|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

XRP's Rocky Road: New Addresses Plummet Amid Bearish Metrics

Jun 22, 2025 at 07:00 am

XRP faces headwinds as new address creation craters, signaling potential bearish trends despite optimism surrounding the Ripple-SEC case resolution.

XRP's Rocky Road: New Addresses Plummet Amid Bearish Metrics

XRP's journey has been anything but smooth lately. Amidst the buzz around the Ripple-SEC case potentially wrapping up, a concerning trend has emerged: a sharp decline in new network addresses. This, coupled with other bearish metrics, paints a complicated picture for XRP's immediate future.

New Wallets, Old Problems

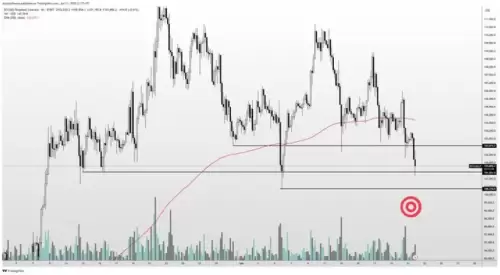

Coin Bureau recently highlighted a troubling trend: the number of new wallets being created on the XRP Ledger has plummeted. Back in January, we were seeing over 30,000 new addresses daily. Now? We're scraping the bottom at below 5,000. That's a serious drop. And as Glassnode's data points out, there's a pretty tight correlation between price action and network growth. Remember that parabolic move in late 2024 that took XRP to $2.71? That was fueled by a surge in new users. Now that the new user excitement has waned, so has the price.

Active Addresses in the Doldrums

It's not just new wallets; daily active addresses have also taken a nosedive. We're talking a drop from 557,000 to a mere 34,000. Ouch. This suggests a serious lack of retail investor interest in the XRP ecosystem. One analyst even thinks that XRP might struggle to hit that crucial $3 resistance zone due to insufficient market demand.

A Grain of Salt?

Now, not everyone's hitting the panic button. Some analysts, like MoonLambo, argue that the previous highs in network activity were simply a result of market greed following the US general elections. According to this view, the current decline is just a natural correction, nothing to get too worked up about.

The Ripple-SEC Wildcard

Of course, we can't talk about XRP without mentioning the elephant in the room: the Ripple-SEC case. The joint petition to Judge Torres to lift the injunction on XRP sales and reduce fines is a big deal. It could pave the way for broader market participation and set a precedent for crypto regulation in the US. A settlement could also significantly impact the prospects of a US XRP-spot ETF, currently favored by Polymarket odds at 88%.

XRP Price Check

As of today, XRP is hovering around $2.13, reflecting a slight dip. Trading volume is up, but investor sentiment remains largely bearish. CoinCodex predicts short-term consolidation but forecasts a bullish revival in the long term.

My Two Satoshis

Okay, here's my take. While the Ripple-SEC case resolution is undoubtedly a positive catalyst, these on-chain metrics can't be ignored. The drop in new and active addresses is a real concern, suggesting waning interest. The case for XRP hinges on its utility for cross-border payments, and if people aren't actively using the network, that utility is undermined. While some argue the previous surge was an anomaly, you have to wonder what will drive the next surge.

Looking Ahead

So, what's the takeaway? XRP is at a crossroads. The resolution of the Ripple-SEC case is a major potential tailwind, but the bearish on-chain metrics are a definite headwind. It's a situation ripe with uncertainty, and caution is advised. Whether it's the best crypto to buy now or not is a bit of a coin flip!

In the meantime, keep an eye on those new address numbers, folks. If they start ticking upwards, that'll be a good sign. Until then, buckle up—it could be a bumpy ride!

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.