|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Dypians, DeFi, and Sei Network: A Deep Dive into the Latest Trends

Jun 22, 2025 at 10:00 am

Explore the evolving landscape of Dypians, DeFi, and Sei Network, uncovering key trends, insights, and the latest developments shaping the future of blockchain technology.

Dypians, DeFi, and Sei Network: A Deep Dive into the Latest Trends

The world of Dypians, DeFi, and Sei Network is buzzing with activity. From groundbreaking stablecoin integrations to dominating the Web3 gaming scene, let's break down the latest happenings.

Sei Network's Rise: A Wyoming Stablecoin Pilot and DeFi Growth

Sei Network has been making waves, particularly with its selection as one of the pilot blockchains for Wyoming's Stable Token (WYST). This is a big deal, marking a significant step in the adoption of fiat-backed, state-issued stablecoins in the US. Sei beat out some serious competition, showcasing its uptime, security, user base, and infrastructure performance. The integration of LayerZero tech for cross-chain messaging further solidifies Sei's position.

But it's not just about stablecoins. Sei Network is also gaining traction in the DeFi and GameFi spaces. The World of Dypians project has seen substantial on-chain activity, contributing to Sei's overall network engagement. Increased TVL, driven by staking and ecosystem incentives, is another indicator of Sei's growing influence.

Sei's Technical Outlook: Bullish Signals and Key Levels

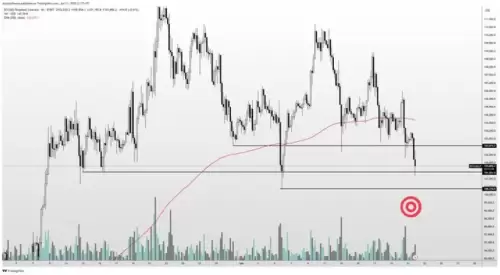

From a technical perspective, the SEI token has shown resilience. After a dip in May, it bounced back, surpassing the 50-day Exponential Moving Average (EMA). The Relative Strength Index (RSI) suggests near-term bullish momentum. However, the 100-day EMA around $0.21 remains a critical hurdle. Keep an eye on the $0.20 support and the $0.18 demand area.

Sei Network Dominates Web3 Gaming

Sei Network has surged ahead of opBNB to become the leader in Web3 gaming, boasting 7.38 million unique active wallets (UAW) in the last 30 days, capturing a 33.5% market share. This dominance highlights Sei's growing influence and importance in the blockchain gaming sector.

Spark Protocol: The DeFi Infrastructure Layer

Let's shift gears and talk about Spark (SPK). Spark is an on-chain asset allocator aiming to solve core DeFi problems. Unlike protocols focused on single products, Spark acts as a liquidation and yield infrastructure layer. It borrows stablecoins from Sky (formerly MakerDAO) and deploys them into DeFi, CeFi, and RWA strategies, creating stable liquidation and risk-adjusted yields.

For users, Spark simplifies complex strategies into easy-to-use products like sUSDS and sUSDC, allowing them to earn on-chain income without needing to be DeFi experts. The beauty of Spark is its role as a logistics engine, enhancing operational efficiency for the entire DeFi market.

Sei's Vision for the Agentic AI Economy

Sei Network is positioning itself to capture a piece of the burgeoning agentic AI economy, projected to reach $200 billion. Sei aims to become the VISA of agentic AI payment systems through its Sei Giga infrastructure. With ultra-low transaction costs, Sei is making AI-to-AI micropayments a reality, addressing a critical need in this rapidly growing sector.

A Personal Take

It's exciting to see Sei Network tackling challenges and capitalizing on opportunities. Its focus on performance, compliance, and cross-chain interoperability positions it well for future growth. The stablecoin pilot, gaming dominance and push into the AI payment space is a great move.

Wrapping Up

So, there you have it. From stablecoins to gaming to AI payments, Sei Network is definitely one to watch. Keep an eye on this space – it's only going to get more interesting from here!

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.