|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

卖卖派对很晚。但是比特币终于在唐纳德·特朗普(Donald Trump)的贸易战吓到的投资者中夺回了它的一席之地,并热衷于抛弃我们

It’s late to the sell-USA party. But bitcoin is finally reclaiming its place as a big alternative for investors spooked by President Donald Trump’s trade war and keen to dump US stocks, Treasuries and the dollar.

卖卖派对很晚。但是,比特币终于在唐纳德·特朗普(Donald Trump)总统的贸易战所吓到的投资者中夺回了其位置,并热衷于抛弃美国股票,国库和美元。

After an initial tumble to its lowest levels this year soon after Trump announced his Liberation Day tariffs on April 2, the notoriously volatile bitcoin has slowly clawed back ground. It managed to outperform stock markets in 10 out of 17 sessions in that period, VanEck data shows.

在特朗普在4月2日宣布解放日关税之后不久,今年不久的最低水平达到了最低水平后,臭名昭著的挥发性比特币逐渐逐渐向后倾斜。 Vaneck的数据显示,在此期间,它在17个会议中的10个会议中的10次表明,它设法超越了股票市场。

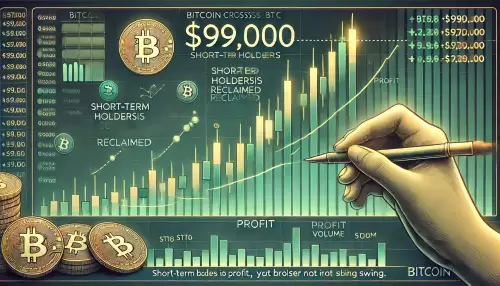

The world’s top and original cryptocurrency is now a whisker away from the $100,000 mark last seen three months ago, after a 15 per cent rise in April alone.

现在,三个月前在四月上升15%之后,世界上最高和原始的加密货币远离了最后一次看到的100,000美元大关的晶须。

By comparison, the S&P 500 (.SPX) slipped around 0.8 per cent in April, the tech-focused Nasdaq Composite (.IXIC) eked out 0.8 per cent gains last month, while the US dollar index fell over 4 per cent.

相比之下,标准普尔500指数(.spx)在4月下跌了0.8%,以技术为重点的纳斯达克综合(.ixic)上个月的收益率为0.8%,而美元指数下跌了4%。

“The most recent price action may have begun to validate the view that Bitcoin is not just the 501st company in the SPX,” analysts at research firm Block Scholes said.

研究公司Block Scholes的分析师说:“最近的价格行动可能已经开始验证比特币不仅是SPX中的第501家公司的观点。”

Bitcoin is up 33 per cent from its April low in a surprising turn for the cryptocurrency, given how closely it has mimicked the performance of equity markets in periods of market turmoil- particularly the tech sector – over the past few years.

鉴于过去几年,比特币在加密货币的惊人转折中比4月份的低点增长了33%。

But correlations between bitcoin and other asset classes have also shifted, according to Block Scholes, and bitcoin is the most inversely correlated to the steepness of the Treasury yield curve in over two years.

但是,根据Block Scholes的说法,比特币与其他资产类别之间的相关性也发生了变化,比特币与两年来财政收益率曲线的陡峭程度最重要。

“Investors are really starting to respond to (bitcoin) as a potential diversifier,” said Ben McMillan, chief investment officer at IDX Advisors.

IDX Advisors首席投资官Ben McMillan说:“投资者确实开始对(比特币)做出回应。”

Bitcoin has even outperformed gold’s 11 per cent rise since April 2, despite the safe-haven metal’s surge to record highs. Measures of bitcoin’s expected volatility have dropped to 18-month lows, as per Block Scholes.

自从4月2日以来,比特币的表现甚至超过了Gold的11%上涨,尽管安全的金属飙升可创下高潮。根据块学者,比特币预期波动率的量度已下降至18个月的低点。

“The damage has been done in terms of trust towards the US and dollar assets … but you can’t (diversify) overnight,” said Martin Leinweber, director of digital asset research & strategy at MarketVector Indexes.

MarketVector Indexes数字资产研究与战略总监Martin Leinweber说:“损害是根据对美国和美元资产的信任而造成的……但是您不能在一夜之间(多元化)。”

“What kind of neutral assets do you have? Underlying that is really a supportive shift towards bitcoin and crypto.”

“您拥有什么样的中性资产?这确实是向比特币和加密货币的支持。”

Investors have also turned more bullish on digital asset-focused investment products, with roughly $5.5 billion over the last three weeks flowing into those funds, as per CoinShares data, including $1.8 billion in the week through May 3 for bitcoin products.

根据Coinshares数据,投资者还对以数字资产为中心的投资产品更加看好,在过去的三周中,投资者约有55亿美元流入这些资金,其中包括一周至5月3日的比特币产品的18亿美元。

If changing tariff policies continue to drive a move away from US assets, bitcoin could find its next leg higher, Geoff Kendrick, global head of digital asset research at Standard Chartered Bank said in a note to clients.

标准特许银行数字资产研究负责人杰夫·肯德里克(Geoff Kendrick)在向客户的一份报告中说,如果不断变化的关税政策继续远离美国资产,则比特币可能会发现其下一个腿部更高的问题。

“We expect a strategic asset reallocation away from US assets to trigger the next sharp up swing in bitcoin in the coming months,” Kendrick said, adding he sees bitcoin hitting a new record high of around $120,000 in the second quarter of 2025.

肯德里克说:“我们预计,在未来几个月中,我们的资产将获得一项战略资产重新分配,以触发比特币的下一个急剧摇摆。”他补充说,他看到比特币在2025年第二季度的新创纪录大约为120,000美元。

TOO MUCH, TOO SOON

太早了

It’s far too early, however, to say bitcoin has severed its ties with macroeconomic developments.

但是,现在说比特币已经切断了与宏观经济发展的联系还为时过早。

Bitcoin’s 30-day correlation to the S&P 500 briefly dipped to 0.45 in early April but has crept back up to 0.87, as per LSEG data, where 1 indicates they are moving in close step.

比特币与标准普尔500指数的30天相关性在4月初短暂下降至0.45,但根据LSEG数据,逐回到0.87,其中1表示它们正在近距离移动。

And it still remains some ways from its January record high.

从一月份的纪录较高来看,这仍然是一些方法。

“I think we’ll inevitably see periods going forward where bitcoin’s correlation (to risk assets) rises again,” said IDX Advisors’ McMillan.

IDX Advisors的Mcmillan说:“我认为我们将不可避免地看到比特币的相关性(风险资产)再次上升的时期。”

“But the key point is, it is starting to take on trading characteristics of its own.”

“但是关键是,它开始具有自己的交易特征。”

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 比特币(BTC)成为第一个确保“宏观资产类”状态的新移民

- 2025-05-15 12:00:30

- 比特币(BTC)是最大的加密货币,已经确保了“宏观资产类别”的状态以及房地产,能源商品,债券,股票和贵金属。

-

-

- Pepe Coin Rally停滞不前:对投资者的影响

- 2025-05-15 11:55:13

- Pepe硬币价格失去了动力,原因有两个。首先,在经历强劲增长后,资产的价格暂停是很常见的。

-

- 乐观的本地代币的价格$ op在过去24小时内攀升了8%

- 2025-05-15 11:55:13

- 乐观的主网现在获得了4.563亿美元的总价值锁定,在过去的24小时内增长了1.74%。

-

- BETMGM奖金代码WTOP150有2个奖金

- 2025-05-15 11:50:12

- 纽约和明尼苏达州都有机会锁定今晚的会议决赛的泊位,因为每个球队在第二轮系列赛中以3-1上升。

-

- 勇敢的钱包通过增加对ADA的支持来扩大其视野

- 2025-05-15 11:50:12

- 输入:5月12日揭示的更新不仅提供了与勇敢的多链钱包的ADA令牌兼容性。它还向其他Cardano资产或令牌打开平台

-

- RWA令牌平台Rexas Finance(RXS)正在快速变化的区块链生态系统中浪潮

- 2025-05-15 11:45:13

- Rexas Finance(RXS)正在超越猜测的瞬息万变的区块链生态系统中的波纹。

-

-

- BTC的增长超过100,000美元之后,比特币牛市看起来又回来了。

- 2025-05-15 11:40:13

- 在BTC的拉力赛高于100,00美元之后,市场参与者正在积累更多的硬币,而比特币牛市正在玩游戏。