|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索比特幣對地緣政治事件的反應,重點關注伊朗的情況及其對加密貨幣市場的影響。了解市場波動和投資策略。

Bitcoin, Iran, and Market Reaction: Navigating Geopolitical Tensions

比特幣,伊朗和市場反應:導航地緣政治緊張局勢

Geopolitical tensions, particularly involving Iran, significantly influence Bitcoin and the broader crypto market, causing volatility and shifts in investor sentiment. Let's dive into recent events and their effects.

地緣政治緊張局勢,尤其是伊朗涉及的緊張局勢,顯著影響比特幣和更廣泛的加密貨幣市場,導致投資者情緒的波動和轉變。讓我們研究最近的事件及其影響。

Market Reaction to U.S. Strikes on Iranian Nuclear Sites

市場對美國在伊朗核場所的罷工的反應

Reports of U.S. airstrikes on Iranian nuclear facilities triggered an immediate "risk-off" response in the markets. Bitcoin experienced a dip, falling 1% over 24 hours and 3.2% for the week, trading around $102,130. This decline reflected investor concerns about escalating conflict in the Middle East. Despite Bitcoin's reputation as a hedge against uncertainty, sudden military actions can induce short-term volatility across all asset classes, including crypto.

美國關於伊朗核設施的空襲的報導引發了市場的立即“風險”反應。比特幣經歷了下降,在24小時內下降了1%,一周3.2%的跌幅,交易約為102,130美元。這種下降反映了投資者對中東沖突升級的擔憂。儘管比特幣是對沖不確定性的聲譽,但突然的軍事行動仍會引起所有資產類別(包括加密貨幣)的短期波動。

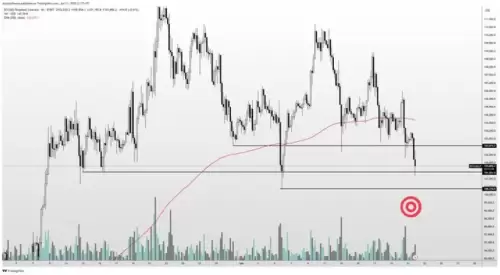

The Bull Trap: Bitcoin's Price Swings

公牛陷阱:比特幣的價格波動

Bitcoin's price movements can be deceptive. After surging past $103,000, the market appeared bullish, but smart whales might have been setting a trap. They push prices up to stimulate FOMO (Fear Of Missing Out) buys, then crash the price to seize liquidity from late buyers. This classic bull trap scenario highlights the need for caution. Key levels to watch include support at $99,000 (a break below could signal a sharp dip) and resistance at $105,000 (a breakout could indicate a genuine rally). Traders should set tight stop-losses, avoid chasing fake pumps, and await confirmation before investing.

比特幣的價格變動可以具有欺騙性。在飆升超過103,000美元之後,市場似乎看漲,但聰明的鯨魚可能已經設定了一個陷阱。他們將價格推高以刺激FOMO(害怕錯過)購買,然後將價格崩潰以抓住晚期買家的流動性。這種經典的牛陷阱場景突出了需要謹慎的需求。要關注的關鍵水平包括99,000美元的支持(低於以下的休息可能表明尖銳的下降),阻力為105,000美元(突破可能表明真正的集會)。交易者應設置嚴格的停止損失,避免追逐假泵,並在投資之前等待確認。

Trump's Comments and Crypto Market Instability

特朗普的評論和加密市場不穩定

President Trump’s provocative statements regarding Iran's leader as an "easy target" also contributed to market instability. Bitcoin dropped from $104,310 to $103,553 within an hour, with Ether and XRP also declining. The Crypto Fear & Greed Index shifted to "Neutral," reflecting shaken investor confidence. Geopolitical tensions, especially clashes involving Israel and Iran, intensify this uncertainty. Trump's previous tariff policies in 2025 had already demonstrated his ability to jolt the market, raising questions about the stability of crypto investments.

特朗普總統關於伊朗領導人作為“簡單目標”的挑釁性言論也導致了市場不穩定。比特幣在一個小時內從104,310美元下降到103,553美元,Ether和XRP也在下降。加密恐懼和貪婪指數轉向“中立”,反映了投資者的信心。地緣政治緊張局勢,尤其是涉及以色列和伊朗的衝突,加劇了這種不確定性。特朗普以前在2025年的關稅政策已經證明了他在市場上震動的能力,從而提出了有關加密投資穩定的疑問。

A Silver Lining: Mutuum Finance (MUTM)

銀色襯裡:Mutuum Finance(MUTM)

Amidst the turmoil, Mutuum Finance (MUTM) has emerged as a promising DeFi crypto. Its presale, now in phase 5, has raised significant capital, attracting numerous investors. This project's resilience highlights that opportunities still exist even during market downturns. With its innovative lending model and focus on community rewards, MUTM offers a compelling alternative for investors seeking stability and growth.

在動盪中,Mutuum Finance(MUTM)已成為有希望的Defi Crypto。它的預售現已處於第5階段,已經籌集了巨大的資金,吸引了眾多投資者。該項目的韌性強調,即使在市場衰退期間,機會仍然存在。 MUTM憑藉其創新的貸款模式並專注於社區獎勵,為尋求穩定和增長的投資者提供了令人信服的替代方案。

Final Thoughts

最後的想法

Navigating the crypto market during times of geopolitical tension requires a blend of awareness, caution, and strategic insight. While Bitcoin and other cryptocurrencies can be susceptible to volatility, understanding market dynamics and identifying promising projects can help investors weather the storm. And hey, at least you're not trying to predict the weather – that's a whole different level of crazy!

在地緣政治緊張時期,在加密市場中導航需要認識,謹慎和戰略見解。儘管比特幣和其他加密貨幣可能容易受到波動的影響,但了解市場動態並確定有前途的項目可以幫助投資者度過風暴。嘿,至少您不是要預測天氣 - 這是一個完全不同的瘋狂水平!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- BTC至$ 330K?解碼轉彎頭的比特幣模型

- 2025-06-22 16:25:13

- 比特幣真的可以達到33萬美元嗎?深入研究模型和指標,暗示了這次牛的壯觀的最後階段。

-

- SUI價格每週模式:它會向上搶購嗎?

- 2025-06-22 16:25:13

- 分析SUI在每週圖表上的價格動作,關鍵模式和潛在的突破場景。是玩遊戲嗎?技術指標暗示什麼?

-

-

- SPX6900模因硬幣:價格預測和市場沉思

- 2025-06-22 16:37:03

- 潛入SPX6900的野生世界,這是一個模因硬幣!獲取最新的價格預測,市場見解和少量加密幽默。是模因還是月光下?

-

- CoinMarketCap安全漏洞:喚醒加密錢包安全的呼籲

- 2025-06-22 14:25:13

- CoinMarketCap面臨最近的安全漏洞,涉及惡意錢包彈出窗口,突出了加密貨幣空間中不斷存在的危險。

-

- 加密貨幣市場跌落:比特幣傾角和清算戰爭

- 2025-06-22 14:25:13

- 地緣政治緊張局勢和大規模清算引發了加密貨幣市場的低迷。這是暫時的傾角還是更大的東西的開始?

-

- 比特幣在印度的經濟戰略中的潛在作用:一個新時代?

- 2025-06-22 14:45:12

- 探索印度比特幣和加密ETF的潛力,與韓國對數字資產和穩定的創新方法相似。

-

- Dogecoin,Meerkat和Telegram:新的模因硬幣生態系統?

- 2025-06-22 14:45:12

- 當Meerkat在電報中創新時,Dogecoin面臨挑戰。這是模因硬幣的未來嗎?

-

- 比特幣價格火箭:新的歷史高昂和預測330,000美元的市場激增

- 2025-06-22 14:50:12

- 比特幣襲擊了機構利益的新高。分析師預測,在這個動蕩的市場中,建議謹慎行事,但謹慎行事。