bitcoin performance

US crypto-linked mining stocks and stocks of major crypto firms wiped out some of their recent gains on Tuesday as Bitcoin tested a familiar resistance level and slipped closer to support.

The correlation between the S&P 500 and Bitcoin has recently dropped, which supports a thesis of equity investors choosing to gain exposure to crypto through stocks, instead of direct access to tokens that entails the risk of custody and security.

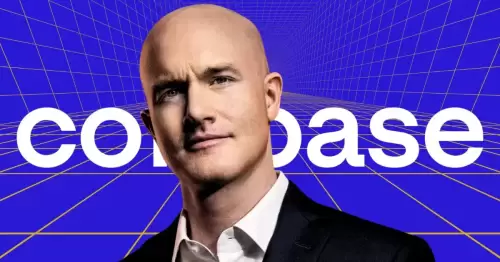

The decline in crypto stocks like CRCL, Coinbase (COIN), KULR Technology Group Inc. (KULR), and Robinhood Markets Inc. (HOOD) presents an opportunity for sidelined buyers to consider adding crypto stocks to their portfolio, and balance against their crypto token holdings this cycle.

If Bitcoin’s correlation with S&P 500 weakens further, it is likely that crypto stocks outperform BTC and altcoin holdings this cycle.

Nasdaq newcomer takes a hit this week

One of the largest stablecoin issuers observed a steep decline throughout the early trading hours on Tuesday after its peak on Monday.

After its stellar IPO on Nasdaq last week, CRCL wiped out nearly 8% on the day, down to $106.62. The stock erased its Monday days nearly entirely.

Core Scientific Inc. (CORZ), CleanSpark Inc. (CLSK), and MARA observed small changes in their price on Tuesday. CORZ is down 0.12%, CLSK is up 0.10%, and MARA gained 0.25% on the day.

Riot Platforms Inc. (RIOT) observed a small increase in price on Tuesday, up by 0.60%.

Bitcoin slipped closer to its support at $108,000 on the day, as crypto stocks continue their consolidation.

Bitcoin’s correlation to the S&P 500 has recently dropped, which supports a thesis of equity investors choosing to gain exposure to crypto through stocks, instead of direct access to tokens that entails the risk of custody and security.

The decline in crypto stocks like CRCL, Coinbase (COIN), KULR Technology Group Inc. (KULR), and Robinhood Markets Inc. (HOOD) presents an opportunity for sidelined buyers to consider adding crypto stocks to their portfolio, and balance against their crypto token holdings this cycle.

If Bitcoin’s correlation with S&P 500 weakens further, it is likely that crypto stocks outperform BTC and altcoin holdings this cycle.

Bitcoin price analysis

Bitcoin price is less than 2% away from its all-time high of $111,980. A re-test of the previous all-time high and a daily candlestick close above this level could push BTC into price discovery. The BTC/USDT price chart shows $122,172, the 127.2% Fibonacci retracement level of the rally from the April low of $74,500 to the all-time high could be the next target for Bitcoin.

Technical indicators, RSI and MACD support further gains in Bitcoin. RSI reads 62, above average but under the overvalued level at 70. MACD flashes green histogram bars above the neutral level, meaning that the underlying momentum in Bitcoin price trend is positive.

Bitcoin is 11% away from the 127.2% Fibonacci retracement level and BTC could find support at $106,488, the lower boundary of the FVG on the daily price chart.

Ruslan Lienkha, Chief of Markets at YouHodler told Crypto.news in a written note that there is a strong possibility that Bitcoin hits a new all-time high.

Lienkha said, “…As the price currently stands just a few percentage points below its previous peak. Broadly speaking, financial markets remain optimistic. The S&P 500, for example, is trading approximately 3% below its all-time high. However, the risk of a reversal remains, particularly if upcoming economic data disappoints.

All eyes are now on tomorrow’s U.S. inflation report. While markets are pricing in a moderate uptick, a higher-than-expected reading

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

-

-

-

- SEC Postpones Decision on VanEck Avalanche ETF, Seeks More Comments

- Jun 13, 2025 at 08:10 am

- The U.S. Securities and Exchange Commission has extended its review period for the proposed VanEck Avalanche ETF. This delay adds to a growing list of pending altcoin ETF applications under the agency's new leadership.