|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索DYPIAN,DEFI和SEI網絡不斷發展的景觀,發現關鍵趨勢,見解以及最新的發展,塑造了區塊鏈技術的未來。

Dypians, DeFi, and Sei Network: A Deep Dive into the Latest Trends

DYPIAN,DEFI和SEI網絡:深入了解最新趨勢

The world of Dypians, DeFi, and Sei Network is buzzing with activity. From groundbreaking stablecoin integrations to dominating the Web3 gaming scene, let's break down the latest happenings.

DYPIAN,DEFI和SEI網絡的世界充滿了活動。從開創性的Stablecoin集成到主導Web3遊戲場景,讓我們分解最新的事件。

Sei Network's Rise: A Wyoming Stablecoin Pilot and DeFi Growth

SEI網絡的崛起:懷俄明州的Stablecoin飛行員和Defi增長

Sei Network has been making waves, particularly with its selection as one of the pilot blockchains for Wyoming's Stable Token (WYST). This is a big deal, marking a significant step in the adoption of fiat-backed, state-issued stablecoins in the US. Sei beat out some serious competition, showcasing its uptime, security, user base, and infrastructure performance. The integration of LayerZero tech for cross-chain messaging further solidifies Sei's position.

SEI網絡一直在引起浪潮,尤其是它作為懷俄明州穩定令牌(WYST)的飛行員區塊鏈之一的選擇。這很重要,這標誌著在美國採用菲亞特支持的,由國家簽發的穩定股份的重要一步。 SEI擊敗了一些激烈的競爭,展示了其正常運行時間,安全性,用戶群和基礎架構性能。跨鏈消息傳遞的LayerZero Tech集成進一步鞏固了SEI的位置。

But it's not just about stablecoins. Sei Network is also gaining traction in the DeFi and GameFi spaces. The World of Dypians project has seen substantial on-chain activity, contributing to Sei's overall network engagement. Increased TVL, driven by staking and ecosystem incentives, is another indicator of Sei's growing influence.

但這不僅是關於穩定的。 SEI網絡還在Defi和GameFi空間中獲得了吸引力。 DYPIANS項目的世界已經進行了實質性的鏈活動,這有助於SEI的整體網絡參與。在堆放和生態系統激勵措施的推動下,TVL的增加是SEI影響力不斷增長的另一個指標。

Sei's Technical Outlook: Bullish Signals and Key Levels

SEI的技術前景:看漲信號和關鍵水平

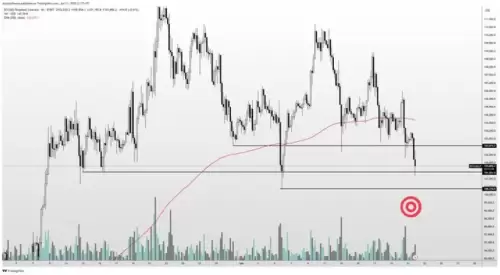

From a technical perspective, the SEI token has shown resilience. After a dip in May, it bounced back, surpassing the 50-day Exponential Moving Average (EMA). The Relative Strength Index (RSI) suggests near-term bullish momentum. However, the 100-day EMA around $0.21 remains a critical hurdle. Keep an eye on the $0.20 support and the $0.18 demand area.

從技術角度來看,SEI令牌顯示出彈性。 5月份下降後,它反彈,超過了50天的指數移動平均線(EMA)。相對強度指數(RSI)表明近期看漲勢頭。但是,100天的EMA約0.21美元仍然是一個關鍵的障礙。密切關注$ 0.20的支持和0.18 $的需求區域。

Sei Network Dominates Web3 Gaming

SEI網絡主導Web3遊戲

Sei Network has surged ahead of opBNB to become the leader in Web3 gaming, boasting 7.38 million unique active wallets (UAW) in the last 30 days, capturing a 33.5% market share. This dominance highlights Sei's growing influence and importance in the blockchain gaming sector.

SEI網絡已在OPBNB領先,成為Web3遊戲的領導者,在過去30天內擁有738萬個獨特的活動錢包(UAW),捕獲了33.5%的市場份額。這種主導地位凸顯了SEI在區塊鏈遊戲領域的影響力和重要性的日益增長。

Spark Protocol: The DeFi Infrastructure Layer

火花協議:Fefi基礎架構層

Let's shift gears and talk about Spark (SPK). Spark is an on-chain asset allocator aiming to solve core DeFi problems. Unlike protocols focused on single products, Spark acts as a liquidation and yield infrastructure layer. It borrows stablecoins from Sky (formerly MakerDAO) and deploys them into DeFi, CeFi, and RWA strategies, creating stable liquidation and risk-adjusted yields.

讓我們轉動齒輪,談論Spark(SPK)。 SPARK是旨在解決核心偏見問題的鏈上資產分配器。與關注單一產品的協議不同,Spark充當清算和產量基礎設施層。它藉鑑了Sky(以前是Makerdao)的Stablecoins,並將其部署到DEFI,CEFI和RWA策略中,從而創造出穩定的清算和風險調整後的收益率。

For users, Spark simplifies complex strategies into easy-to-use products like sUSDS and sUSDC, allowing them to earn on-chain income without needing to be DeFi experts. The beauty of Spark is its role as a logistics engine, enhancing operational efficiency for the entire DeFi market.

對於用戶而言,Spark簡化了複雜的策略,例如SUSDS和SUSDC等易於使用的產品,從而使他們能夠賺取鏈接收入而無需成為Defi專家。 Spark的優點在於它作為物流引擎的作用,增強了整個Defi市場的運營效率。

Sei's Vision for the Agentic AI Economy

SEI對代理AI經濟的願景

Sei Network is positioning itself to capture a piece of the burgeoning agentic AI economy, projected to reach $200 billion. Sei aims to become the VISA of agentic AI payment systems through its Sei Giga infrastructure. With ultra-low transaction costs, Sei is making AI-to-AI micropayments a reality, addressing a critical need in this rapidly growing sector.

SEI Network正在定位自己,以捕獲一部分新興的代理AI經濟經濟,預計將達到2000億美元。 SEI的目標是通過其SEI GIGA基礎設施成為代理AI支付系統的簽證。憑藉超低交易成本,SEI將AI到AI至AI微付費成為現實,這是解決這個快速增長的行業的關鍵需求。

A Personal Take

個人看法

It's exciting to see Sei Network tackling challenges and capitalizing on opportunities. Its focus on performance, compliance, and cross-chain interoperability positions it well for future growth. The stablecoin pilot, gaming dominance and push into the AI payment space is a great move.

看到SEI網絡應對挑戰並利用機遇真是令人興奮。它專注於績效,合規性和跨鏈互操作性的位置,可以很好地為未來的增長。 Stablecoin飛行員,遊戲優勢和進入AI支付空間是一個很好的舉動。

Wrapping Up

總結

So, there you have it. From stablecoins to gaming to AI payments, Sei Network is definitely one to watch. Keep an eye on this space – it's only going to get more interesting from here!

所以,你有。從Stablecoins到遊戲再到AI付款,SEI網絡絕對是一個值得關注的網絡。密切關注這個空間 - 從這裡只會變得更加有趣!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- CoinMarketCap安全漏洞:喚醒加密錢包安全的呼籲

- 2025-06-22 14:25:13

- CoinMarketCap面臨最近的安全漏洞,涉及惡意錢包彈出窗口,突出了加密貨幣空間中不斷存在的危險。

-

- 加密貨幣市場跌落:比特幣傾角和清算戰爭

- 2025-06-22 14:25:13

- 地緣政治緊張局勢和大規模清算引發了加密貨幣市場的低迷。這是暫時的傾角還是更大的東西的開始?

-

- Fusaka在地平線上:以太坊的下一章和加密人馬的狂野騎行

- 2025-06-22 14:35:12

- 以太坊的fusaka更新有望提高可擴展性,但是地緣政治搖擺不定和模因硬幣躁狂症為加密景觀增添了複雜性。

-

- 特朗普,伊朗和比特幣崩潰?這是怎麼回事?

- 2025-06-22 14:35:12

- 特朗普在伊朗的行動通過加密貨幣市場造成了衝擊波,導致比特幣崩潰。這是即將到來的跡象嗎?

-

- 歐洲的比特幣:法國與BTC的萌芽浪漫

- 2025-06-22 12:45:12

- 法國正在為比特幣熱身,潛在的民族國家採用和監管發展暗示了歐洲BTC的看漲未來。

-

- BNB鏈替補崩潰:導航風暴和發現機會

- 2025-06-22 12:45:12

- BNB連鎖店面臨著一個動蕩的一周,市值大幅下降。但是,在Altcoin崩潰中,彈性和未來增長的跡像出現。

-

-

- 菲亞特支持的穩定幣,象徵性的國庫和Defi:紐約財務未來的一分鐘

- 2025-06-22 12:25:12

- 由菲亞特支持的穩定幣,代幣化的國庫和Defi正在重塑融資。本文深入了解最新趨勢,市場優勢和未來前景。

-