|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

随着数字资产政策制定者,领导者和影响者聚集在一起谈论比特币,区块链,法规,AI等,能源很高!

Today's Crypto for Advisor newsletter is coming to you from Consensus Toronto. The energy is high as digital asset policy makers, leaders and influencers gather to talk about bitcoin, blockchain, regulation, AI and so much more!

今天的顾问通讯的加密货币将从多伦多共识来找您。随着数字资产政策制定者,领导者和影响者聚集在一起谈论比特币,区块链,法规,AI等,能源很高!

Attending Consensus? Visit the CoinDesk booth, #2513. If you are interested in contributing to this newsletter, Kim Klemballa will be at the booth today, May 15, from 3-5 pm EST. You can also reply to this email directly.

达成共识?访问Coindesk Booth,#2513。如果您有兴趣向该新闻通讯做出贡献,Kim Klemballa将于5月15日美国东部时间下午3-5点在展位上。您也可以直接回复此电子邮件。

In today's Crypto for Advisors, Harvey Li from Tokenization Insights looks at stablecoins, where they came from and their growth.

在当今的顾问加密货币中,来自代币化见解的Harvey Li着眼于他们来自的Stablecoins和他们的成长。

Then, Trevor Koverko from Sapien answers questions about the status of stablecoin regulations and adoption and new regulations in Europe in Ask an Expert.

然后,来自Sapien的Trevor Koverko回答了有关欧洲欧洲的Stablecoin法规,采用和新法规的状况的问题。

Thank you to our sponsor of this week's newsletter, Grayscale. For financial advisors near Chicago, Grayscale is hosting an exclusive event, Crypto Connect, on Thursday, May 22. Learn more.

感谢我们对本周新闻通讯Grayscale的赞助商。对于芝加哥附近的财务顾问,Grayscale将于5月22日(星期四)举办一项独家活动,即Crypto Connect。了解更多信息。

– Sarah Morton

- 莎拉·莫顿(Sarah Morton)

Stablecoins - Past, Present and Future

Stablecoins-过去,现在和未来

When major financial institutions—from Citi and Standard Chartered to Brevan Howard, McKinsey and BCG—rally around a once-niche innovation, it’s a good idea to take note, especially when the innovation is stablecoins, a tokenized representation of money in the on-chain world.

当大型金融机构(从花旗和宪章租给布雷文·霍华德,麦肯锡和BCG)围绕曾经是个偏见的创新而努力时,最好注意的是,这是一个好主意,尤其是当创新是stablecoins,这是稳定的货币代表。

What email was to the internet, stablecoin is to blockchain—instant and cost-effective value transfer at a global scale running 24/7. Stablecoin is blockchain’s first killer use case.

互联网上的电子邮件是,Stablecoin是要进行区块链 - 以24/7的全球范围内的全球价值转移。 Stablecoin是区块链的第一个杀手用例。

A Brief History

简短的历史

First introduced by Tether in 2015 and hailed as the first stablecoin, USDT offered early crypto users a way to hold and transfer a stable, dollar-denominated value on-chain. Until then, their only alternative was bitcoin.

USDT首先是由Tether于2015年推出,并被称为第一个Stablecoin,为早期的加密用户提供了一种持有和转移稳定的美元计价的价值的方式。在此之前,他们唯一的选择是比特币。

Tether’s dollar-backed stablecoin made its debut on Bitfinex before rapidly spreading to major exchanges like Binance and OKX. It quickly became the default trading pair across the digital asset ecosystem.

Tether的美元支持的Stablecoin在Bitfinex上首次亮相,然后迅速传播到Binance和OKX等重大交易所。它很快成为数字资产生态系统中默认交易对。

As adoption grew, so did its utility. No longer just a trading instrument, stablecoin emerged as the primary cash-equivalent for trading, cash management and payments.

随着收养的增长,其效用也是如此。不再仅仅是一种交易工具,Stablecoin成为交易,现金管理和付款的主要现金当量。

Below is the trajectory of stablecoin’s market size since inception, a reflection of its evolution from a crypto niche to a core pillar of digital finance.

以下是自成立以来Stablecoin市场规模的轨迹,反映了其从加密莱基市场发展到数字金融核心支柱的发展。

Usage at Scale

大规模使用

The reason stablecoins have been a hot topic in finance is their rapid adoption and growth. According to Visa, stablecoin on-chain transaction volume exceeded $5.5 trillion in 2024. By comparison, Visa’s volume was $13.2 trillion while Mastercard transacted $9.7 trillion during the same period.

稳定的原因是金融上的热门话题是它们的迅速采用和增长。根据Visa的数据,Stablecoin在2024年的链交易量超过5.5万亿美元。相比之下,Visa的量为13.2万亿美元,而MasterCard在同一时期内交易9.7万亿美元。

Why such proliferation? Because stable dollar-denominated cash is the lifeline for the entire digital assets ecosystem. Here are 3 major use cases for stablecoin.

为什么这样的扩散?因为稳定的美元计价现金是整个数字资产生态系统的生命线。这是3个用于稳定的主要用例。

Major Use Cases

主要用例

1. Digital Assets Trading

1。数字资产交易

Given its origins, it’s no surprise that trading was stablecoin’s first major use case. What began as a niche tool for value preservation in 2015 is now the beating heart of digital asset trading. Today, stablecoins underpin over $30 trillion in annual trading volume across centralized exchanges, powering the vast majority of spot and derivatives activity.

鉴于其起源,交易是Stablecoin的第一个主要用例也就不足为奇了。最初从2015年作为维护价值保存的利基工具现在是数字资产交易的跳动之心。如今,Stablecoins支撑了超过300万亿美元的集中式交流的年度交易量,为绝大多数现货和衍生品活动提供了动力。

But stablecoin’s impact doesn’t end with centralized exchanges—It is also the liquidity backbone of decentralized finance (DeFi). Onchain traders need the same reliable cash equivalent for moving in and out of positions. A glance at leading decentralized platforms, such as Uniswap, PancakeSwap and Hyperliquid, shows that top trading pairs are consistently denominated by stablecoins.

但是Stablecoin的影响并没有以集中交流结束,这也是分散财务(DEFI)的流动性骨干。 Onchain交易者需要相同的可靠现金等价物来进出位置。一眼看领先的分散平台,例如uniswap,pancakeswap和超流油,表明顶级交易对始终被stablecoins划分。

Monthly decentralized exchange volumes routinely hit $100-200 billion, according to The Block, further cementing stablecoin’s role as the foundational layer of the modern digital assets market.

根据该街区的数据,每月分散的交换量通常达到100-200亿美元,这进一步巩固了Stablecoin作为现代数字资产市场的基础层的作用。

2. Real World Assets

2。现实世界资产

Real-world assets (RWAs) are tokenized versions of traditional instruments such as bonds and equities. Once a fringe idea, RWAs are now among the fastest-growing asset classes in crypto.

现实世界中的资产(RWAS)是传统工具的标记版,例如债券和股票。曾经是一个附带的想法,RWAS现在是加密货币中增长最快的资产类别之一。

Leading this wave is the tokenized U.S. Treasury market, now boasting over $6 billion AUM. Launched in early 2023, these on-chain Treasuries opened the door for crypto-native capital to access the low-risk, short-duration US T-Bills yield.

领先的这一浪潮是代币化的美国财政市场,现在拥有超过60亿美元的AUM。这些链上的国库于2023年初推出,为加密本地资本打开了大门,以获取低风险,短期的美国T-Bills收益率。

The adoption saw a staggering 6,000% growth according to RWA.xyz: from just $100 million in early 2023 to over $6 billion AUM today.

根据RWA.XYZ的数据,采用的增长惊人了6,000%:从2023年初的1亿美元到今天超过60亿美元的AUM。

Asset management heavyweights such as BlackRock, Franklin Templeton and Fidelity (pending SEC approval) are all creating on-chain treasury products for digital capital markets.

资产管理重量级人物,例如贝莱德,富兰克林·邓普顿(Franklin Templeton)和富达(Farklin Templeton)和富达(Farde)(即将批准),都为数字资本市场创造了链债券产品。

Unlike traditional Treasuries, these digital versions offer 24/7 instant mint/redemptions, and seamless composability with other DeFi yield opportunities. Investors can subscribe and redeem around the

与传统的国库不同,这些数字版本提供24/7即时的薄荷/赎回,以及与其他Defi屈服机会的无缝合成性。投资者可以订阅和兑换

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

-

-

-

- 您现在可以拥有$ 1的金币,庆祝美国最革命性的成就之一:NASA航天飞机计划

- 2025-05-16 04:40:13

- 正在进行的美国创新$ 1硬币系列中的最新变体可以通过美国造币厂订购。

-

- Coinbase因涉嫌参与社会工程攻击而解雇了客户支持代理商

- 2025-05-16 04:35:13

- 合同的代理商位于印度。根据5月15日的财富采访,Coinbase的首席安全官Philip Martin

-

- betmgm奖金代码WTOP150雷霆队NBA

- 2025-05-16 04:35:13

- 当您立即在注册时应用BetMGM奖金代码WTOP150时,就可以利用市场上最大的BET优惠之一。

-

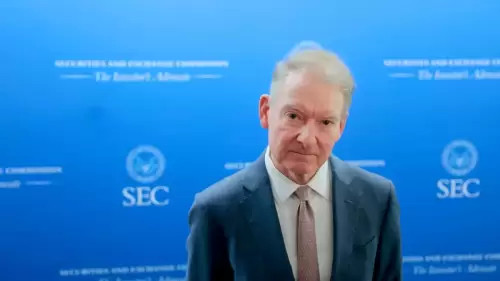

- SEC通过其用户计数指标调查了Coinbasecoin-3.06%)

- 2025-05-16 04:30:13

- 美国证券交易委员会正在调查Coinbasecoin-3.06%以前声称拥有超过1亿“经过验证的用户”