|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

XRP作為新的地址創建隕石坑的逆風而面對逆風,儘管對Ripple-SEC案例解決方案樂觀,但仍表示潛在的看跌趨勢。

XRP's Rocky Road: New Addresses Plummet Amid Bearish Metrics

XRP的岩石路:新地址在看跌指標的情況下下降

XRP's journey has been anything but smooth lately. Amidst the buzz around the Ripple-SEC case potentially wrapping up, a concerning trend has emerged: a sharp decline in new network addresses. This, coupled with other bearish metrics, paints a complicated picture for XRP's immediate future.

最近,XRP的旅程過得很順利。在可能總結的Ripple-SEC案件周圍的嗡嗡聲中,有關趨勢的出現:新網絡地址的急劇下降。加上其他看跌指標,為XRP的不久的將來畫了一幅複雜的圖片。

New Wallets, Old Problems

新錢包,舊問題

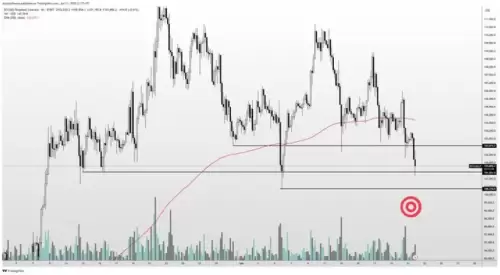

Coin Bureau recently highlighted a troubling trend: the number of new wallets being created on the XRP Ledger has plummeted. Back in January, we were seeing over 30,000 new addresses daily. Now? We're scraping the bottom at below 5,000. That's a serious drop. And as Glassnode's data points out, there's a pretty tight correlation between price action and network growth. Remember that parabolic move in late 2024 that took XRP to $2.71? That was fueled by a surge in new users. Now that the new user excitement has waned, so has the price.

硬幣局最近強調了一個令人不安的趨勢:XRP分類帳中創建的新錢包數量已暴跌。早在一月份,我們每天看到超過30,000個新地址。現在?我們在5,000以下的底部刮擦底部。那是一個嚴重的下降。正如GlassNode的數據指出的那樣,價格動作與網絡增長之間存在相當密切的相關性。還記得2024年末的拋物線措施,XRP達到了2.71美元嗎?這是由於新用戶的激增所推動的。現在,新的用戶興奮已經下降,價格也有所下降。

Active Addresses in the Doldrums

低迷中的主動地址

It's not just new wallets; daily active addresses have also taken a nosedive. We're talking a drop from 557,000 to a mere 34,000. Ouch. This suggests a serious lack of retail investor interest in the XRP ecosystem. One analyst even thinks that XRP might struggle to hit that crucial $3 resistance zone due to insufficient market demand.

這不僅僅是新錢包;每日活躍的地址也是一個鼻子。我們說的是從557,000下降到僅34,000。哎喲。這表明對XRP生態系統缺乏散戶投資者的興趣。一位分析師甚至認為,由於市場需求不足,XRP可能會努力達到至關重要的3美元阻力區。

A Grain of Salt?

一粒鹽?

Now, not everyone's hitting the panic button. Some analysts, like MoonLambo, argue that the previous highs in network activity were simply a result of market greed following the US general elections. According to this view, the current decline is just a natural correction, nothing to get too worked up about.

現在,並不是每個人都按下恐慌按鈕。像Moonlambo這樣的一些分析師認為,以前的網絡活動高點僅僅是美國大選之後市場貪婪的結果。根據這種觀點,目前的下降只是一種自然的糾正,沒有什麼可實現的。

The Ripple-SEC Wildcard

漣漪 - 塞克通配符

Of course, we can't talk about XRP without mentioning the elephant in the room: the Ripple-SEC case. The joint petition to Judge Torres to lift the injunction on XRP sales and reduce fines is a big deal. It could pave the way for broader market participation and set a precedent for crypto regulation in the US. A settlement could also significantly impact the prospects of a US XRP-spot ETF, currently favored by Polymarket odds at 88%.

當然,我們不能在房間裡提及大象的情況下談論XRP:Ripple-Sec案。托雷斯法官提出的聯合請願書取消對XRP銷售並減少罰款的禁令是很大的。它可以為更廣泛的市場參與鋪平道路,並為美國加密監管樹立先例。解決方案還可能會嚴重影響美國XRP賽車ETF的前景,目前由Polymarket賠率佔88%。

XRP Price Check

XRP價格檢查

As of today, XRP is hovering around $2.13, reflecting a slight dip. Trading volume is up, but investor sentiment remains largely bearish. CoinCodex predicts short-term consolidation but forecasts a bullish revival in the long term.

截至今天,XRP徘徊在2.13美元左右,反映出輕微的下降。交易量增加,但投資者的情緒在很大程度上仍然是看跌。 Concodex預測短期合併,但從長遠來看,預測看漲的複興。

My Two Satoshis

我的兩個satoshis

Okay, here's my take. While the Ripple-SEC case resolution is undoubtedly a positive catalyst, these on-chain metrics can't be ignored. The drop in new and active addresses is a real concern, suggesting waning interest. The case for XRP hinges on its utility for cross-border payments, and if people aren't actively using the network, that utility is undermined. While some argue the previous surge was an anomaly, you have to wonder what will drive the next surge.

好吧,這是我的看法。雖然Ripple-SEC的案例解決無疑是積極的催化劑,但這些鏈度指標卻不能忽略。新的活躍地址的下降是一個真正的問題,這表明興趣減弱。 XRP的案例取決於其跨境支付的效用,如果人們不積極使用網絡,則該公用事業將受到破壞。雖然有些人認為以前的激增是異常的,但您必須想知道什麼會推動下一次激增。

Looking Ahead

展望未來

So, what's the takeaway? XRP is at a crossroads. The resolution of the Ripple-SEC case is a major potential tailwind, but the bearish on-chain metrics are a definite headwind. It's a situation ripe with uncertainty, and caution is advised. Whether it's the best crypto to buy now or not is a bit of a coin flip!

那麼,收穫是什麼? XRP處於十字路口。 Ripple-SEC案例的分辨率是主要的潛在逆風,但看跌的鏈指標是明確的逆風。這種情況已經不確定性成熟,並建議您謹慎。現在購買是否最好的加密貨幣是硬幣翻轉!

In the meantime, keep an eye on those new address numbers, folks. If they start ticking upwards, that'll be a good sign. Until then, buckle up—it could be a bumpy ride!

同時,請密切關注這些新的地址號碼,伙計們。如果他們開始向上打勾,那將是一個好兆頭。在此之前,搭扣,這可能是一個顛簸的旅程!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- CoinMarketCap安全漏洞:喚醒加密錢包安全的呼籲

- 2025-06-22 14:25:13

- CoinMarketCap面臨最近的安全漏洞,涉及惡意錢包彈出窗口,突出了加密貨幣空間中不斷存在的危險。

-

- 加密貨幣市場跌落:比特幣傾角和清算戰爭

- 2025-06-22 14:25:13

- 地緣政治緊張局勢和大規模清算引發了加密貨幣市場的低迷。這是暫時的傾角還是更大的東西的開始?

-

- 比特幣在印度的經濟戰略中的潛在作用:一個新時代?

- 2025-06-22 14:45:12

- 探索印度比特幣和加密ETF的潛力,與韓國對數字資產和穩定的創新方法相似。

-

- Dogecoin,Meerkat和Telegram:新的模因硬幣生態系統?

- 2025-06-22 14:45:12

- 當Meerkat在電報中創新時,Dogecoin面臨挑戰。這是模因硬幣的未來嗎?

-

- 比特幣價格火箭:新的歷史高昂和預測330,000美元的市場激增

- 2025-06-22 14:50:12

- 比特幣襲擊了機構利益的新高。分析師預測,在這個動蕩的市場中,建議謹慎行事,但謹慎行事。

-

-

-

- Fusaka在地平線上:以太坊的下一章和加密人馬的狂野騎行

- 2025-06-22 14:35:12

- 以太坊的fusaka更新有望提高可擴展性,但是地緣政治搖擺不定和模因硬幣躁狂症為加密景觀增添了複雜性。

-

- 特朗普,伊朗和比特幣崩潰?這是怎麼回事?

- 2025-06-22 14:35:12

- 特朗普在伊朗的行動通過加密貨幣市場造成了衝擊波,導致比特幣崩潰。這是即將到來的跡象嗎?