|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

美聯儲委員會在周四採取了重大行動,以簡化與加密貨幣和數字美元令牌互動的銀行規則

The Federal Reserve Board has made a significant move to simplify rules for banks engaging with cryptocurrencies and digital dollar tokens, aiming to foster innovation while keeping risks in mind, a decision that will shape how banks interact with these emerging technologies.

美聯儲委員會採取了重大行動,簡化了與加密貨幣和數字美元代幣交往的銀行的規則,旨在促進創新的同時牢記風險,這一決定將影響銀行與這些新興技術的互動方式。

To understand this, cryptocurrencies like Bitcoin or XRP are digital forms of money that operate on secure, decentralized technology, and dollar tokens are digital versions of the U.S. dollar, usually backed by assets to maintain a stable value.

為了理解這一點,像比特幣或XRP這樣的加密貨幣是在安全,分散的技術和美元代幣上運行的數字貨幣形式,是美元的數字版本,通常由資產支持以保持穩定的價值。

Last year, the Federal Reserve required banks under its oversight to notify it in advance if they planned to engage with cryptocurrencies, allowing the Fed to review potential risks like fraud or instability. However, this requirement has now been eliminated, permitting banks to handle crypto activities without prior notification. Instead, the Fed will monitor these activities during routine bank examinations, treating them like other banking operations.

去年,美聯儲要求其監督銀行,如果他們計劃與加密貨幣互動,則將其提前通知,並允許美聯儲審查諸如欺詐或不穩定之類的潛在風險。但是,現在已經取消了這一要求,允許銀行在沒有事先通知的情況下處理加密活動。取而代之的是,美聯儲將在常規銀行考試期間監視這些活動,並像對待其他銀行業務一樣對待它們。

Moreover, the Federal Reserve has scrapped a rule that was set to come into effect this year requiring banks to get a formal “nonobjection” approval before engaging in dollar token activities, such as issuing or managing digital dollars on blockchain networks. This change removes a layer of bureaucracy, making it easier for banks to explore technologies for tokenized payments, stablecoins, or other services.

此外,美聯儲已經取消了一項規則,該規則將在今年生效,要求銀行在進行美元代幣活動之前獲得正式的“非反應”批准,例如在區塊鍊網絡上發行或管理數字美元。這種變化消除了一層官僚主義,使銀行更容易探索用於代幣化的付款,Stablecoins或其他服務的技術。

The Federal Reserve, together with the Federal Deposit Insurance Corporation, is also aligning with the Office of the Comptroller of the Currency to withdraw two joint statements that had set the stage for a cautious approach to crypto.

美聯儲與聯邦存款保險公司一起,也與貨幣審計長辦公室保持一致,以撤回兩個聯合聲明,這為謹慎的加密方法奠定了基礎。

Earlier this year, the three agencies had released statements setting strict guidelines for banks’ crypto activities and risk exposures, a move that came after several U.S. banks began offering crypto services. These statements had set a cautious tone, emphasizing the need for banks to manage risks carefully and stay within the agencies’ limited approval for crypto activities.

今年早些時候,這三個機構發布了對銀行加密活動和風險曝光的嚴格指南的聲明,此舉是在美國幾家銀行開始提供加密服務後採取的。這些陳述定義了謹慎的基調,強調了銀行需要仔細管理風險並留在該機構對加密活動的有限批准中。

But with this step back, the agencies are signaling a more flexible approach, planning to collaborate on new guidance to support safe innovation in the rapidly evolving crypto space.

但是,隨著這一退後一步,這些代理機構標誌著一種更靈活的方法,計劃在新的指導下進行合作,以支持快速發展的加密貨幣空間中的安全創新。

This shift comes as the Federal Reserve has observed that the crypto landscape is changing rapidly, with banks showing increasing interest in offering services like crypto custody or tokenized dollar transactions.

這種轉變是因為美聯儲觀察到加密貨幣景觀正在迅速變化,銀行對提供加密貨幣或令牌美元交易等服務的興趣越來越大。

In response, the central bank is aiming to streamline oversight, encouraging banks to innovate in crypto while ensuring risks are managed through standard supervision. This balances the potential of digital assets to transform finance with the need for stability in the banking system.

作為回應,中央銀行的目標是簡化監督,鼓勵銀行在加密貨幣中進行創新,同時通過標準監督來確保風險得到管理。這可以平衡數字資產轉化金融的潛力與銀行系統中穩定的需求。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 比特幣的售價超過$ 90K,以太坊和山寨幣現很出色的收益

- 2025-04-25 17:55:13

- 全球加密貨幣市場繼續反映出看漲的情緒,比特幣保持穩定的立場高於93,000美元。

-

- 分析師說

- 2025-04-25 17:55:13

- 一位廣泛關注的加密分析師說,比特幣(BTC)可能在看跌逆轉之前向上行進程。

-

-

- SUI區塊鏈的本地令牌SUI本週飆升了62%以上

- 2025-04-25 17:50:13

- SUI區塊鏈的原住民令牌SUI本週飆升了62%以上,這是由於猜測與Pokémon的潛在合作所推動。

-

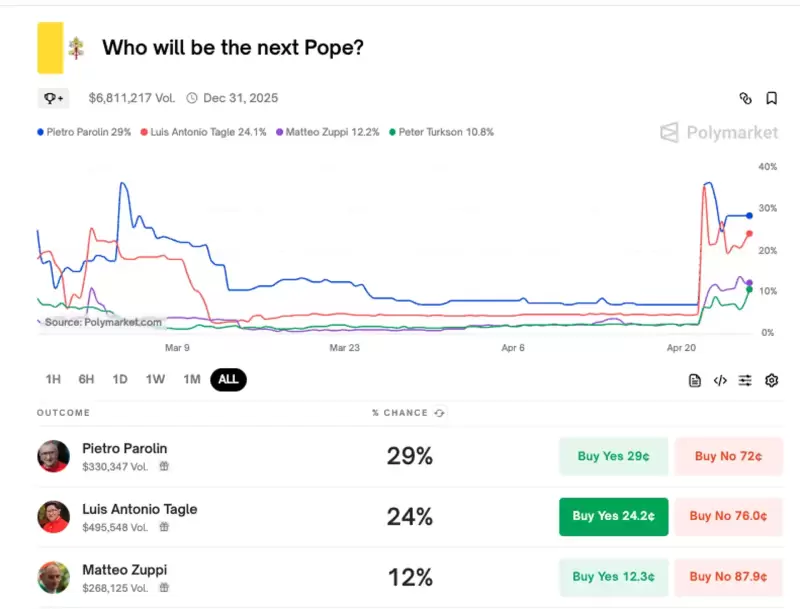

- 多聚市場捕獲

- 2025-04-25 17:45:13

- 由於預計將在下個月舉行的“結論”(教皇選舉秘密會議)選舉下一屆教皇時,圍繞教皇候選人主題的Meme Coins引起了人們的關注。

-

-

-

- DraftKings支付1000萬美元以解決NFT證券集體訴訟

- 2025-04-25 17:40:13

- 流行的體育博彩和幻想體育公司Draftkings已同意達成1000萬美元的和解,以解決集體訴訟

-