|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索比特幣,石油衝擊和通貨膨脹的複雜相互作用。發現地緣政治緊張局勢和經濟政策如何塑造金融的未來。

Bitcoin, Oil Shock, and Inflation: Navigating the Perfect Storm

比特幣,石油衝擊和通貨膨脹:導航完美風暴

Geopolitical tensions, potential oil shocks, and persistent inflation create a volatile environment. Bitcoin's role as a hedge is again in the spotlight.

地緣政治緊張局勢,潛在的石油衝擊和持續的通貨膨脹創造了動蕩的環境。比特幣作為樹籬的角色再次成為聚光燈。

Iran's Strait of Hormuz Threat: A New Oil Shock?

伊朗的Hormuz海峽威脅:新的石油衝擊?

Recent tensions in the Middle East, particularly Iran's threat to control access through the Strait of Hormuz, have sparked fears of a potential oil shock. This chokepoint handles nearly 20% of the world's oil trade, and any disruption could send prices soaring.

最近在中東的緊張局勢,特別是伊朗通過霍爾木茲海峽控制通道的威脅,引發了人們對潛在的石油衝擊的擔憂。這個備受關注點可處理世界上近20%的石油貿易,任何干擾都可能使價格飛漲。

According to CNBC, analysts warn that a full closure of the Strait of Hormuz could drive Brent crude oil prices to $120-$130 per barrel. JPMorgan forecasts that such a disruption could push US CPI inflation to 5%.

根據CNBC的說法,分析師警告說,Hormuz海峽的完全關閉可能會使布倫特原油價格達到每桶120-130美元。摩根大通預測,這種中斷可能會將CPI通貨膨脹率提高到5%。

Bitcoin as a Safe Haven Amidst Uncertainty

比特幣是不確定性中的避風港

As traditional markets digest the implications of a potential oil shock, Bitcoin has shown resilience, reclaiming the $105,000 threshold. Its perception as a hedge against inflation and geopolitical uncertainty is driving renewed safe-haven demand.

隨著傳統市場消化潛在的石油衝擊的影響,比特幣顯示出彈性,收回了105,000美元的門檻。它作為對沖通貨膨脹和地緣政治不確定性的對沖的看法正在推動新的避風港需求。

While gold prices are also seeing increased volatility as traders rotate into hard assets, Bitcoin's stability and decentralized nature make it an attractive alternative for investors seeking to protect their wealth during turbulent times.

儘管隨著交易者旋轉成艱苦的資產,黃金價格也增加了波動性,但比特幣的穩定性和分散的性質使其成為尋求在動盪時期保護自己的財富的投資者的吸引人替代品。

The Fed's Dilemma: Inflation vs. Market Panic

美聯儲的困境:通貨膨脹與市場恐慌

The US Federal Reserve faces a tough decision as it navigates persistent inflation amid geopolitical disruptions. With the FOMC (Federal Open Market Committee) set to deliver its next interest rate decision, investors are closely watching for signs of how the Fed plans to handle the situation.

美國聯邦儲備在地緣政治中斷的情況下導航通貨膨脹持續通貨膨脹時面臨艱難的決定。隨著FOMC(聯邦公開市場委員會)將作出下一個利率決定,投資者正在密切關注美聯儲計劃如何處理這種情況的跡象。

The market remains tense as the Fed struggles between controlling inflation and avoiding market panic. A hawkish tilt could further test Bitcoin's resilience, especially if energy markets continue to spiral.

當美聯儲控制通貨膨脹和避免市場恐慌之間的鬥爭時,市場仍然緊張。鷹派傾斜可以進一步測試比特幣的彈性,尤其是在能源市場繼續螺旋的情況下。

The Rise of Altcoins in Nigeria

尼日利亞山寨幣的興起

Interestingly, while Bitcoin, Ethereum, and stablecoins remain dominant, Nigerian traders are showing a growing interest in altcoins like SAND, AURA, and TAO. This trend reflects a broader global shift towards digital assets that offer exposure to emerging narratives like the metaverse, DeFi, and AI.

有趣的是,儘管比特幣,以太坊和穩定幣仍然占主導地位,但尼日利亞商人對諸如沙,光環和陶等山寨幣的興趣日益增加。這一趨勢反映了向數字資產邁出的更廣泛的全球轉變,該資產提供了元素,諸如Metaverse,Defi和AI等新興敘事的影響。

According to Ayotunde Alabi, Country Manager at Luno Nigeria, stablecoins still account for over 40% of Nigeria’s crypto inflows, highlighting their role in financial planning, international trade, and treasury management across the region.

根據尼日利亞盧諾(Luno)國家經理Ayotunde Alabi的說法,Stablecoins仍然佔尼日利亞加密貨幣流入量的40%以上,強調了它們在整個地區的財務計劃,國際貿易和財政部管理中的作用。

Personal Viewpoint

個人觀點

While the situation is complex, Bitcoin's demonstrated ability to act as a hedge against geopolitical uncertainty and inflation is compelling. The potential for an oil shock, coupled with the Fed's delicate balancing act, creates a perfect storm for Bitcoin to shine. It's not a magic bullet, but it offers a viable alternative for investors seeking to diversify their portfolios and protect their assets.

儘管情況很複雜,但比特幣表現出的能力充當對沖地緣政治不確定性和通貨膨脹的能力是令人信服的。加油的潛力,再加上美聯儲的微妙平衡行為,為比特幣發光創造了完美的風暴。這不是魔術子彈,但它為尋求多樣化其投資組合併保護其資產的投資者提供了可行的替代方案。

Looking Ahead

展望未來

So, buckle up, folks! It's going to be a wild ride as we navigate the choppy waters of oil shocks, inflation fears, and the ever-evolving crypto landscape. Keep your eyes on Bitcoin, stay informed, and remember, a little bit of humor can go a long way in these crazy times!

所以,搭扣,伙計們!當我們駕駛著波濤洶湧的石油衝擊,通貨膨脹恐懼和不斷發展的加密貨幣景觀時,這將是一次狂野的旅程。請注意比特幣,保持知情,並記住,在這些瘋狂的時期,有些幽默可以走很長一段路!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 比特幣的平衡行為:導航地緣政治緊張局勢達到眼睛記錄高點

- 2025-06-19 00:25:12

- 隨著地緣政治緊張局勢加劇通貨膨脹的擔憂,比特幣眼睛的新高點。機構積累,市場導航不確定性。

-

- Crypto ATMS在華盛頓市被禁止:這是怎麼回事?

- 2025-06-19 00:45:13

- 華盛頓斯波坎(Spokane)在騙局問題上禁止加密貨幣。這是局部鎮壓還是更大趨勢的跡象?讓我們潛水。

-

-

- 冷錢包,陶,靠近:安全地導航加密不穩定性

- 2025-06-19 01:10:13

- 在陶的市場波動中,冷錢包作為安全的避風港出現,強調用戶控制和隱私。這是2025年的正確選擇嗎?

-

- 冷錢包:您的代幣堡壘在毛茸茸的貿易狂潮中

- 2025-06-19 00:45:13

- 用冷錢包在加密貨幣的狂野世界中瀏覽。優先考慮隱私,控制和安全性,這是精明的交易者的明智之舉。

-

-

- Memecoin Mania:基本面符合高風險市場

- 2025-06-19 01:45:12

- 深入了解大型賭注和社區支持的狂野世界。發現基本面在這個高風險遊戲中如何變得至關重要。

-

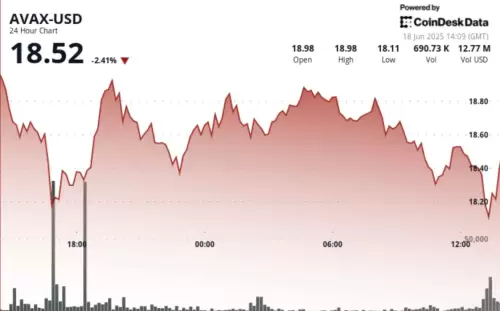

- avax恢復:短期動量還是看跌陷阱?

- 2025-06-19 01:12:13

- 在看跌情緒的情況下,分析了Avax最近的價格行動,短期勢頭和潛在的恢復。 V形恢復會持有,還是暫時的緩刑?

-