|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Is Finally Reclaiming Its Place As A Big Alternative

May 11, 2025 at 10:13 pm

It's late to the sell-USA party. But bitcoin is finally reclaiming its place as a big alternative for investors spooked by President Donald Trump's trade war and keen to

It's a bit late to the party. But bitcoin is finally reclaiming its place as a big alternative for investors who are spooked by President Donald Trump's trade war and keen to dump U.S. stocks, Treasuries and the dollar.

After an initial tumble to its lowest levels this year soon after Trump announced his Liberation Day tariffs on April 2, the notoriously volatile bitcoin has slowly clawed back ground.

It managed to outperform stock markets in 10 out of 17 sessions in that period, according to data from VanEck, which also tracks the performance of major asset classes.

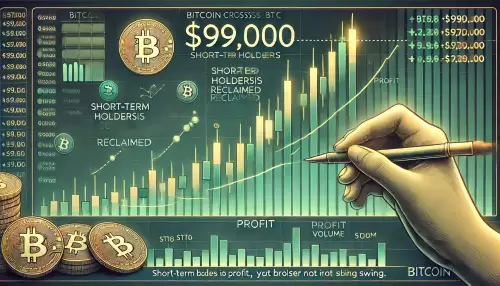

The world's top and original cryptocurrency is now a whisker away from the $10,000 mark last seen three months ago, after a 15% rise in April alone.

By comparison, the S&P 500 slipped around 0.8% in April, the tech-focused Nasdaq Composite eked out 0.8% gains last month, while the U.S. dollar index fell over 4%.

"The most recent price action may have begun to validate the view that Bitcoin is not just the 501st company in the SPX," analysts at research firm Block Scholes said.

Bitcoin is up 33% from its April low in a surprising turn for the cryptocurrency, given how closely it has mimicked the performance of equity markets in periods of market turmoil- particularly the tech sector - over the past few years.

But stellar returns from the cryptocurrency, and strong outperformance against other major asset classes, has seen investors rapidly funnel more money into digital asset-focused funds.

Roughly $5.5 billion has been plowed into such products over the last three weeks, according to data from CoinShares, which also tracks institutional flows into cryptocurrency products. Of that sum, $1.8 billion went into bitcoin products alone in the week to May 3.

Those flows pushed total inflows into digital asset-focused products to a record high in the first quarter, with investors pouring a net $6.4 billion into such funds.

That compares to outflows of $1.3 billion in the fourth quarter of 2019 and inflows of $4.2 billion in the third quarter of last year.

Relative performance aside, investors are also becoming more pessimistic on U.S. assets due to Trump's trade war and threat to cut taxes, while worries over a potential no-deal Brexit are also escalating.

Those worries have seen traders rapidly unwind bullish bets on the S&P 500 and dollar in recent weeks, while increasing bearish positions on the tech sector.

But bulk uprisings in bitcoin and other cryptocurrencies saw their bullish positions hit their highest since early 2018.

Correlations between bitcoin and other asset classes have also shifted, according to Block Scholes, and bitcoin is the most inversely correlated to the steepness of the Treasury yield curve in over two years."Investors are really starting to respond to (bitcoin) as a potential diversifier," said Ben McMillan, chief investment officer at IDX Advisors.

Bitcoin has also outperformed gold's 11% rise since April 2, despite the safe-haven metal surging to record highs on worries over the trade war and global growth. Measures of bitcoin's expected volatility have dropped to 18-month lows, as per Block Scholes.

"The damage has been done in terms of trust towards the U.S. and dollar assets ... but you can't (diversify) overnight," said Martin Leinweber, director of digital asset research & strategy at MarketVector Indexes.

"What kind of neutral assets do you have? Underlying that is really a supportive shift towards bitcoin and crypto."

Investors are becoming more bullish on bitcoin and other cryptocurrencies at a time when macro trends suggest a case for investing in "neutral" assets.

If changing tariff policies continue to drive a move away from U.S. assets, bitcoin could find its next leg higher, Geoff Kendrick, global head of digital asset research at Standard Chartered Bank said in a note to clients on Monday.

"We expect a strategic asset reallocation away from U.S. assets to trigger the next sharp up swing in Bitcoin in the coming months," Kendrick said, adding he sees bitcoin hitting a new record high of around $120,000 in the second quarter of 2025.

Still, it's far too early to say bitcoin has severed its ties with macroeconomic developments.

Bitcoin's 30-day correlation to the S&P 500 briefly dipped to 0.45 in early April but has crept back up to 0.87, according to LSEG data, where 1 indicates they are moving in lockstep.

And it still remains some ways away from its January record high.

"I think we'll inevitably see periods going forward

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- Two Large Bitcoin Transfers to Coinbase Spark Speculations of Increasing Bitcoin Sell-offs

- May 15, 2025 at 11:35 am

- On May 14, two large Bitcoin transfers to Coinbase, a leading U.S.-based crypto exchange, were identified during the latter hours of the day by blockchain tracking platform Whale Alert.

-

-

- Foreign money is pouring into president Donald Trump's meme coin, $TRUMP, and the list of buyers includes powerful governments

- May 15, 2025 at 11:30 am

- Billions are being pushed into this token by entities from China, Saudi Arabia, Qatar, and the UAE, just as Trump sits in the White House and his family runs the coin's business.

-

-