Explore how Bitcoin reacts to geopolitical events, focusing on the Iran situation and its impact on the crypto market. Stay informed on market volatility and investment strategies.

Bitcoin, Iran, and Market Reaction: Navigating Geopolitical Tensions

Geopolitical tensions, particularly involving Iran, significantly influence Bitcoin and the broader crypto market, causing volatility and shifts in investor sentiment. Let's dive into recent events and their effects.

Market Reaction to U.S. Strikes on Iranian Nuclear Sites

Reports of U.S. airstrikes on Iranian nuclear facilities triggered an immediate "risk-off" response in the markets. Bitcoin experienced a dip, falling 1% over 24 hours and 3.2% for the week, trading around $102,130. This decline reflected investor concerns about escalating conflict in the Middle East. Despite Bitcoin's reputation as a hedge against uncertainty, sudden military actions can induce short-term volatility across all asset classes, including crypto.

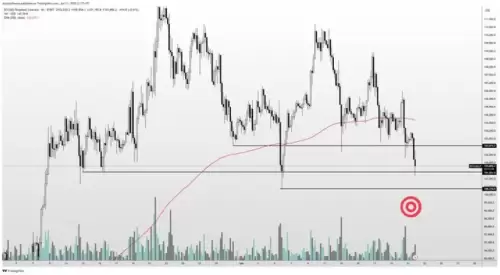

The Bull Trap: Bitcoin's Price Swings

Bitcoin's price movements can be deceptive. After surging past $103,000, the market appeared bullish, but smart whales might have been setting a trap. They push prices up to stimulate FOMO (Fear Of Missing Out) buys, then crash the price to seize liquidity from late buyers. This classic bull trap scenario highlights the need for caution. Key levels to watch include support at $99,000 (a break below could signal a sharp dip) and resistance at $105,000 (a breakout could indicate a genuine rally). Traders should set tight stop-losses, avoid chasing fake pumps, and await confirmation before investing.

Trump's Comments and Crypto Market Instability

President Trump’s provocative statements regarding Iran's leader as an "easy target" also contributed to market instability. Bitcoin dropped from $104,310 to $103,553 within an hour, with Ether and XRP also declining. The Crypto Fear & Greed Index shifted to "Neutral," reflecting shaken investor confidence. Geopolitical tensions, especially clashes involving Israel and Iran, intensify this uncertainty. Trump's previous tariff policies in 2025 had already demonstrated his ability to jolt the market, raising questions about the stability of crypto investments.

A Silver Lining: Mutuum Finance (MUTM)

Amidst the turmoil, Mutuum Finance (MUTM) has emerged as a promising DeFi crypto. Its presale, now in phase 5, has raised significant capital, attracting numerous investors. This project's resilience highlights that opportunities still exist even during market downturns. With its innovative lending model and focus on community rewards, MUTM offers a compelling alternative for investors seeking stability and growth.

Final Thoughts

Navigating the crypto market during times of geopolitical tension requires a blend of awareness, caution, and strategic insight. While Bitcoin and other cryptocurrencies can be susceptible to volatility, understanding market dynamics and identifying promising projects can help investors weather the storm. And hey, at least you're not trying to predict the weather – that's a whole different level of crazy!

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.