|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin (BTC) Price Prediction: Targeting $120,000 This Quarter, $200,000 by Year-End

May 01, 2025 at 05:43 pm

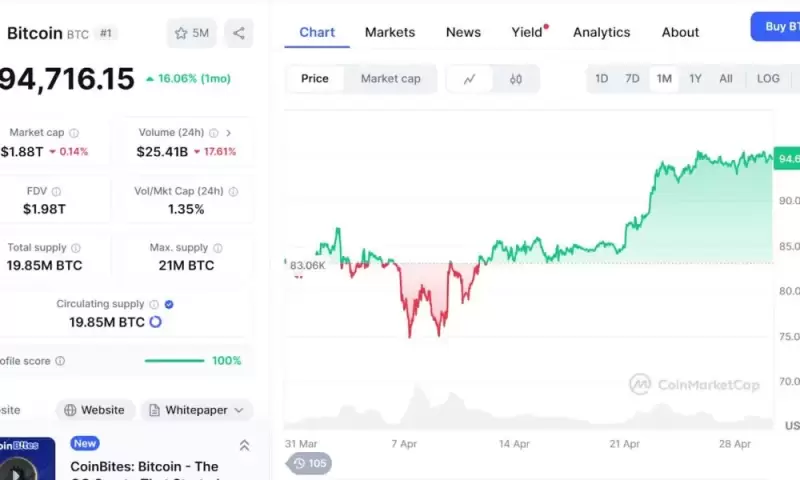

After a disappointing first quarter, the world's largest cryptocurrency has made a remarkable comeback, surging from its April lows of $76,000 to touching $95,000

Bitcoin (BTC) is quickly approaching the $95,000 mark, continuing its impressive recovery from April’s lows of $76,000. The world’s largest cryptocurrency has made a remarkable comeback, fueled in part by staggering institutional inflows into BTC ETFs.

In the past week alone, a record-breaking $3.4 billion flowed into Bitcoin ETFs, closely trailing the all-time high of $3.9 billion set back in December, according to Standard Chartered Bank.

Among the major contributors are BlackRock’s IBIT fund, which raised nearly $1.5 billion, ARK’s Bitcoin ETF (ARKB) with around $620 million, and Fidelity’s FBTC fund, which added approximately $574 million.

However, Geoff Kendrick, a strategist at Standard Chartered, predicts that this capital will continue shifting from US assets and into Bitcoin throughout the second quarter.

“While timing sharp rises in bitcoin is difficult, we think the current period of potential strategic asset reallocation away from US assets may trigger the next such upswing,” Kendrick recently told Business Insider.

“If so, we would expect a new all-time high to be reached in Q2 with further gains over the summer.”

This shift in capital follows a period of sluggish returns for US assets, driven partly by the ongoing trade disputes between the US and China, TechCrunch reports.

The relationship between Bitcoin and gold prices has been a subject of interest. Once viewed as a ‘safe haven’ like gold, that characterization was tested several times as BTC often moved in sync with tech stocks rather than traditional hedges.

But this latest market movement suggests a genuine decoupling is underway. As gold prices dropped from nearly $3,500 to $3,275 last week, and tech stocks continue to struggle amid Trump tariff turmoil, Bitcoin has continued its ascent, converging with the $94,000 level.

In fact, according to Standard Chartered’s analysis, capital has been flowing from gold ETFs directly into Bitcoin ETFs, indicating a preference for the world’s leading cryptocurrency.

Discussing this trend with TradingView, James Butterfill, head of research at CoinShares, said: “While equities are weighed down by tariffs and declining corporate earnings prospects, bitcoin remains unaffected and has actually benefited from investors seeking alternative safe-haven assets.”

Other institutional players are also doubling down on their Bitcoin bets. For example, Strategy (formerly MicroStrategy) just announced its latest purchase of 15,355 BTC for a staggering $1.42 billion.

This brings their total Bitcoin holdings to over 553,000 BTC, valued at more than $50 billion at current prices.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

- As President Donald Trump hit the 100-day mark this week for his second term in office, his approval numbers were lower than for any administration at this point

- May 01, 2025 at 10:20 pm

- Don't tell that to the crypto community. Trump ran for office on a promise to make America "the crypto capital of the world."

-

- On-chain data shows the XRP network has seen a strong jump in 'Hot Capital' recently. Here's how this growth compares with Bitcoin and others.

- May 01, 2025 at 10:15 pm

- In a new post on X, the on-chain analytics firm Glassnode has talked about how the Hot Capital of XRP has changed recently. The “Hot Capital”

-

-