|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

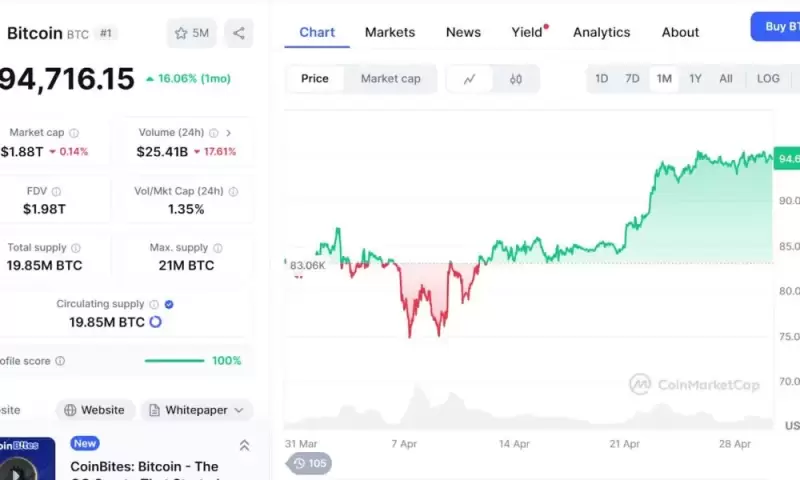

在一个令人失望的第一季度之后,世界上最大的加密货币卷土重来,从4月的低点开始飙升至95,000美元

Bitcoin (BTC) is quickly approaching the $95,000 mark, continuing its impressive recovery from April’s lows of $76,000. The world’s largest cryptocurrency has made a remarkable comeback, fueled in part by staggering institutional inflows into BTC ETFs.

比特币(BTC)迅速接近$ 95,000的大关,从4月份的76,000美元的低点开始,其令人印象深刻的恢复。世界上最大的加密货币引起了非凡的卷土重来,部分原因是使机构流入成为BTC ETF。

In the past week alone, a record-breaking $3.4 billion flowed into Bitcoin ETFs, closely trailing the all-time high of $3.9 billion set back in December, according to Standard Chartered Bank.

根据标准Chartered Bank的数据,仅在过去的一周中,创纪录的34亿美元就流向了比特币ETF,这在12月的历史最高点落后了39亿美元。

Among the major contributors are BlackRock’s IBIT fund, which raised nearly $1.5 billion, ARK’s Bitcoin ETF (ARKB) with around $620 million, and Fidelity’s FBTC fund, which added approximately $574 million.

在主要贡献者中,贝莱德的IBIT基金筹集了近15亿美元,ARK的比特币ETF(ARKB),约为6.2亿美元,而富达的FBTC基金则增加了约5.74亿美元。

However, Geoff Kendrick, a strategist at Standard Chartered, predicts that this capital will continue shifting from US assets and into Bitcoin throughout the second quarter.

但是,标准宪章的战略家杰夫·肯德里克(Geoff Kendrick)预测,这项资本将在第二季度继续从美国资产转移到比特币。

“While timing sharp rises in bitcoin is difficult, we think the current period of potential strategic asset reallocation away from US assets may trigger the next such upswing,” Kendrick recently told Business Insider.

肯德里克(Kendrick)最近告诉《商业内幕》(Business Insider):“虽然比特币的时机急剧上升是困难的,但我们认为目前潜在的战略资产重新分配远离美国资产的时期可能会触发下一个这样的上升。”

“If so, we would expect a new all-time high to be reached in Q2 with further gains over the summer.”

“如果是这样,我们预计在夏季,随着夏季的进一步增长,我们将在第二季度达到新的高位。”

This shift in capital follows a period of sluggish returns for US assets, driven partly by the ongoing trade disputes between the US and China, TechCrunch reports.

据TechCrunch报道,这一资本转变是美国资产回报率迟钝的一段时间,部分是由美国和中国之间持续的贸易纠纷驱动的。

The relationship between Bitcoin and gold prices has been a subject of interest. Once viewed as a ‘safe haven’ like gold, that characterization was tested several times as BTC often moved in sync with tech stocks rather than traditional hedges.

比特币与黄金价格之间的关系一直是感兴趣的主题。一旦被视为“避风港”之类的黄金,该表征经过多次测试,因为BTC经常与技术股票而不是传统的树篱同步。

But this latest market movement suggests a genuine decoupling is underway. As gold prices dropped from nearly $3,500 to $3,275 last week, and tech stocks continue to struggle amid Trump tariff turmoil, Bitcoin has continued its ascent, converging with the $94,000 level.

但是,这种最新的市场运动表明正在进行真正的脱钩。随着上周黄金价格从近3,500美元下降到3,275美元,在特朗普关税动荡的情况下,科技股继续挣扎,比特币继续上涨,汇聚了94,000美元的水平。

In fact, according to Standard Chartered’s analysis, capital has been flowing from gold ETFs directly into Bitcoin ETFs, indicating a preference for the world’s leading cryptocurrency.

实际上,根据标准宪章的分析,资本一直从金ETF直接流入比特币ETF中,表明偏爱世界领先的加密货币。

Discussing this trend with TradingView, James Butterfill, head of research at CoinShares, said: “While equities are weighed down by tariffs and declining corporate earnings prospects, bitcoin remains unaffected and has actually benefited from investors seeking alternative safe-haven assets.”

Coinshares研究负责人詹姆斯·巴特菲尔(James Butterfill)在讨论这一趋势时说:“虽然股票受到关税和公司收益前景下降的压力,但比特币仍然不受影响,实际上已经从寻求替代安全保护资产的投资者中受益。”

Other institutional players are also doubling down on their Bitcoin bets. For example, Strategy (formerly MicroStrategy) just announced its latest purchase of 15,355 BTC for a staggering $1.42 billion.

其他机构参与者也在比特币赌注中加倍。例如,策略(以前是MicroStrategy)刚刚宣布了最新购买15,355 BTC的14.2亿美元。

This brings their total Bitcoin holdings to over 553,000 BTC, valued at more than $50 billion at current prices.

这使他们的总比特币持有量超过553,000 BTC,价值超过500亿美元。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- FIFA推出了自己的区块链,将阿尔戈兰德留在后面进入元链

- 2025-05-01 22:35:16

- 忘记简单的通行证和滑动铲球:FIFA刚刚进入了元视频。

-

- 模因硬币市场仍在继续指出,即使更广泛的市场保持镇定

- 2025-05-01 22:35:15

- 标题:Neet,Fartcoin(Fartcoin),Dogwifhat(Wif)是观看的模因硬币

-

- 新数据显示,Solana(Sol)ETF批准概率达到90%

- 2025-05-01 22:30:13

- 根据彭博情报局的说法,美国监管机构批准Solana ETF(交易所交易基金)的可能性现在高达90%。

-

-

- Tezos成功激活了Rio升级,增强了固定灵活性和第2层可伸缩性

- 2025-05-01 22:25:12

- 该升级是通过网络的链政治过程批准的,并参与了验证者和社区成员

-

-

- XRP网络看到“热门”的强劲跳跃

- 2025-05-01 22:20:12

- 这是这种增长与比特币和其他主要加密货币进行比较的方式。

-

- 当唐纳德·特朗普总统本周在任期第二任期的100天大关时,他的批准人数低于此时的任何政府

- 2025-05-01 22:20:12

- 不要告诉加密货币社区。特朗普竞选公职,承诺使美国成为“世界的加密之都”。

-