|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密貨幣新聞文章

Bitcoin (BTC) Drops Below $90K as Risk-Off Sentiment Prevails; Saylor Hints at Another Purchase

2025/01/13 19:55

Risk assets are seen trading lower on Monday as the dollar index and U.S. Treasury yields benefit from Friday's stellar nonfarm payrolls report, while the Palisades Fires pose a risk to the insurance sector and some P&C companies.

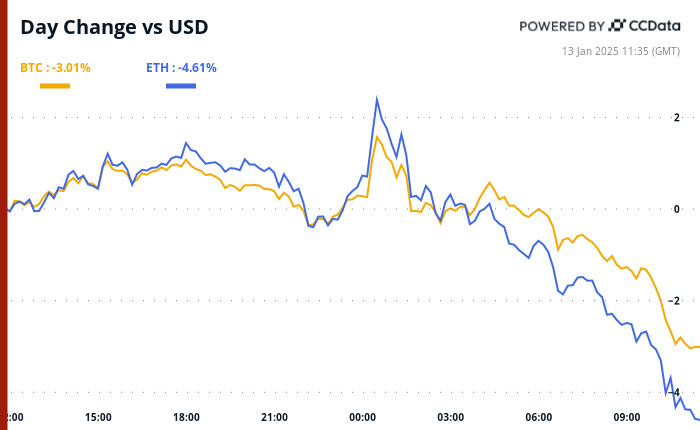

BTC is seen down 2%, changing hands in the key support zone of $90,000 and $93,000. Alternative cryptocurrencies are posting bigger losses, as is usually the case. ETH has dropped to the lowest level since Dec. 21 and the risk-off mood is clouding XRP's bullish technical outlook (see TA section). Whales did appear to be accumulating XRP on South Korea-based Upbit over the weekend, as far as we can tell.

AI coins are the worst performing sub-sector of the past 24 hours. In traditional markets, futures tied to the S&P 500 are indicating a negative open, along with continued downside volatility in the British pound and emerging market currencies.

The risk-off sentiment, however, did not stop Michael Saylor from indicating a potential appetite for another bitcoin purchase as he shared an update on MicroStrategy's bitcoin purchase tracker. Whether that would put a dent in the negative market sentiment, is another story. "The firm's purchase last Monday amounted to approximately $100 million, which had limited market impact, but underscores the firm's ongoing demand," said Valentin Fournier, an analyst at BRN.

Other things being equal, the risk of BTC losing the support zone appears high as some investment banks believe the Fed rate-cutting cycle is over, with Bank of America suggesting a potential for a rate hike. Per some observers, the consensus is that prices will deflate to $70K, followed by a renewed rally.

Meanwhile, the 30-day moving average of the Coinbase-Binance BTC price differential, which has a knack of marking major price tops, slipped to the lowest since at least 2019, a sign of weaker stateside demand. Over the near term, the crypto market is likely to focus on President-elect Donald Trump's inauguration on Jan. 20 and the ongoing FTX claim distributions, according to Coinbase Institutional.

What to Watch

Token Events

Conferences:

Token Talk

By Oliver Knight

Derivatives Positioning

Market Movements:

Bitcoin Stats:

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- 比特幣與股票市場的脫離

- 2025-04-26 02:45:13

- 4月,許多加密市場觀察家正在撰寫有關比特幣與股票的持續分離或差異的撰寫,這意味著比特幣價格的軌跡與股票和股票相比,比特幣的軌跡邁出了不同的方向。

-

- Ripple USD(RLUSD)在領先的流動性方案AAVE上經歷了令人印象深刻的增長。

- 2025-04-26 02:40:13

- 用戶在短短四天內就已經存入了價值7600萬美元的RLUSD。

-

-

- 現在購買5個加密貨幣,並保留下一個市場週期

- 2025-04-26 02:35:13

- 加密投資者對炒作並不陌生,但2025年被證明是新的水平。隨著項目更新下降,預售變得越來越多

-

-

-

- 如果特朗普大火鮑威爾,加密貨幣會怎樣?

- 2025-04-26 02:30:13

- 最近幾個月,某種模式的潮起潮落:美國總統唐納德·特朗普(Donald Trump)將採取一些客觀上的有害行動

-