|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密货币新闻

Bitcoin (BTC) Drops Below $90K as Risk-Off Sentiment Prevails; Saylor Hints at Another Purchase

2025/01/13 19:55

Risk assets are seen trading lower on Monday as the dollar index and U.S. Treasury yields benefit from Friday's stellar nonfarm payrolls report, while the Palisades Fires pose a risk to the insurance sector and some P&C companies.

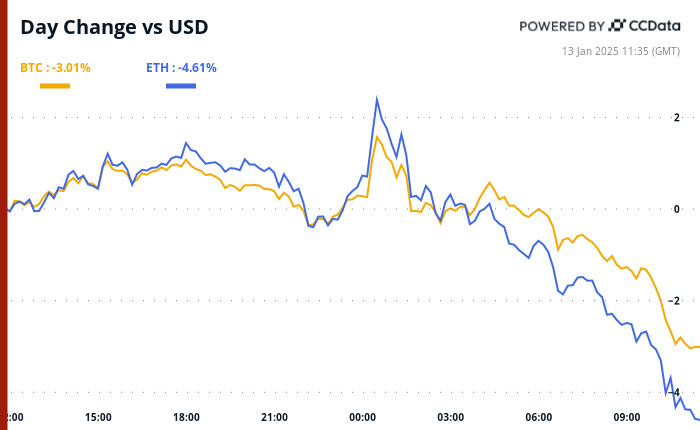

BTC is seen down 2%, changing hands in the key support zone of $90,000 and $93,000. Alternative cryptocurrencies are posting bigger losses, as is usually the case. ETH has dropped to the lowest level since Dec. 21 and the risk-off mood is clouding XRP's bullish technical outlook (see TA section). Whales did appear to be accumulating XRP on South Korea-based Upbit over the weekend, as far as we can tell.

AI coins are the worst performing sub-sector of the past 24 hours. In traditional markets, futures tied to the S&P 500 are indicating a negative open, along with continued downside volatility in the British pound and emerging market currencies.

The risk-off sentiment, however, did not stop Michael Saylor from indicating a potential appetite for another bitcoin purchase as he shared an update on MicroStrategy's bitcoin purchase tracker. Whether that would put a dent in the negative market sentiment, is another story. "The firm's purchase last Monday amounted to approximately $100 million, which had limited market impact, but underscores the firm's ongoing demand," said Valentin Fournier, an analyst at BRN.

Other things being equal, the risk of BTC losing the support zone appears high as some investment banks believe the Fed rate-cutting cycle is over, with Bank of America suggesting a potential for a rate hike. Per some observers, the consensus is that prices will deflate to $70K, followed by a renewed rally.

Meanwhile, the 30-day moving average of the Coinbase-Binance BTC price differential, which has a knack of marking major price tops, slipped to the lowest since at least 2019, a sign of weaker stateside demand. Over the near term, the crypto market is likely to focus on President-elect Donald Trump's inauguration on Jan. 20 and the ongoing FTX claim distributions, according to Coinbase Institutional.

What to Watch

Token Events

Conferences:

Token Talk

By Oliver Knight

Derivatives Positioning

Market Movements:

Bitcoin Stats:

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

- 比特币与黄金:辩论升温

- 2025-04-26 07:15:13

- 随着全球经济不确定性的安装,投资者正在重新评估传统的避风港资产。

-

- 四个加密泰坦:未固定,超级液体,链条和aptos

- 2025-04-26 07:15:13

- 在加密景观的不断变化的沙子中,四个名字不是通过瞬态嗡嗡声而不是通过无情的创新和现实世界实用程序获得的。

-

-

- 当金钱能够与政治领导人接触时,这并不奇怪,但通常至少有一个立面

- 2025-04-26 07:10:13

- 当金钱能够与政治领导人接触时,在美国政治中,这并不是一个惊喜,但通常,至少有一个外墙使它看起来比交易略低。

-

- 意大利Fornelli揭开了一座纪念碑,该纪念碑献给了比特币的伪造创造者Satoshi Nakamoto

- 2025-04-26 07:05:13

- 位于莫里斯地区的意大利小镇福内利(Fornelli

-

- 瑞士国家银行拒绝了持有比特币储备,理由是对加密货币市场流动性和波动性的担忧。

- 2025-04-26 07:05:13

- “对于加密货币而言,市场流动性有时似乎还可以,尤其是在自然受到质疑的危机期间”

-