|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索DYPIAN,DEFI和SEI网络不断发展的景观,发现关键趋势,见解以及最新的发展,塑造了区块链技术的未来。

Dypians, DeFi, and Sei Network: A Deep Dive into the Latest Trends

DYPIAN,DEFI和SEI网络:深入了解最新趋势

The world of Dypians, DeFi, and Sei Network is buzzing with activity. From groundbreaking stablecoin integrations to dominating the Web3 gaming scene, let's break down the latest happenings.

DYPIAN,DEFI和SEI网络的世界充满了活动。从开创性的Stablecoin集成到主导Web3游戏场景,让我们分解最新的事件。

Sei Network's Rise: A Wyoming Stablecoin Pilot and DeFi Growth

SEI网络的崛起:怀俄明州的Stablecoin飞行员和Defi增长

Sei Network has been making waves, particularly with its selection as one of the pilot blockchains for Wyoming's Stable Token (WYST). This is a big deal, marking a significant step in the adoption of fiat-backed, state-issued stablecoins in the US. Sei beat out some serious competition, showcasing its uptime, security, user base, and infrastructure performance. The integration of LayerZero tech for cross-chain messaging further solidifies Sei's position.

SEI网络一直在引起浪潮,尤其是它作为怀俄明州稳定令牌(WYST)的飞行员区块链之一的选择。这很重要,这标志着在美国采用菲亚特支持的,由国家签发的稳定股份的重要一步。 SEI击败了一些激烈的竞争,展示了其正常运行时间,安全性,用户群和基础架构性能。跨链消息传递的LayerZero Tech集成进一步巩固了SEI的位置。

But it's not just about stablecoins. Sei Network is also gaining traction in the DeFi and GameFi spaces. The World of Dypians project has seen substantial on-chain activity, contributing to Sei's overall network engagement. Increased TVL, driven by staking and ecosystem incentives, is another indicator of Sei's growing influence.

但这不仅是关于稳定的。 SEI网络还在Defi和GameFi空间中获得了吸引力。 DYPIANS项目的世界已经进行了实质性的链活动,这有助于SEI的整体网络参与。在堆放和生态系统激励措施的推动下,TVL的增加是SEI影响力不断增长的另一个指标。

Sei's Technical Outlook: Bullish Signals and Key Levels

SEI的技术前景:看涨信号和关键水平

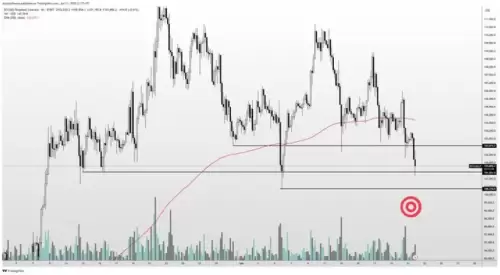

From a technical perspective, the SEI token has shown resilience. After a dip in May, it bounced back, surpassing the 50-day Exponential Moving Average (EMA). The Relative Strength Index (RSI) suggests near-term bullish momentum. However, the 100-day EMA around $0.21 remains a critical hurdle. Keep an eye on the $0.20 support and the $0.18 demand area.

从技术角度来看,SEI令牌显示出弹性。 5月份下降后,它反弹,超过了50天的指数移动平均线(EMA)。相对强度指数(RSI)表明近期看涨势头。但是,100天的EMA约0.21美元仍然是一个关键的障碍。密切关注$ 0.20的支持和0.18 $的需求区域。

Sei Network Dominates Web3 Gaming

SEI网络主导Web3游戏

Sei Network has surged ahead of opBNB to become the leader in Web3 gaming, boasting 7.38 million unique active wallets (UAW) in the last 30 days, capturing a 33.5% market share. This dominance highlights Sei's growing influence and importance in the blockchain gaming sector.

SEI网络已在OPBNB领先,成为Web3游戏的领导者,在过去30天内拥有738万个独特的活动钱包(UAW),捕获了33.5%的市场份额。这种主导地位凸显了SEI在区块链游戏领域的影响力和重要性的日益增长。

Spark Protocol: The DeFi Infrastructure Layer

火花协议:Fefi基础架构层

Let's shift gears and talk about Spark (SPK). Spark is an on-chain asset allocator aiming to solve core DeFi problems. Unlike protocols focused on single products, Spark acts as a liquidation and yield infrastructure layer. It borrows stablecoins from Sky (formerly MakerDAO) and deploys them into DeFi, CeFi, and RWA strategies, creating stable liquidation and risk-adjusted yields.

让我们转动齿轮,谈论Spark(SPK)。 SPARK是旨在解决核心偏见问题的链上资产分配器。与关注单一产品的协议不同,Spark充当清算和产量基础设施层。它借鉴了Sky(以前是Makerdao)的Stablecoins,并将其部署到DEFI,CEFI和RWA策略中,从而创造出稳定的清算和风险调整后的收益率。

For users, Spark simplifies complex strategies into easy-to-use products like sUSDS and sUSDC, allowing them to earn on-chain income without needing to be DeFi experts. The beauty of Spark is its role as a logistics engine, enhancing operational efficiency for the entire DeFi market.

对于用户而言,Spark简化了复杂的策略,例如SUSDS和SUSDC等易于使用的产品,从而使他们能够赚取链接收入而无需成为Defi专家。 Spark的优点在于它作为物流引擎的作用,增强了整个Defi市场的运营效率。

Sei's Vision for the Agentic AI Economy

SEI对代理AI经济的愿景

Sei Network is positioning itself to capture a piece of the burgeoning agentic AI economy, projected to reach $200 billion. Sei aims to become the VISA of agentic AI payment systems through its Sei Giga infrastructure. With ultra-low transaction costs, Sei is making AI-to-AI micropayments a reality, addressing a critical need in this rapidly growing sector.

SEI Network正在定位自己,以捕获一部分新兴的代理AI经济经济,预计将达到2000亿美元。 SEI的目标是通过其SEI GIGA基础设施成为代理AI支付系统的签证。凭借超低交易成本,SEI将AI到AI至AI微付费成为现实,这是解决这个快速增长的行业的关键需求。

A Personal Take

个人看法

It's exciting to see Sei Network tackling challenges and capitalizing on opportunities. Its focus on performance, compliance, and cross-chain interoperability positions it well for future growth. The stablecoin pilot, gaming dominance and push into the AI payment space is a great move.

看到SEI网络应对挑战并利用机遇真是令人兴奋。它专注于绩效,合规性和跨链互操作性的位置,可以很好地为未来的增长。 Stablecoin飞行员,游戏优势和进入AI支付空间是一个很好的举动。

Wrapping Up

总结

So, there you have it. From stablecoins to gaming to AI payments, Sei Network is definitely one to watch. Keep an eye on this space – it's only going to get more interesting from here!

所以,你有。从Stablecoins到游戏再到AI付款,SEI网络绝对是一个值得关注的网络。密切关注这个空间 - 从这里只会变得更加有趣!

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- CoinMarketCap安全漏洞:唤醒加密钱包安全的呼吁

- 2025-06-22 14:25:13

- CoinMarketCap面临最近的安全漏洞,涉及恶意钱包弹出窗口,突出了加密货币空间中不断存在的危险。

-

- 加密货币市场跌落:比特币倾角和清算战争

- 2025-06-22 14:25:13

- 地缘政治紧张局势和大规模清算引发了加密货币市场的低迷。这是暂时的倾角还是更大的东西的开始?

-

- Fusaka在地平线上:以太坊的下一章和加密人马的狂野骑行

- 2025-06-22 14:35:12

- 以太坊的fusaka更新有望提高可扩展性,但是地缘政治摇摆不定和模因硬币躁狂症为加密景观增添了复杂性。

-

- 特朗普,伊朗和比特币崩溃?这是怎么回事?

- 2025-06-22 14:35:12

- 特朗普在伊朗的行动通过加密货币市场造成了冲击波,导致比特币崩溃。这是即将到来的迹象吗?

-

- 欧洲的比特币:法国与BTC的萌芽浪漫

- 2025-06-22 12:45:12

- 法国正在为比特币热身,潜在的民族国家采用和监管发展暗示了欧洲BTC的看涨未来。

-

- BNB链替补崩溃:导航风暴和发现机会

- 2025-06-22 12:45:12

- BNB连锁店面临着一个动荡的一周,市值大幅下降。但是,在Altcoin崩溃中,弹性和未来增长的迹象出现。

-

-

- 菲亚特支持的稳定币,象征性的国库和Defi:纽约财务未来的一分钟

- 2025-06-22 12:25:12

- 由菲亚特支持的稳定币,代币化的国库和Defi正在重塑融资。本文深入了解最新趋势,市场优势和未来前景。

-