|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMX不變的實用程序令牌在過去24小時內飆升15%

Immutable’s utility token, IMX, has surged by 15% over the last 24 hours, showcasing one of the strongest performances in the altcoin market. At the time of writing, IMX is trading at around $0.64, having risen from the recent lows of $0.55.

在過去的24小時內,不變的公用事業令牌IMX飆升了15%,展示了Altcoin市場上最強的表現之一。在撰寫本文時,IMX的交易價格約為0.64美元,與最近的低價0.55美元相比。

This rally is being driven by renewed bullish momentum, which is fueled by improving technicals and solid on-chain metrics. As the token continues to move upward, traders are now keeping an eye on whether IMX can maintain this trajectory and challenge the psychological resistance at $0.70.

這次集會是由新的看漲勢頭驅動的,這是由於改善技術和穩定的鏈界指標所推動的。隨著令牌繼續向上移動,交易者現在一直在關注IMX是否可以維持這一軌跡並挑戰心理阻力為0.70美元。

One key signal that supports this optimistic sentiment is the rise in IMX’s long/short ratio. This metric, which tracks how many traders are betting on a price increase versus a decrease, has pushed above the neutral line to stand slightly over 1.0. When this ratio tips above one, it typically indicates that more traders are opening long positions, which in the current context, suggests increased confidence in a continued upward move and is a common indicator of a market bottom.

支持這種樂觀情緒的一個關鍵信號是IMX的長/短比率上升。該度量標準跟踪了多少交易者在價格上漲上賭注而不是下降,它已將中性線上推高以略高於1.0。當該比率提示以上一個時,通常表明越來越多的交易者正在開放長位置,在當前情況下,這表明對持續向上移動的信心增加了,這是市場底層的常見指標。

Another positive factor is the divergence in IMX’s price action compared to its Daily Active Addresses (DAA). The token is showing a strong positive DAA divergence of over 63%, which implies that network activity is growing in tandem with price increases. This is a healthy sign in crypto markets because it means user adoption is backing the price action, rather than speculative volume alone. As more users engage with the network, the fundamentals appear to be strengthening, increasing the probability of sustained price appreciation.

另一個積極因素是與日常活動地址(DAA)相比,IMX的價格行動的分歧。令牌顯示出強大的正DAA差異超過63%,這意味著網絡活動隨著價格上漲而增長。這是加密市場中的一個健康標誌,因為這意味著用戶的採用是支持價格動作,而不是僅僅投機量。隨著越來越多的用戶與網絡互動,基本面似乎正在加強,從而增加了持續價格升值的可能性。

Looking at the technical indicators, on the daily chart, the Moving Average Convergence Divergence (MACD) indicator suggests that buying momentum is building. The MACD line is currently positioned above both the signal line and the neutral zero line, confirming an ongoing bullish trend. This crossover is widely interpreted as a buy signal, hinting that IMX could sustain its upward drive in the short term. If momentum holds, the token could break past the near-term resistance at $0.73 and move toward the next target at $0.79.

查看每日圖表上的技術指標,移動平均收斂差異(MACD)指標表明購買動量正在建立。 MACD線目前位於信號線和中性零線的上方,證實了持續的看漲趨勢。這種跨界被廣泛解釋為買入信號,暗示IMX可以在短期內維持其向上的驅動器。如果動量保持,令牌可能會以0.73美元的價格超越近期阻力,並以0.79美元的價格朝下一個目標轉移。

While the optimism is high, it’s crucial to remain aware of the potential downside risks. Market volatility is a constant factor in the crypto space, and any significant shift in sentiment could reverse the current trend. If bearish pressure returns and buyers fail to hold the current support, IMX could retreat toward $0.55. However, the present structure of higher lows and increasing volume suggests that buyers still have the upper hand.

儘管樂觀態度很高,但要了解潛在的下行風險至關重要。市場波動是加密貨幣領域的恆定因素,情感上的任何重大轉變都可以扭轉當前趨勢。如果看跌壓力回報,買家無法持有當前的支持,IMX可能會撤退到0.55美元。但是,較高的低點和增加體積的當前結構表明,買家仍然具有上風。

The broader market conditions also play a role in IMX’s outlook. As investor appetite for altcoins grows, projects with strong utility and user engagement like Immutable X are likely to benefit. The current environment, combined with the rising on-chain activity and a favorable technical setup, provides a solid foundation for continued bullish performance.

更廣泛的市場條件在IMX的前景中也起著作用。隨著投資者對AltCoins的需求,具有強大實用性和用戶參與(如不變X)的項目可能會受益。當前的環境,結合了鏈上活動的上升和有利的技術設置,為持續看漲的表現奠定了堅實的基礎。

In summary, Immutable’s IMX token appears well-positioned for further gains following its impressive 15% daily rally. The alignment of bullish trading sentiment, user activity and strong technical indicators increases the likelihood of a continued breakout. If the token successfully clears resistance in the $0.70-$0.73 zone, the next stop could be closer to $0.79, offering a compelling opportunity for short-term traders and long-term holders alike.

總而言之,在每天令人印象深刻的15%的集會後,不變的IMX令牌似乎有良好的位置。看漲貿易情緒,用戶活動和強大的技術指標的一致性增加了持續突破的可能性。如果代幣成功地在0.70美元至0.73美元的區域中成功清除了阻力,那麼下一站可能接近0.79美元,為短期交易者和長期持有人提供了令人信服的機會。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- 當比特幣攀登和Pepeto準備發射時,市場情緒變為正面

- 2025-05-03 23:05:13

- 加密市場的情緒表現出明顯的樂觀跡象,因為恐懼和貪婪指數的變化更高,這表明投資者信心正在增長。

-

-

- 在Crypto Twitter上找到下一個大加密的最終指南

- 2025-05-03 23:00:12

- 在加密貨幣的超級快速世界中,在其他所有人加入船上之前找到下一個大事是許多投資者的最終目標。

-

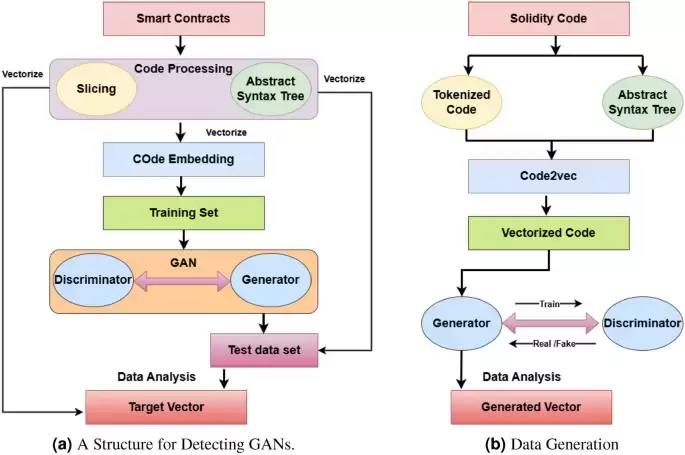

- 用於檢測智能合約中整數溢出漏洞的生成對抗網絡

- 2025-05-03 22:55:13

- 由於快速區塊鏈技術開發,銀行,醫療保健,保險和物聯網已採用了智能合約(SC)

-

-

-

-

- 比特幣可能正在進入自2020年以來最看漲的階段 - 這就是為什麼

- 2025-05-03 22:45:13

- 根據天鵝的市場見解,當前的環境可能是自2020年以來比特幣最看漲的設置。