|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索比特币,石油冲击和通货膨胀的复杂相互作用。发现地缘政治紧张局势和经济政策如何塑造金融的未来。

Bitcoin, Oil Shock, and Inflation: Navigating the Perfect Storm

比特币,石油冲击和通货膨胀:导航完美风暴

Geopolitical tensions, potential oil shocks, and persistent inflation create a volatile environment. Bitcoin's role as a hedge is again in the spotlight.

地缘政治紧张局势,潜在的石油冲击和持续的通货膨胀创造了动荡的环境。比特币作为树篱的角色再次成为聚光灯。

Iran's Strait of Hormuz Threat: A New Oil Shock?

伊朗的Hormuz海峡威胁:新的石油冲击?

Recent tensions in the Middle East, particularly Iran's threat to control access through the Strait of Hormuz, have sparked fears of a potential oil shock. This chokepoint handles nearly 20% of the world's oil trade, and any disruption could send prices soaring.

最近在中东的紧张局势,特别是伊朗通过霍尔木兹海峡控制通道的威胁,引发了人们对潜在的石油冲击的担忧。这个备受关注点可处理世界上近20%的石油贸易,任何干扰都可能使价格飞涨。

According to CNBC, analysts warn that a full closure of the Strait of Hormuz could drive Brent crude oil prices to $120-$130 per barrel. JPMorgan forecasts that such a disruption could push US CPI inflation to 5%.

根据CNBC的说法,分析师警告说,Hormuz海峡的完全关闭可能会使布伦特原油价格达到每桶120-130美元。摩根大通预测,这种中断可能会将CPI通货膨胀率提高到5%。

Bitcoin as a Safe Haven Amidst Uncertainty

比特币是不确定性中的避风港

As traditional markets digest the implications of a potential oil shock, Bitcoin has shown resilience, reclaiming the $105,000 threshold. Its perception as a hedge against inflation and geopolitical uncertainty is driving renewed safe-haven demand.

随着传统市场消化潜在的石油冲击的影响,比特币显示出弹性,收回了105,000美元的门槛。它作为对冲通货膨胀和地缘政治不确定性的对冲的看法正在推动新的避风港需求。

While gold prices are also seeing increased volatility as traders rotate into hard assets, Bitcoin's stability and decentralized nature make it an attractive alternative for investors seeking to protect their wealth during turbulent times.

尽管随着交易者旋转成艰苦的资产,黄金价格也增加了波动性,但比特币的稳定性和分散的性质使其成为寻求在动荡时期保护自己的财富的投资者的吸引人替代品。

The Fed's Dilemma: Inflation vs. Market Panic

美联储的困境:通货膨胀与市场恐慌

The US Federal Reserve faces a tough decision as it navigates persistent inflation amid geopolitical disruptions. With the FOMC (Federal Open Market Committee) set to deliver its next interest rate decision, investors are closely watching for signs of how the Fed plans to handle the situation.

美国联邦储备在地缘政治中断的情况下导航通货膨胀持续通货膨胀时面临艰难的决定。随着FOMC(联邦公开市场委员会)将作出下一个利率决定,投资者正在密切关注美联储计划如何处理这种情况的迹象。

The market remains tense as the Fed struggles between controlling inflation and avoiding market panic. A hawkish tilt could further test Bitcoin's resilience, especially if energy markets continue to spiral.

当美联储控制通货膨胀和避免市场恐慌之间的斗争时,市场仍然紧张。鹰派倾斜可以进一步测试比特币的弹性,尤其是在能源市场继续螺旋的情况下。

The Rise of Altcoins in Nigeria

尼日利亚山寨币的兴起

Interestingly, while Bitcoin, Ethereum, and stablecoins remain dominant, Nigerian traders are showing a growing interest in altcoins like SAND, AURA, and TAO. This trend reflects a broader global shift towards digital assets that offer exposure to emerging narratives like the metaverse, DeFi, and AI.

有趣的是,尽管比特币,以太坊和稳定币仍然占主导地位,但尼日利亚商人对诸如沙,光环和陶等山寨币的兴趣日益增加。这一趋势反映了向数字资产迈出的更广泛的全球转变,该资产提供了元素,诸如Metaverse,Defi和AI等新兴叙事的影响。

According to Ayotunde Alabi, Country Manager at Luno Nigeria, stablecoins still account for over 40% of Nigeria’s crypto inflows, highlighting their role in financial planning, international trade, and treasury management across the region.

根据尼日利亚卢诺(Luno)国家经理Ayotunde Alabi的说法,Stablecoins仍然占尼日利亚加密货币流入量的40%以上,强调了它们在整个地区的财务计划,国际贸易和财政部管理中的作用。

Personal Viewpoint

个人观点

While the situation is complex, Bitcoin's demonstrated ability to act as a hedge against geopolitical uncertainty and inflation is compelling. The potential for an oil shock, coupled with the Fed's delicate balancing act, creates a perfect storm for Bitcoin to shine. It's not a magic bullet, but it offers a viable alternative for investors seeking to diversify their portfolios and protect their assets.

尽管情况很复杂,但比特币表现出的能力充当对冲地缘政治不确定性和通货膨胀的能力是令人信服的。加油的潜力,再加上美联储的微妙平衡行为,为比特币发光创造了完美的风暴。这不是魔术子弹,但它为寻求多样化其投资组合并保护其资产的投资者提供了可行的替代方案。

Looking Ahead

展望未来

So, buckle up, folks! It's going to be a wild ride as we navigate the choppy waters of oil shocks, inflation fears, and the ever-evolving crypto landscape. Keep your eyes on Bitcoin, stay informed, and remember, a little bit of humor can go a long way in these crazy times!

所以,搭扣,伙计们!当我们驾驶着波涛汹涌的石油冲击,通货膨胀恐惧和不断发展的加密货币景观时,这将是一次狂野的旅程。请注意比特币,保持知情,并记住,在这些疯狂的时期,有些幽默可以走很长一段路!

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 比特币的平衡行为:导航地缘政治紧张局势达到眼睛记录高点

- 2025-06-19 00:25:12

- 随着地缘政治紧张局势加剧通货膨胀的担忧,比特币眼睛的新高点。机构积累,市场导航不确定性。

-

- Crypto ATMS在华盛顿市被禁止:这是怎么回事?

- 2025-06-19 00:45:13

- 华盛顿斯波坎(Spokane)在骗局问题上禁止加密货币。这是局部镇压还是更大趋势的迹象?让我们潜水。

-

-

- 冷钱包,陶,靠近:安全地导航加密不稳定性

- 2025-06-19 01:10:13

- 在陶的市场波动中,冷钱包作为安全的避风港出现,强调用户控制和隐私。这是2025年的正确选择吗?

-

- 冷钱包:您的代币堡垒在毛茸茸的贸易狂潮中

- 2025-06-19 00:45:13

- 用冷钱包在加密货币的狂野世界中浏览。优先考虑隐私,控制和安全性,这是精明的交易者的明智之举。

-

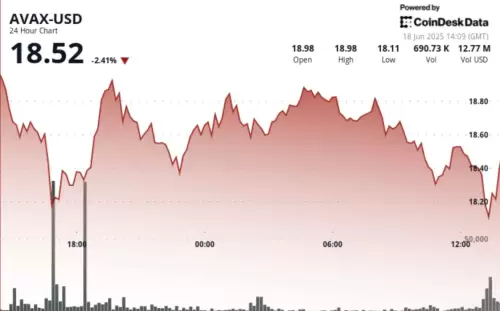

- avax恢复:短期动量还是看跌陷阱?

- 2025-06-19 01:12:13

- 在看跌情绪的情况下,分析了Avax最近的价格行动,短期势头和潜在的恢复。 V形恢复会持有,还是暂时的缓刑?

-

-

- 参议院,加密货币和数字资产:有什么问题?

- 2025-06-19 01:30:12

- 查看参议院的最新发展有关加密货币和数字资产的发展,包括《天才法》和《目的XRP ETF》的启动。

-

- 睡眠代币,科恩和下载节:头条新闻胜利

- 2025-06-19 00:51:50

- Korn赞扬Sleep Motken的下载节日标题套装,以其巨大的舞台表演和新专辑的实力使批评家沉默。